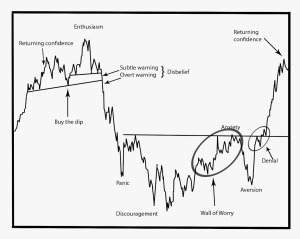

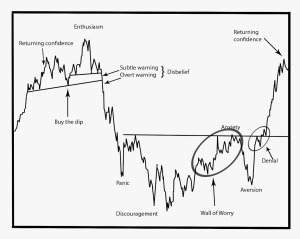

Anxiety flows into aversion, no?

Have we hit aversion today? Or are you thinking we fit somewhere else in the cycle? Below is a 4hr /ES_F.

I’m frozen thus far. I hate volatility.

I’m frozen thus far. I hate volatility.

Anxiety flows into aversion, no?

Have we hit aversion today? Or are you thinking we fit somewhere else in the cycle? Below is a 4hr /ES_F.

I’m frozen thus far. I hate volatility.

I’m frozen thus far. I hate volatility.

Either discouragement or aversion — stating the obvious.. I vote discouragement though.

Holding my ES short, bought some IWM calls.

At some point, I think we test the bull breakout of 1580 $SPX.

II U

I think we’re just about to finish up Panic (maybe a gap down tomorrow to confirm), and then we start Discouragement tomorrow or Weds.

Bot FB weekly 90 calls

Casting a vote for that third tip (no homo) of the discouragement phase.

I’m discouraged.

We are at Overt Warning.

I vote discouragement but I’m only really considering daily sentiment at the moment

OA…Among your “in the know” professional colleagues, has there been discussion regarding liquidation of hedge funds too long and levered the market before recent events? If so, how much do you think this will weigh on markets over the next month?

One anecdote I use from Twitter is the questions people send to Jim Cramer. Not the greatest sign right now:

Tor Gunnar Idland

@toggi40

Buy the dips! It has been a good strategy in this chart. @jimcramer @CNBC

AKA The Kid @Stockmarket_Kid 6h6 hours ago

@jimcramer If u are short into recent bounce, YOU HAVE TO COVER on pre-mkt weakness. Hedge funds/long buyers WILL always cover/buy bargains

candyman

@1candyman1

No new market news today that we haven’t heard before. @jimcramer should be yelling “buy buy buy” today.

Classic.

Interesting. Valid point. When you see people cheerleading and campaigning for stocks it’s not usually good. There certainly has been more people than you usually see that have the “buy the dip” mentality on this sell off in general.

If we go neutral for a 6th consecutive day then I’ll toss my hat into the, “heading down into discouragement” camp because my mind will be fully blown and discouraged.

Considering a long in $FCX under 10 here, little nervous

I bought some underneath today. But I’ve only been day trading for the past couple of weeks.

wait for a lot nervous, then click “buy”!

Buy ’em up boys! We rip higher from here.

New low made 11 minutes after this post

and then what happened???

Another new low. 🙁

And another

Another

Ditto

my bet is volatility puts in a lower high soon. If it’s aversion, volatility may roll over about the same time market rebounds. If it’s discouragement volatility will probably roll over before we bottom and you will have ample warning.

Buying XIV as a first entry, with plans to potentially add, and build a position in TNA or something if discouragement plays out and volatility diverges seems like a prudent way to play it.

Or if you have an edge in individual stocks, selling puts in place of a limit order since VOL high, downside relatively limited isn’t bad either.

This A.M. felt more like aversion than I anticipated. All the questions I asked myself when the “Dow futures down 400” was more “shit, was I wrong that the bull move isn’t over?” If I was an emotional trader who had positioned more aggressively on the dip I could see a “get me outta here” type attitude.

subtle warning?!

I agree with you. I think last Monday was the start of subtle warning. We are nearing overt warning.

No enthusiasm. If you are using a daily or weekly chart, this is more like buy the dip, IMO.

I agree we could see a bounce. I have a hard time coming up with reasons why the bounce won’t get rejected at the 50 week moving average. But my charting skills suck, so what do I know.

I am encouraged as the more this works out textbook , the more i’m confident to buy the blood.

later though .

( a later date )

Bot DDD Sept 15 calls —

I will say the fear is pretty palpable. The overriding concern I have is we could very easily just continue to sell off into the Fed meeting which is two weeks way. But I think last week’s lows will be really hard to break. I think we would need more evidence of a recession for that to happen.

i think we break them easy as the selling have to go ..

if discouragement, we’re in for a new lower low.

My gut says pain trade tomorrow is gap up.

Agree

I’m not a good day trader and have been keeping mostly cash for a couple of weeks so I’m probably wrong. Risk is still too high to hold things overnight either way.

Higher crude = higher market. Elevator up!

Discouragement – on the 1 minute chart. LOL

Gosh … and my first question is whether the margin clerks are going to be making the rounds today at the hedge funds. If they are, I think we go lower.

We don’t even have a flattening yield curve here, so I’m happy with long-term purchases here. Retirement accounts and an another block or two of solar over the next 3-5 weeks.

No options since July. Playing some sub-$5 biotechs in the last 2 weeks to divert my interest.

I can remember chop being called for by several people last week. Chop is not ‘grind’….and it’s very uncomfortable.

Current market = death of swing trader

I just keep looking at the 2011 chart and wonder if that’s how this plays out:

http://stockcharts.com/h-sc/ui?s=%24SPX&p=D&st=2011-03-01&en=2012-01-01&id=p93465592358

That was my initial knee jerk reaction. PLay for moves back to the middle. Month of chop at best.

even so, we’d have to go through a full month of sept of big ups and downs right? just need to survive until October.

2 months. Use 2011 as a template.

Whatever it is…it’s a biotch.

Buying those $IWM weeklies earlier than I wanted to was my first rash move of this chaos. Which is why I started small, but still annoying that I gave myself a bad spot for the risk when I knew the end of the day was the time to take it on.

buy NQ 4157 stop at lows.

Stopped

Headed for discouragement? This volatility is so boring.

haha that was quick!

I’m right behind you boss…

Go again?

not yet that was a big level, needs to get back through 4155-60

Who thinks there aren’t hedge funds being forced to dump?

Whoever uses the word “capitulation” first will be awarded the “fluffer” job on CNBC’s fast money.

could try 4130 but I’m going to wait.

Getting short in the hole they are.

Who will be the first on television to tell us that this selloff was “very orderly”. That’s when I throw the TV set out the window.

1894 on $ES_F is lone VPOC below. Almost there now.

I think the word “Denial” belongs on other parts of the sentiment chart. Like at points just before selloffs. Picking up some spy calls here.

I have been all over the map, or sentiment diagram, but now I feel we just left the plateau that followed last weeks panic and heading into discouragement.

Could totally see that from here.

Agree

Thanks Jeff for conveying the pain trade heading into the close. Got me to fade my sentiment and bought from panic sellers in fcx and chk after hours