I’m trying to approach the week without short term memories of last week. No bias, no recollection of price levels, just a fresh canvas taking only this weeks movements, extremes, and divergences into account.

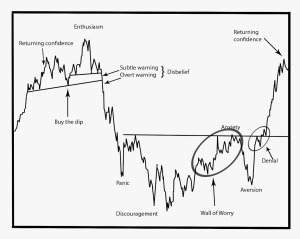

As for overall sentiment, we came off some major extremes last week, as the market successfully underwent a discouragement phase early last week. Where would you say we are on the sentiment chart (lower time frame)?

Thus far we got a Russell divergence against the rest of the indices, and only one TICK extreme to the upside. I’m assuming we’ve seen the high and the low until at least 2pm, and the break of today’s range gives us an idea of what to expect tomorrow.

I’m spending the morning developing a watchlist for the week. I haven’t done this in the last few weeks because the correlation across the market made no sense to try and pick relative strength. I’ll have a core group out by this afternoon. Let me know your favorite names if you wish, and would love a quick description as to why.

Thanks,

OA

I’d say we have just come out of panic and yet to go through discouragement.

We had multiple tests of relative lows last week after a massive drop…you sure that fits?

When i look at the sentiment chart it looks like the panic low happens over a few days. Begining of last week and a bit the week before. Looks like we came out of that but theres one more stomach churning woosh down… ahead of us. Wouldnt be more of a discouragement phase if we broke those lows from 10 days ago?

Dudes, let’s not get too granular here, right?

That graph was drawn with a crayon, not a fine-tip pen. I think the graph was meant to be used more as a realistic, carefully drawn visual road-map for a story-line on trading patterns and human emotion–not a crystal ball accurate to the hour.

Just my $02.

Agree with super when I look at daily but OA when I look at hourly, so…

I mentioned in the post, gotta consider the lower time frame. The daily has a different look.

i lie this perspective better too

a final wash to 1500 would clear the path for bull recovery

KORS (balance sheet), KBH (should not be affected by China), HCA (healthcare and should not be affected by China)

Jeff – I like YRCW right now the most out of any of my picks. They had explosive earnings a few weeks ago and got dragged down by the market.

Also looking to get exposure to Nat Gas as the launch of the export terminals nears (ETA is end of year).

Great spot on the weekly.

which one?

$YRCW

YRCW looks good on a 30 minute chart as well. Panic last Monday, Discouragement mid last week, Anxiety late last week, Aversion now.

Zooming out to a weekly chart, we are still nowhere near a panic.

Another one I like is CRNT. Margins have been expanding and they just turned profitable last quarter. Estimates are for $0.17 next year…20x that is $3.40.

We’re either at “buy the dip” or “disbelief”. Hard to say because we never really saw a full enthusiasm rally to top things off.

I think that comes in the next two years. Agree with kidstocks assessment last night.

I thought that moment was last year tho.

Other than energy stocks, everything looks the same

scotty

and elon

Like the GPRO idea, may pick up some stock in IRA if it heads just a bit lower.

My shopping list:

-$ht (I think interest rates are staying down and like their portfolio for most economic environments going forward)

-$fcx (now late to the party. Looking at $9.75 for an entry if it comes).

-$fslr down around $43

-$key or $bac

-$habt a little lower, and watching $shak very intently as well (but trying to be very greedy with an entry into that particular name)

-virtually anything home building based in what I see in the industry here in my particular rust belt town coming off a gnarly winter that should have set us back much further. Crazy what’s going on, and I don’t see it reflected in the equities. So far I have $bzh, $kbh, and $zg exposure, fighting temptation to add more to any/all.

We were in Florida last year looking at houses and were impressed with what LEN was building. Have you looked at that one?

No doubt LEN stock has been good trading for people over the years.

As far as impressions, I had one when Hurricane Andrew blew the roof shingles of a Lennar condo I was living in,leading to destruction of the interior from water damage from the gaps in the roof.

You might say… yes but Andrew was a major storm. True. However the condo was 30 miles from the path of the storm. Thanks a lot Lennar, for your build quality.

H50- It would be interesting to see if major developers are building Florida houses with concrete block (CMU) construction with adequate re-bar and concrete fill. A hip roof is desirable because gables are a big wind load.

The crap house builders get away with here in the mid-Atlantic is amazing. Let’s see.. aluminum framing, near-particle board siding, plastic wrap taped down and vinyl siding. Oh you’re a premium customer? You get engineered foam board instead of the plastic wrap, sealed with expensive tape. No worries about toxic fumes, only the finest materials from trusted partners in China are used.

Interesting. I saw the construction and It looked good to me, but i have little expertise.

$TEVA for the fact that its going higher.

I think we are in Denial. OA, a few article write Hedge fund diched BABA to smaller fast growing company, does that change your view for BABA? If not, why? Thanks,

No, it increases my conviction.

Thanks. I like to buy HD and health care on weakness as long term hold.

love it.

I was just driving and contemplating my positions… when $BABA came up I thought to myself, “I hate this position, I want to sell it so bad. But I know it’s going to hit $95 and I’m going to kick myself in the face for selling down here. Don’t sell. Don’t sell. Don’t sell….” Truly the herpes stock of 2015.

exactly my feelings TJ

Looking at the SPY hourly, I’d say we’re working through denial.

I’d say the Senator from Ohio is working through Denali 🙂

The Fed must be happy to see McKinley’s

name gone.

$URI – oil play. The IV did not go up drastically , if you comparitively

*compare

It looks a little like anxiety but at the same time I’d say we haven’t fully gone through discouragement yet and should see discouragement over this week. I don’t think we break the intraday low, but we might have new closing day lows and that would represent discouragement to me. The dip buyers aren’t really discouraged imp because the majority didn’t actually catch the low to be frustrated with their dip buys yet.

*imo* not imp.

I looked again 30 day 1 hr chart. I actually think early stages of discouragement. I bet if you go to 10m or 5m you could easily argue anxiety is here and aversion is coming up but it’s essentially the same move. I think we break below the first discouragement low, but stay above the weird panic low that lasted less than 1m.

http://ibankcoin.com/hattery/files/2015/08/sentiment.jpg

Jeff – What do you think about Nat Gas on the weekly chart? Looks like it’s forming one of those wedge patterns you seem to like. I need to get the link to an analyst quote I read over the weekend…guy commented about how Nat Gas has been a safe haven for commodity investors looking for low volatility. I almost spit up my coffee at that comment.

I’d play this side of the range for sure.

This was posted before I considered sentiment.

http://ibankcoin.com/hattery/illiquid-panic/

Cliff notes version is I think we’re caught in a zone of very little price history which translates to difficulties ahead. My guess is we retest support below 190 and it holds, but of greater importance is the lack of predictability moving forward as a result of less price history than normal that exists and provides a range of just below 190 to just above 205.

I made it half way through my scanner this weekend and my favorite is MCRB. I want it to come in a little but awesome balance.

A colleague working out of her home office and knows I like to follow the market just skyped me to ask what I thought of “this stock UWTI”

What if we’re at the lines to the right od “Buy the Dip” in the middle of Disbelief heading towards Panic.

Of all the responses not one mentioned the downside, not a single Short or Put.

Is that a sentiment indicator?

Sure.

Even though folks might be bearish, what percentage actually are short or own puts?

Traders? Plenty I would think. P/C ratio?

P:C has been steadily above 1 for the longest time. I find it hard to play short side with conviction until the indicies and leading stocks are all trading in same direction…methinks we might have reached that inflection point.

On what basis are energy stocks surging? Whole market is loony and making a sane risk/reward trade is impossible. I think patience wins out as always.

LEFT SIDE of ANXIETY on the chart.. meaning we dive into discouragement soon

SUBTLE WARNING(Disbelief) Phase In the weeklies anyone? of course a V up will negate all this 🙂

OA – when does FEYE start to look interesting to you? Thanks.

I bought $FEYE on Monday.

I agree with OA on sentiment using the hourly.

Commence with the wall of worry gentlemen.

Major bearish action on monthly $SPX chart. You name it, it’s broke. Hoping for big down Sept.

I don’t know man, the monthly close here saved the day, IMO. Next month is going to chop some, but this close kept it bull.

Elevated VIX is worrisome, no doubt. I still remain cautious and mostly in cash until I see some setups that tilt in my favor. Right here seems a bit no mans land.

Asian indexes gapped lower last week and have continued lower last night. Gaps were not closed as they were in the US. Tonight’s action should be very telling.

it seems more some bearish accumulation for a bigger wash later

not that late 🙂

Would you care to elaborate? I’m seeing things that haven’t happened since 09 and 11.

Not 09, 2007..

Would love to. Want to hash it out in AHWOA? I’ll give u a pass for the day. SPecial guest..

That would be great.

1. Please join my Webinar.

https://global.gotowebinar.com/register/108527003

2. You will be connected to audio using your computer’s microphone and speakers (VoIP). A headset is recommended.

Or, you may select “Use Telephone” after joining the Webinar.

Dial +1 (415) 655-0059

Access Code: 640-706-231

Audio PIN: Shown after joining the webinar

https://global.gotowebinar.com/register/108527003

Webinar Password: options

Webinar ID: 108-527-003

GoToWebinar®

Webinars Made Easy®

Where does Resentment reside on this sentiment chart?

Very few people will actually predict we’re in a bear market, but I will. I’m with McClellan on this. Think we see a bear market until March/April. So the last few days were nothing more than a counter trend rally. Every rally for the next 6 or 7 months will have bottom callers coming out of the woodwork and they will be wrong every time.

I think we had an extensive distribution top all year.

Lots of people are predicting this. Fly did last week.

Sure, but a lot more, including some bears, are predicting 1-2 months of chop before resumption of the bull market. Only the super bears are calling for a protracted down turn and they’re all saying we’re in a secular bear. I’m not even going to say this is a secular bear. I do think it’s a cyclical bear though.

I’m always up for changing my opinion midstream, but as of now this is how I see it.

Did you reshort?

I grabbed this week’s $SPY 197s on Thursday and Friday last week near the highs. Thus far, I’m losing a small amount due to time decay. I start to make decent coin on another 1-2% drop.

I’m going to be implementing an /ES parlay in the coming days. I worked this weekend on formulating a strategy. I can turn $3K into $100K in only 8 or 9 trades and only 80 /ES points (on paper thin margins of course). Of course it’s highly unlikely that I hit the perfect parlay. There will be a few ups and downs.

But, the strategy starts off with 4 points of risk on only 1 contract, and the strategy remains profitable even if I get to trade 7 or 8 and reverse the entire chain as long as I adhere strictly to stops/trading rules.

I’ll be playing up and down in futures as long as they are relatively stable and we don’t see flashy stuff going on intraday, and will retain puts (or even calls if I think we countertrend, or if I’m wrong and the bull is coming) for swing plays.

BTW, I missed the entire day, where did you come out on sentiment analysis? Anxiety still after the close?

My bear signals got more confident, and my bull signals got quiet.

I favor up tomorrow as the pain trade. Little less conviction than I had last week.

Could totally see that. This market is meant to make grown men cry.

I think we’ll know more after Labor Day for sure as to whether it’s bull/bear from here. Either side could theoretically be right at this point, but I do really like the analysis that guys like McClellan have been offering up.

Either way it pans out I’m just here to find profitable trades.

Unless we get another bidless overnight session then all bets are off. Got to wondering if the Chinese were selling our market to raise cash to support theirs. Did not like TLT close (big red flag – no flight to safety?). I put on my “Save Tom Brady” trade with purchase of DIS Oct 90 puts sold out of FIT calls and bought back this week’s NFLX 105 puts.

Afternoon in AMZN and FB was dreadful (bidless) and I am expecting more of a reaction to unexpected cancellation of deal w Epix in the coming days in NFLX shares.

It’s hard to use the amount of bears as a contrarian indicator since the last drop happened at a time when fear was already very high. Well, the VIX — but the P/C ratio, fear/geed index, twitter sentiment. Market Watch was posting market crash articles and then it happened. Very weird..

They’re gonna smoke NQs down below 4200 and test the prior weeks lows.

Lows of ended 8/21…officially bearish until we retest lows of last week.

So I follow this guy on Twitter and he usually offers some interesting data observations. Check out this analysis he did on $NYMO thrusts that we just experienced. http://andrewunknown.tumblr.com/post/128045627146/since-the-market-topped-in-2007-the-mcclellan

.

,,, that front page “owl pic” is hilarious !!!

CLASSIC !!!

.

Definitely not looking like an up day tomorrow :p

Definitely didn’t look like an up week last week.

Bull trap of the grandest proportions…folks mistakenly interpret last week’s action because of bullish candle instead of more accurately a week with lower highs and significantly lower lows (with some major tails)

Weren’t you just saying earlier that you were bullish? Easier times ahead? Or did I misread something?

Call me flip flop however today and tonights action put me firmly back in the retest camp…just adjusting to the conditions in front of me. Not calling for end of the world – will reserve the right to do so when we approach lows from last week.

My patience has been rewarded. I will be filthy rich by this time next year.

Didn’t buy anything last week nor today.

I don’t believe monday was “it”. You don’t have ETF’s getting instant 50% whacks without some kind of further downside from people scared shitless.

You are correct.

NQ about to drop another 40 handles…next stop 4150

Well if yesterday was Anxiety, this sure looks like Aversion. And the divergent nature of the Russell continues… OA – you thinking late today or tomorrow for some IWM calls or TNA?

UB, for what’s it worth if today continues as is, I will flip my $TZA to $TNA. And maybe add some weekly $IWM.

TJ – I’m watching, bro….

Yeah, this is where you want to try that trade with a tight leash.

Took a swing on $IWM weeklies here. Sentiment play and also liked the way the chart was behaving. But not going to give it a lot of room down.

I nibbled on some XIV.

I may be wearing the tin foil hat, but something tells me that there are some major market participants that are causing this increased volatility to essentially force the Fed’s hand to not raise rates. They are trying to draw the Fed in, and call their bluff. Then again, I just started wedding planning so I could be loosing my marbles.

Sold NFLX puts — getting more bullish here. Bought FIT Sept 35’s and TLT next week 119 puts

Bought EXXI Sept 2 Calls

Looking for crude to bounce here out of $45.5