Gold prices appear to be making their final descent towards support, and the trap door we’ve been patiently awaiting.

If Silver prices were a leading indicator here, you’ll see likely see a little panic as my friends, relatives and neighbors all liquidate their “long term investments” that were purchased in 2011.

Here’s another look at Gold and the structure below…

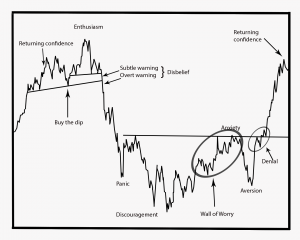

Just for kicks, here is the old sentiment chart that correlates to what we’re about to witness here.

If you enjoy the content at iBankCoin, please follow us on Twitter

So… do we reverse tomorrow in the big up /big down scenario or see market shoot higher?

Are puts on the GLD effective? I am not able to trade futures at work right now.

They will be if it follows Silver

So I have something to say. I quit my job July last year to trade f/t; been at this a little more than a year. Found Jeff shortly after I started. Last year was insane. Talkin’ MONTHS without a losing trade. Then this year happened. Big drawdown early on trying to press risk. Jeff, think we can both admit there was a month where you couldn’t hit a WALL with a baseball bat, let alone a pitch. I lost faith, lost focus.

Then I realized something. What makes Jeff the best trader I’ve ever known is that he is ALWAYS ON TO SOMETHING THAT IS WORKING, AS LONG YOU ARE. As long as YOU bring a sustainable set of rules to manage risk, trade management, and position size, there is SOMETHING within Jeff’s purview that is going to fly. The eye is just too brilliant, the hand too hot.

So earlier this year when things got choppy I decided to simply FOCUS on WHAT WAS WORKING. My options trades weren’t. I didn’t have CONVICTION in anything. Nothing made SENSE.

Except the Gold trade. I noticed the one-sided sentiment on the blog. I followed along with Jeff’s guidance and charts. So I started to study. I charted and charted and charted. Posted charts to my twitter constantly (@autumnalcity87, it’s all there in real time, going back months). Most of you have heard me ranting about this, wearing my conviction on my sleeve.

This trade flew under the radar for a little bit, because it happened SLOWER than most thought. But I didn’t stop watching the tape for one HOUR. I PM’d Jeff constantly within TA asking him his thoughts, updating him with charts and gauges of swings in sentiment.

Long story short, $JDST is essentially the only thing I’ve traded for 2 months. I have a feel for it. I have a core of 25k shares that I scalp around. I caught the first big move from 10 – 20, sold in a disciplined manner, and have been in for this secondary move, with size. I’m up roughly $250k on this trade in the last TWO MONTHS, which relative to my (small) account size is ineffably enormous.

I guess this is a testimonial; I didn’t necessarily mean it to be. Jeff is a toolbox; the best in the business. YOU are the architect of your success as a trader, neither Jeff nor anyone else can craft that FOR you. But the QUALITY and DIVERSITY of ideas presented in this forum, the access to guidance, the rapidity with which drawdowns are repaired, and the size and consistency of the wins is COMPLETELY singular.

Thanks for the life-changing win, Jeff.

Congratulations on that well-earned win!

Typing after snorting JDST, I see… Great post!!

WOW! great job!!!! Always nice hearing things like this. I like the the long equities/short gold trade into year end.

great post

This win of yours should be analyzed and highlighted for every trader to read about in terms of how to manage an idea to the fullest, and maximize opportunity in doing so.

Thank you for the compliments as well. Very appreciated.

Awesome post and thanks for sharing

Love the story and the enthusiasm. Caught a little of the $JDST ride for which I thank both you and Jeff.

Thanks for the post. The only question in the back of my mind is, what about position sizing? Even the more conservative guideline is 20% of portfolio max…

Great trading autumn. If you sit tight it may be worth another 250 in the next couple of weeks!

congrats on the big win, but scalping around a $250,000 position (25k shares at $10), is not exactly something that can be done by most members, and doesn’t fit in with the position sizing we’ve been working on. unless you’re trading with a $5 Million dollar account that is.

I’m not knocking you, as I love to hear other members well. But on the same token it’s a different page of a different playbook this group has been learning the past year or so.

Those guidelines I give are to help people in the process of learning, and to avoid blowing up accounts. Once you feel competent enough, risk is yours to manage – as you know.

Awesome, congrats!

Great job. Looking at the chart over that period, there were plenty of places you might’ve gotten shook out.

Thanks for sharing your story. Im where you were at in the dark days. I will take what you said to heart.

Paramedic, your story differs quite a bit, but it will pass.

The bottom in GDX is in with this post and subsequent comment. #timestamp

You were in this trade for two months and long “with size” this morning now you are completely out … nice timing!

Well said, my dude.

hat tip bud…I have my own JDST story,,as you know,,well done,congrats

Any thoughts on JAKK?

None, sorry. If you haven’t noticed yet, volatility is kryptonite for option buyers. I shy away from it.

Thanks for the reply OA.

Ask me again in a week.

I’m VERY interested in this trade, but haven’t taken a position yet. I’m looking for one last fake-out (if it happens). I asked this question too late last night: has anyone in the group traded DGLD? I curious how it worked for you. I’m averse to GLD puts, it seems that gold moves like an old mule… slow & erratic.

With you there UB – want to get in, but waiting for some kind of last-gasp defensive stand. Have a bad feeling I’ll miss the rest of the move, though.

doubleplus – You have to have a plan. This really looks to be a big move setting up. There will be opportunities to get yours…

I sold JDST on Fed day (it dropped a buck before my market order found a buyer), and then bought back in about a week ago once it based out and started to show some traction again.

My concern right now is that I don’t have enough exposure. Calls seem expensive.

UB – also looking at DGLD but have never owned. Back testing the last swings from 10/3 to 10/21 looks like it performed exactly in line at 3x GLD. From 7/10 to 10/3 it looks like DGLD outperformed the GLD by 3.5x

jpw – Thanks for that. Patiently watching….

out MDXG common for 31%, took a month and a half, but I’m happy with it. Gotta find the next opportunistic trade.

25K shares or 25,000 dollars?

If you’re asking me, shares.

autumnal – Does this mean you really are going as J.R. Ewing for Halloween?

Sooo…drinks are on you, right? 🙂

That’s 2.5 million bucks…

what in God’s name are you talking about? learn math

+1

Actually I’m exceptional at math. But I took the GLD price rather than JDST. Still a big chunk of change for that trade.

Jeff – One concern I have with putting too much reliance on the XLU indicator is it still hasn’t made a new all time high. It looks like $44.66 was the all time high from 2007. So technically it has vastly underperformed SPY.

Look, you don’t have to listen to the charts, or care how people position. I’ve physically shown you in events where the XLU went to new highs above everything else (REGARDLESS OF % GAINS OR LOSSES) in VOLATILE environments that more market weakness followed. 2011, 2010, 2007, 2000, 1998, etc.

I don’t care that it is underperforming. THEY ARE UTILITY STOCKS, THAT IS WHAT THEY DO – UNDERPERFORM. It should be at least noted that defensive sectors are going to new highs before the market. No?

I hear ya. Just always trying to push back on my own view points and challenge my own bias. I really haven’t been willing to commit much capital yet on a longer term basis.

JDST. What a great trade. Thanks Jeff.

How come I never heard of JDST? Was this covered in TA?

I heard about it in AHWOA

We cover JDST, Gold, Etc multiple times per week. I’m blown away you’ve not heard about this.

there’s a delinquent student in the class 🙂

lol…all I gotta say to that

Feels nice having a 30 percent gain in jdst in my ira. I feel edgy telling my gf I am short the gold miners today on the 1 train on my way into work. I am sure I made some ease dropping bag holders cringe.hat tip

The miners are sitting on support, and everyone’s patting themselves on the back for holding an inverse leveraged ETF. I have no position, but seems like long is the higher probability trade at this moment.

OA is dead spot on here.

Yep. Deflation looms.

“Jeff is a toolbox” – that line made me laugh. Are you saying he’s one box short of being a tool? lol. I know it was used as a compliment autumnal (just having some fun). oddly enough, the urban dictionary defines toolbox as “a person of little social value” – so either way, it made me laugh…knowing full well nothing could be further from the truth, and we can’t take things out of context. Jeff is awesome at this stuff, and the peeps that say otherwise are likely bitter for their misfortunes and not owning up to their own trades. good stuff here as always. http://www.urbandictionary.com/define.php?term=toolbox

HAHAHAHA

Jeff what do you think of ZU Nov WK1 37 yolo call.Earnings on Nov 4.Too expensive? Hell of a base.

Really good base.

OA

Do you like SEAS here

I liked SIX better, but it already popped.

If you really want to find out how good Jeff is, go back to the beginning of his AHWOA presentations and listen to them. It’s remarkable how often he is right when he predicts what will happen tomorrow in the market. It’s also amazing how many of his buy recommendations were spot on. I’m a market newbie and have so much to learn, but I’m confident Jeff is one of the best teachers I can find. And, the proof is in an entire year of his presentations and predictions. The market is frustrating because there are so many variables and no one is going to bat 1000, but Jeff’s average is way up there.

My trade thesis on GMCR is playing out well – red in a sea of green – hope next week was enough time to get a full move below 136

OA, take a look at ISIS (the stock). Great sentiment chart plus a nice volume pocket. IBB breakout play?

Could be. I need to revisit biotech and find a few names I want.

NVAX?

SPLK / FEYE look to have put in their bottoms, no?

Yeah, I sold FEYE too early yesterday, but bought a bunch of SPLK I’m sitting on here today. FEYE still looks like it has a little left.

Do you have a target for SPLK? Went round trip on calls bought a few weeks ago and now sitting with profit – crazy

About to book here I suppose. Can’t risk the gain into tomorrow.

This market is nuts. Totally missed this big move up and took a loss trying a short. We are in nose bleed territory here but nobody wants to sell.

Same here I was positioned for oil weakness and was expecting further downside today. I really don’t see much to do right now heading into tomorrow as the market speed we had last week is gone

You know, that is the craziest part about this all. I think everyone, to a degree or another, got robbed.

What about those who sat on their hands? Fared pretty well.

They don’t count as participants.

actually, sometimes I need to remind myself that cash is a position.

Amen. Good point.

totally get that we are in nosebleed here, this had to have been a painful move for guys short, i think if we close above this 1120 RUT area, we push into that 35-40 balance with some head scratching and short covering..my thoughts

As for Gold: WWJD?

No, not him, Jake (Gint).

TC – I’d love to see what he has to say.

Yea market robbed me of my CELG a week short.funny though the market is generally following it’s seasonal pattern,volatility etc.

strength across the board. best trade is long until we retest the highs.

YHOO and BABA competing to see which one loves me the most. So far, YHOO is winning % wise and BABA is winning in pure $ wise (bigger position).

knew I could have traded some AZZ…pretty much called the double bottom at 42

If we break out from the 1956 pivot (over 1963) I will sit tight for the 1972 pivot highs before going short. But if the 1956 pivot is breached (below 1949) I will add UVXY asap.

WTF?? Don’t short a bull market!

OA- Whts your view on UCO HERE. Risk reward pretty good for a bounce play. Let me know when you get a chance. Thanks.

Agree.

Where’s that guy who called us “buy the dip” monkeys yesterday.

Off in a corner bleeding from various orifices.

Very prescient about that bleeding comment as the as ebola sell programs hit.Jasus.

Despite market’s strength, I’m eyeing AMZN put with an expiration of tomorrow or next week. Stocks like AMZN that miss earnings get badly punished.

This is the most expensive premium to pay for AMZN in the last few years. You will likely be right on direction and still lose money.

Nasdaq set up to test 52 week highs heading in to fed meeting. Wonder how market will react when Yellen confirms the end of QE. Maybe push higher

If we get any sort of gap up tomorrow my game plan is to short into it.

same

People are getting too excited about the bounce in oil names. I think OIH will retest lows.

Uhhhh what just happened to JDST

ebola

Looks like someone just dropped a bunch of positions at once.

It was me.

Ahhh I like what you did there. Literally and figuratively

Just took my first bite of UVXY for the rollover …

In JNUG at 7.88 just to spite all the self congratulation going on here.

I’m short JDST with you buddy.

Where is your stop?

ebola in NY

http://nypost.com/2014/10/23/nyc-may-have-its-first-ebola-case/

My gut says we run up more.That low volume sell off was too cute.Hair trigger selling.

Anyone looking at P for a YOLO? Do people still subscribe to P?

ebola news still rules

its the new way to yell “fire” in the crowded bull theater

Got my second bite of UVXY … Let the games begin!

Who jinxed JDST?

autumnalcity, clearly.

some of my favorite lines:

“So I started to study. I charted and charted and charted”

“But I didn’t stop watching the tape for one HOUR.”

“$JDST is essentially the only thing I’ve traded for 2 months. I have a feel for it.”

“Jeff is a toolbox; the best in the business”

Couldn’t have just opposed a view? Had to be a twat about it?

Oh HELL yes: I have a troll. God damn dream come true. I’m so happy.

I’m still up nearly 15% in $JDST, autumnal has booked at least a double, and you, you have nothing.

Wow. What a reversal in gold late day. Wtf

Finally bot a half position in JDST. Plan to add more.

If you think the move in GDXJ today changes the trade fundamentally, you don’t understand the trade. But that’s okay. You didn’t before, either.

Don’t get too confident just because you have had a good year. That’s my first thought.

Not saying this for any other reason than to remind you to protect your capital at all measures. I’ve been in that up huge boat and given decent chunks back immediately after so many times that I have had to create a mini checklist to know when I’m about to get a smackdown.

This is my mini checklist…if I do any of the following its time to sell:

(1) Whip open a spreadsheet and start extrapolating my gains out to see how much I will be up by date X.

(2) Brag to friend / wife

(3) Write a comment on a blog about how easy a run it has been.

(4) Make some ridiculous comments to myself like “it’s like shooting fish in a barrel” etc.

I have done none of that. No comments about ease. No fish in barrels. No wild extrapolations or assumptions. I eat a big slice of humble pie every morning. Doesn’t taste good, but I eat it anyway. I wrote what I wrote to thank Jeff, not to grandstand. So miss me with it.

Some would argue that a guy who holds a levered ETF with inherent decay as a core position to trade around, doesn’t understand the trade.

Im happy that you have done well with your trade, but you should seriously reconsider holding a triple levered ETF for any period of time…..its an amateur mistake.

I planned and executed a trade in JDST that yielded 100% in just a little over a week ($10 – $20) and you’re saying it was a mistake to hold it for that time frame because of inherent decay?

Nothing creates disdain like watching one’s neighbor make money in stocks. People will always hate.

I’ve made plenty, especially recently. I was long TLT Calls before the run up and unloaded at 124. Yesterday i bought AMZN Puts and well up on those as well. Im far from a hater. I was just passing along some friendly advice.

Levered ETF’s can be a great tool, but they work both ways, holding them as a core position to trade around is just reckless. Im a bit surprised that this statement is even debatable….I think any professional would agree. Hell it even says so in the prospectus.

I don’t mean this confrontationally, at all, but I promise I know more about decay in levered ETFs than you do.

HAHAHAHAHA absurd comment of the year. You don’t know me or my qualifications. Only someone lacking in qualifications would make a comment like yours.

As a side note, is it ironic that Jon V above warns you about being arrogant and you unsurprisingly claim you are not; only to follow up your comment with this?

“I don’t mean this confrontationally, at all, but I promise I know more about decay in levered ETFs than you do.”

BTW, pointing to an isolated win that happened, doesn’t change the fact that you clearly don’t understand the risk. Best of luck holding that JDST position…..you will get everything you are looking for and more with it, no doubt. Some lessons are expensive. I don’t mean this confrontation ally, but you are in WAYYYY over your head.

I sold today, but thank you for wishing me luck.

let me guess. you’ll buy in premarket tomorrow, but only if it’s up at the open? ; )

my apologies. I got fired up because I think a post like that causes collateral damage. people blow up their accounts trying to emulate that style. he uses terms like risk management and position sizing, yet based on the numbers he’s referencing he doesn’t understand what those terms mean. JDST doubled at best during this time period, so what kind of leverage did it take to make this happen? Endorsing this behavior seems kinda immoral but maybe that’s just me

You’re right Autumn… Jeff is a great teacher. Peerless. We are lucky to have him. But let it also be said that you are a great student and even better trading buddy. It has been an exceptional experience walking this trade with you. Cheers.

Thanks, Ab. You too bro. Can’t wait for the next trade in this. Need to find the right entry.

the way i see who gives a shit what ticker you use to make money? isn’t that the end goal? i don’t know why people get so bent out of shape about you making money on JDST. I only point out that when i personally make posts like you did mentioning big ass gains its a sign i’m too confident and likely to take a smackdown. its tough to do but i’ve gotten better at identifying my own sentiment and when to pare down risk. i made a huge run on those ebola stocks 2 weeks ago and pressed my luck and gave back 1/3 of the gains in a day. i had a conversation with a buddy of mine also in that trade and we were talking about how we were on the cusp of having “f u money” literally at the top right before giving back 1/3 of the gains.

funny how it works.

Let us know when you put on that next 25k share position so we can follow along for the ride.

I can’t tell if you’re trolling me or not, but I have been alerting my trades in this this very transparently the whole way up. There were two separate main trades in this as I had said. Ask anyone in the TA community, I’m not just showing up for a win here. I’ve been discussing it openly with a lot of folks.

The comments on here about JDST prove its time for JNUG. Anyone seen the large mouth bass chart comparing S&P to Miners?http://blog.kimblechartingsolutions.com/wp-content/uploads/2014/10/goldbugsspyratiofishmouthoct15.jpg

Richard Russell called for the mother of all buy opportunities too. It’s an easy call right? After all, they are oversold.

Okay. This seems like an appropriate time……NNNNUGT!

Late to the party I see…

Amazing to see how many people dont take this as a learning experience.

Literally an amazing set of trades, You killed it, Autumn.

OA, much props for turning us onto this idea. Learn something every day. You really are the best in the business.

I got yer NUGT right here…gold puking more

for the non-believers,,,autumn did indeed play JDST with an open hand,,i know, I saw it daily in the trading room…well done and open