“Economists cut their estimates for how much the Federal Reserve will reduce the amount of its monthly asset purchases, a Bloomberg survey shows.

Policy makers led by Chairman Ben S. Bernanke will trim their so-called quantitative easing program to $65 billion a month at the Oct. 29-30 meeting of the Federal Open Market Committee, from the current level of $85 billion, according to the median estimate in the survey of 59 economists this week. In a similar survey before the Fed’s April 30-May 1 meeting, economists expected the Fed to cut purchases to $50 billion in the fourth quarter.

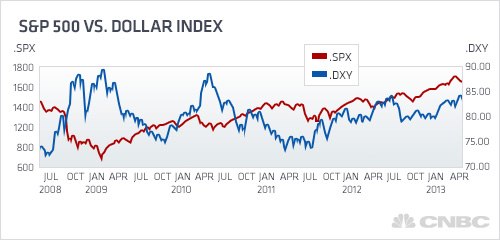

Debate among central bank policy makers over when and how to dial back their unprecedented easing campaign has shaken financial markets. The Standard & Poor’s 500 Index has dropped 2.8 percent since reaching a record closing high on May 21, and the yield on 10-year Treasuries has risen to 2.08 percent from as low as 1.63 percent last month as investors weighed the timing of a reduction in the central bank’s stimulus.

“Even those who are advocating for tapering are thinking that it could be a pretty small first step to see how it goes,” said Julia Coronado, chief economist for North America at BNP Paribas in New York and a former Fed economist. “That’s one of the few things we’ve learned” from the debate among policy makers.

When the first move comes, officials will split their $65 billion in purchases between $30 billion a month of mortgage bonds and $35 billion a month of Treasuries, a $10 billion reduction in each category, according to the survey, conducted June 4-5.

June Tapering?

Two of the 59 economists surveyed this week expect the pace of purchases to be reduced at the FOMC meetings on June 18-19 or July 30-31. Sixteen say tapering will begin at the Sept. 17-18 meeting, 14 see it happening Oct. 29-30 and 15 forecast the first tapering Dec. 17-18. Twelve see tapering next year or later.

“If jobs growth continues in the 150,000-to-200,000 per month range, that’s probably sufficient to lower the unemployment rateslightly,” said Tom Lam, chief economist at DMG & Partners Securities in Singapore. “Coupled with real GDP growth recovering to 2.5 percent, that would be sufficient for them to consider tapering modestly at the December meeting.”