“That love affair between the stock market and dollar this year appears to be heading for the rocks.

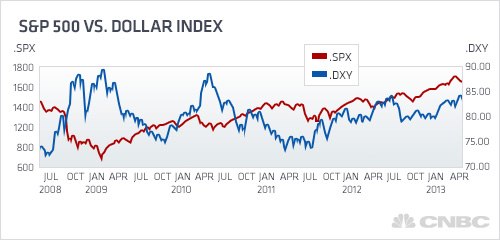

The two entities have moved in tandem, breaking a pattern that had been prevalent since the Federal Reserve began its aggressive easing measures that helped keep the U.S. currency weak against its global trading partners and the equity markets strong.

But with expectations dimming that the Fed is planning an early exit, the dollar likely will lose some of its momentum as the central bank maintains its low interest rate posture and quantitative easing program.

“The dollar was going up because people were of the mindset the Fed was imminently going to exit their QE strategy,” said Michael Pento, head of Pento Portfolio Strategies and author of the newly released “The Coming Bond Market Collapse: How to Survive the Demise of the U.S. Debt Market” (Wiley).

“Now the state of bad news, or less good news, has put some question between what … Japan is doing and what (Fed Chairman Ben) Bernanke is doing here. I never held tight to the theory that the dollar was going to soar because the Fed was going to start unwinding its balance sheet.”

Indeed, economic news lately has ranged from mediocre to weak, which could reinforce the Fed’s conviction to hold its key rate near zero and to continue to pump $85 billion a month into the economy through asset purchases….”