[youtube://http://www.youtube.com/watch?v=nX7J8-VTG08 450 300]

Comments »The Fed Puts Tapering to Bed

So a lame congress threatening to shut down government over budget policy along with the jump in interest rates stemming from the last FOMC meeting allows the Bearded clam to put tapering to bed for the moment. Markets rejoice in full retard tape.

Comments »The Saudi Arabia of Lithium

[youtube://http://www.youtube.com/watch?v=U5UoMTjs9Cg 450 300]

Comments »Witch Hunts Always Find Witches

[youtube://http://www.youtube.com/watch?v=fj-zfwWrCok 450 300]

Comments »iPhone 5NSA

[youtube://http://www.youtube.com/watch?v=IQQH_A9qVgs 450 300]

Comments »Two Whistle Blowers Come Forward With “Hard Evidence” That $JPM Manipulates Gold and Silver Markets

“In a stunning development, two JP Morgan whistleblowers have confessed that the bank manipulates the gold and silver markets. This is truly a shocking admission by the courageous JP Morgan whistleblowers. In a blockbuster King World News interview, London metals trader Andrew Maguire told KWN that the two JP Morgan employees came directly to him with hard evidence that the bank was actively manipulating the gold and silver markets.

This is a truly catastrophic event for JP Morgan, which up to now has denied manipulating these markets. Below Maguire takes KWN readers around the world on a trip down the rabbit hole as he discusses how he led the two JP Morgan employees to turn over the evidence to a law firm which specializes in high profile whistleblowers, and also to the CFTC. According to Maguire, the CFTC has virtually buried this information. Is this a cover up, or the next LIBOR scandal about to be exposed? Below is what Maguire had to say in this blockbuster interview.

Thanks to King World News for taking up this story, this news went mainstream. But most importantly, Eric, it caught the attention of some serious Eastern hemisphere buyers who moved in (to these markets) from the sidelines. They were buying it (gold and silver) aggressively. Now, in this case the bullion banks were exposed to be naked short (gold and silver in 2010).”

Eric King: “Andrew, I don’t have to tell you that the price of gold and silver exploded after that (March, 2010 King World News interview) interview.”

Maguire: “Absolutely. And I’m going to go into that in a minute, Eric, because it is quite astounding what happened after that. A lot of people are really concerned about the upcoming 5-year anniversary, and the possibility of the statute of limitations bringing this all-important (CFTC) investigation to a close this month.

Very recently Commissioner Chilton assured me, and I’m going to quote him exactly, “I can’t appropriately express my frustration and disappointment with how we’ve handled the silver investigation….

Bart Chilton continues: “And, as you know, I’m prohibited from actually saying much. That said, I will not let September go by without speaking out if the agency doesn’t do so.”

Now, since the original CFTC Meeting, I’ve provided a very large amount of detailed evidence to the agency. And what isn’t known, however, up until now, is during that time I was also contacted by two JP Morgan employees who told me they had a large amount of documented evidence of market trading abuses in gold and silver by their bank (JP Morgan).

Now, it was my understanding that this covered the same time period of metals abuses that I had prepared in my submissions. And for their own protection I directed them to a law firm specializing in whistle blowers so they could formally provide this evidence under the Dodd-Frank Whistleblower Provision directly to the CFTC.

This would provide them the necessary protections which they would need if they were going to make such a submission. Now, this was actually done in early June, 2012. Not June, 2013, but June of 2012, which is staggering. Now, I didn’t want to hinder any investigation, so I kept this information ‘under wraps,’ until now….”

Senator Lindsey Graham: “Let’s Just Blow Up Iran” (Video)

“Warmongering South Carolina Senator Lindsey Graham has decided to skip straight over Syria and convince Congress to attack the sovereign nation of Iran. Senator Graham must not have gotten the message when Vladimir Putin politely warned Barack Obama hands off of Syria and now Graham believes that the US can launch humanitarian love bombs at Iran’s nuclear facilities, an attack he’d hope would go unanswered. Senator Graham’s office can be reached at 202-224-5972. From Truthstream Media.:

The Republican Senator from South Carolina announced on Saturday that he is going to officially approach Congress to seek military authorization for a strike on Iran to destroy the nation’s nuclear program.

Is this a signal that Iran was the goal of Syrian intervention all along? Senator Graham has been warning that if we don’t bomb Syria, it will lead to war with Iran within six months.

Graham has a long history of warmongering, especially when it comes to Iran.”

[youtube://http://www.youtube.com/watch?v=CLfAdSCSE5M 450 300] Comments »Real Wealth vs Perceived Wealth

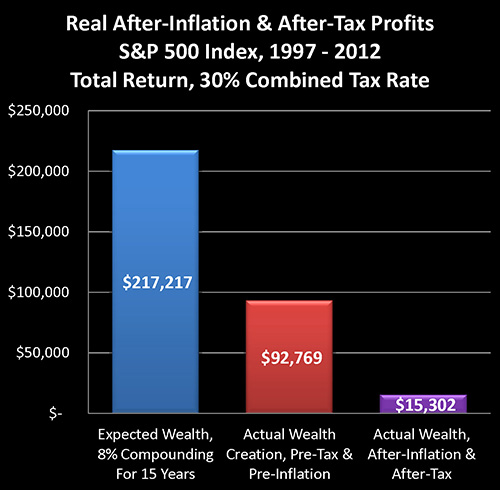

“Why is there a fundamental mismatch between stock market performance as reported in financial headlines – and the actual retirement behavior of the many millions of Americans who own those stocks in their portfolios?

Using 15 years of stock market performance data and the type of analysis tools used by sophisticated wealth management professionals, we will solve that mystery in this research-based tutorial. The results may come as a major surprise, even for well read and financially literate investors who have been buying stocks for decades.

On the one hand, stocks have been in a sustained rally, with the markets recovering from the depths of 2008 and 2009 and finally moving on to all new highs. This should have created enormous wealth for tens of millions of long-term retirement investors who have stock-heavy investment portfolios in their retirement accounts.

Yet at the very same time, according to recently released government data as reported in Bloomberg and the Washington Post, the fastest growing group of workers in the United States is older than age 65, up 67% in 10 years, and their average weekly pay has climbed from $502 to $825 over that time.

Over a decade, there has been a three-part change in behavior among those aged 65 and older, with a reduction in the percentage of those retiring, an increase in full time work rather than part time work, and incomes that are higher than those of all workers on average. So people with higher wages than the rest of the population are not only not retiring, they are increasingly not slowing down either, but are continuing full time jobs.

Now where the mystery comes in, is that people who are older than 65 with successful careers and good incomes are the exact same people who would be expected to have substantial stock portfolios in their retirement accounts. So if stocks have in fact been creating so much wealth in recent years, why is it that the same segment of the population that owns the largest amount of those stocks are in practice the same group that is changing their retirement behavior in order to prolong their careers and keep their full income coming in?

The explanation of the mystery can be found in the graph above, which is based upon historical performance of the Standard & Poor’s 500 index from the end of 1997 through the end of the 2012, as well as official US government inflation statistics for those same 15 years. As such, the graph should act as a reasonable proxy for the real world long term performance results achieved by tens of millions of American investors during those years.

Based on an assumed starting portfolio value of $100,000, the blue bar reflects expectations for the compounding of wealth through stock investment. It assumes an 8% average return – which has been a quite common assumption, particularly 15 years ago.

The red bar shows actual real-world performance on a total return basis, with price movements in the S&P 500 index, dividend payments and the reinvestment of dividend payments. It is much lower than expectations, but still substantially positive.

The purple bar shows what really matters – the purchasing power of average stock market investments on an after-tax and after-inflation basis. As shown above, in the real world for many millions of investors, the purchasing power of long term stock market profits has been virtually non-existent. If we compare what really matters – which is what money will buy for us on an after-tax basis – then real gains are a mere 7% of expected wealth gains.

The purple bar is what reconciles the mystery, and explains the divergence between the headline illusion of major profits and the reality of actual after-tax purchasing power in retirement that is currently driving the behavior of millions of investors.

As we will explore, the ultimate bottom line number of what our investments will buy for us after we’ve paid our taxes has been dominated by something that few average individual investors fully understand, which is the powerful and deceptive relationship between inflation and taxes.

What may come as a particular surprise is that these dramatic results are entirely based upon the officially reported 2.42% average rate of inflation over the 15 years. If our personal experience …..”

Comments »Everything’s Fixed, Everything’s Great!

“A brief summary of everything that’s been fixed.

Much to the amazement of doom-and-gloomers, everything’s been fixed and as a result, everything’s great. The list is impressive: China: fixed. Japan: fixed. Europe: fixed. U.S. healthcare: fixed. Africa: fixed. Mideast: well, not fixed, but no worse than a month ago, and that qualifies as fixed.

Let’s scroll through a brief summary of everything that’s been fixed.

1. China’s economy. It was slowing down, which would have been bad for the global economy. But the recent PMI (preliminary made-up indicator) readings have been the strongest since the Great Leap Forward.

The basic story here is China needs a million more of everything…”

Comments »You Gotta Laugh Every Now and Then

[youtube://http://www.youtube.com/watch?v=kS2TpW7dnPo 450 300]

Comments »“I Believe You Must Know What I Know as President”

“West Coast of North America to Be Hit Hard by Fukushima Radiation

Radiation Levels Will Concentrate in Pockets In Baja California and Other West Coast Locations

An ocean current called the North Pacific Gyre is bringing Japanese radiation to the West Coast of North America:

The leg of the Gyre closest to Japan – the Kuroshio current – begins right next to Fukushima:

While many people assume that the ocean will dilute the Fukushima radiation, a previously-secret 1955 U.S. government report concluded that the ocean may not adequately dilute radiation from nuclear accidents, and there could be “pockets” and “streams” of highly-concentrated radiation.

The University of Hawaii’s International Pacific Research Center created a graphic showing the projected dispersion of debris from Japan:…”

Documentary: Surviving Progress

[youtube://http://www.youtube.com/watch?v=RT9FfECB8A8 450 300] [youtube://http://www.youtube.com/watch?v=sMmTkKz60W8 450 300]

Comments »On the Matter of Summers Running for Fed Chair

Joy Camp’s Pre-Game Show to Syria

[youtube://http://www.youtube.com/watch?v=qF0YaSh4NXk 450 300]

Comments »Case Closed

A Word From Nigel Farage

[youtube://http://www.youtube.com/watch?v=MjruPuo1KgU 450 300]

Comments »Graham: Nuke Strike in S.C. Could Be Coming, Military Source Leaks Black Ops Movement

[youtube://http://www.youtube.com/watch?v=9-QgMMIa_sk 450 300]

“GOOSE CREEK, S.C. (CBS Charlotte/AP) — South Carolina U.S. Sen. Lindsey Graham says he’s convinced that Syrian President Assad used chemical weapons on his own people.

Graham told reporters in Goose Creek on Tuesday that taking action against Syria in response to the situation is not a question of yes or no, but rather a question of bad or worse choices.

He says if there is no U.S. response, Iran will not believe America’s resolve to block Iran from developing nuclear weapons. Graham also says those nuclear weapons in the hands of terrorists could result in a bomb coming to Charleston Harbor.

He says he’s working to convince South Carolinians weary of war that the situations in Syria and Iran are linked. Graham says Syria could destabilize the entire Middle East…..”

Comments »Echoes of Darkness

[youtube://http://www.youtube.com/watch?v=5PY_qM28rnA 450 300]

Comments »Reality Check

[youtube://http://www.youtube.com/watch?v=A7tSfwkKaUo 450 300] [youtube://http://www.youtube.com/watch?v=ef-SK_nN8Ko 450 300]

Comments »

In Plane Sight

[youtube://http://www.youtube.com/watch?v=igX7Z8VstN4 450 300] Comments »