No. Ticker % Change

1 TNA 15.27

2 DRN 12.79

3 UWM 12.68

4 SOXL 12.67

5 MATL 11.00

6 SICK 10.90

7 ERX 8.35

8 MVV 8.24

9 FAS 8.13

10 KRE 8.02

11 USD 7.87

12 URE 7.78

13 UYM 7.76

14 UYG 7.44

15 IWC 7.18

16 IJS 7.05

17 DUST 7.02

18 MWJ 6.81

19 IJR 6.72

20 TYH 6.70

21 TQQQ 6.63

22 SAA 6.48

23 XIV 6.45

24 YINN 6.40

25 IWN 6.33

Today’s Tremendously Long List of Double Digit Winners

Min mkt cap: $100 mill.

No. Ticker % Change Market Cap

1 MILL 32.42 108,010,000

2 MELA 31.10 111,910,000

3 HIL 30.63 180,150,000

4 SGK 28.19 233,120,000

5 HHGP 26.30 112,440,000

6 EPHC 24.94 296,790,000

7 SATC 24.72 113,570,000

8 FMCN 24.31 2,280,000,000

9 PNX 23.71 141,890,000

10 LXRX 23.53 310,630,000

11 WAVX 23.32 185,480,000

12 JRN 22.99 166,900,000

13 KOPN 22.65 230,650,000

14 ETM 22.32 190,860,000

15 PMFG 22.30 278,750,000

16 CVGI 21.64 182,430,000

17 STP 21.47 306,670,000

18 JKS 21.44 112,270,000

19 BLDR 21.36 120,530,000

20 SQI 20.77 267,020,000

21 AMR 20.71 992,210,000

22 WMAR 20.68 159,500,000

23 MCRI 20.35 157,830,000

24 PRO 19.55 347,180,000

25 HVT 19.41 219,270,000

26 CVO 19.34 189,700,000

27 CDZI 19.31 112,260,000

28 CSU 19.27 148,600,000

29 COHU 19.14 238,560,000

30 HDY 19.05 577,630,000

31 SRI 19.03 120,970,000

32 APOG 18.91 241,460,000

33 ATSG 18.86 247,950,000

34 CSBK 18.79 227,400,000

35 ZQK 18.70 427,160,000

36 OVTI 18.57 836,920,000

37 IBOC 18.49 887,910,000

38 SIGA 18.49 149,840,000

39 LDL 18.44 152,620,000

40 ASGN 18.37 261,850,000

41 HOME 18.27 111,390,000

42 LAD 18.04 381,290,000

43 ASIA 17.97 530,860,000

44 VRTU 17.83 309,560,000

45 DRL 17.82 138,750,000

46 FBNC 17.73 158,980,000

47 TWER 17.70 120,340,000

48 SHOR 17.66 223,680,000

49 BALT 17.65 102,900,000

50 MERU 17.61 142,610,000

No. Ticker % Change Market Cap

51 LBAI 17.52 199,390,000

52 DRRX 17.48 140,790,000

53 MOD 17.45 422,230,000

54 KMGB 17.40 135,930,000

55 WRES 17.37 150,890,000

56 TMS 17.32 285,780,000

57 NWY 17.28 194,440,000

58 OMX 17.25 417,120,000

59 RENT 17.20 129,830,000

60 RLH 17.03 122,160,000

61 AP 17.01 211,150,000

62 IRBT 16.95 675,720,000

63 MBLX 16.95 149,270,000

64 MOSY 16.92 139,330,000

65 SPAR 16.85 122,920,000

66 ALJ 16.64 342,270,000

67 WTBA 16.63 141,310,000

68 JRCC 16.58 221,040,000

69 GBX 16.56 293,090,000

70 CBM 16.41 148,330,000

71 TZOO 16.37 346,010,000

72 JMP 16.36 120,440,000

73 ZIXI 16.36 141,010,000

74 CHTP 16.32 208,420,000

75 GTAT 16.29 839,170,000

76 PROJ 16.28 366,360,000

77 CPST 16.28 259,590,000

78 DHT 16.25 131,270,000

79 NOG 16.24 1,200,000,000

80 ATMI 16.23 501,100,000

81 TISI 16.21 402,160,000

82 LTXC 16.18 238,800,000

83 CTS 16.08 279,830,000

84 KRG 16.06 232,720,000

85 URZ 15.97 105,430,000

86 CSFL 15.95 146,890,000

87 CMCO 15.91 210,140,000

88 HUSA 15.82 428,830,000

89 FRM 15.70 200,670,000

90 BUSE 15.70 376,690,000

91 OCZ 15.68 226,630,000

92 PGNX 15.63 193,480,000

93 INWK 15.60 382,070,000

94 BKYF 15.47 150,570,000

95 BKR 15.35 178,350,000

96 CIGX 15.35 272,810,000

97 HELE 15.26 776,210,000

98 STNG 15.26 158,370,000

99 AGYS 15.24 163,930,000

100 PCX 15.20 772,260,000

No. Ticker % Change Market Cap

101 HT 15.09 587,800,000

102 KELYA 15.05 419,700,000

103 INHX 15.02 192,340,000

104 GFF 14.87 517,680,000

105 PLXT 14.87 134,050,000

106 BPAX 14.85 222,210,000

107 FBN 14.81 114,340,000

108 SMP 14.79 276,980,000

109 HFWA 14.79 160,970,000

110 GFIG 14.78 487,580,000

111 CYTX 14.73 158,700,000

112 TNK 14.73 239,550,000

113 CLMS 14.66 201,460,000

114 YGE 14.63 452,420,000

115 ENTR 14.63 357,070,000

116 BGFV 14.59 131,850,000

117 TPLM 14.59 142,310,000

118 ASI 14.56 181,880,000

119 CDR 14.55 207,330,000

120 CIA 14.55 320,170,000

121 SAIA 14.53 166,120,000

122 SURW 14.50 138,930,000

123 MRGE 14.47 483,190,000

124 WIBC 14.46 177,510,000

125 FOLD 14.41 117,640,000

126 FXEN 14.40 216,660,000

127 WNC 14.32 301,480,000

128 SMBL 14.26 330,650,000

129 KAI 14.25 219,280,000

130 CAS 14.22 252,040,000

131 UBSH 14.19 264,380,000

132 GLDD 14.18 239,780,000

133 BFIN 14.13 130,890,000

134 VICR 14.13 340,320,000

135 ROCK 14.06 247,170,000

136 LUB 14.06 115,370,000

137 SSYS 14.00 380,900,000

138 BNCL 13.99 574,340,000

139 DW 13.94 441,300,000

140 CDI 13.91 204,710,000

141 ACPW 13.91 103,390,000

142 MGI 13.88 928,800,000

143 KWR 13.87 332,370,000

144 SAH 13.85 572,230,000

145 VVTV 13.81 114,380,000

146 CCNE 13.80 149,270,000

147 AFAM 13.77 155,570,000

148 MLHR 13.75 1,040,000,000

149 CFNL 13.73 249,390,000

150 FCBC 13.71 169,850,000

No. Ticker % Change Market Cap

151 PLFE 13.69 218,260,000

152 RLJ 13.67 1,250,000,000

153 HNI 13.64 856,640,000

154 CPF 13.64 430,740,000

155 IO 13.63 733,800,000

156 TESO 13.62 392,670,000

157 CHFC 13.61 420,350,000

158 ESIO 13.60 341,740,000

159 VHC 13.57 754,250,000

160 VDSI 13.56 177,150,000

161 SWS 13.51 137,310,000

162 OYOG 13.47 333,110,000

163 LZB 13.46 385,740,000

164 IFSIA 13.45 776,530,000

165 TSL 13.44 392,370,000

166 ABG 13.34 533,010,000

167 MEI 13.31 275,060,000

168 CWCO 13.27 114,740,000

169 PNFP 13.23 366,000,000

170 CGX 13.21 400,000,000

171 SHEN 13.19 248,750,000

172 CENT 13.15 368,770,000

173 CIR 13.13 506,690,000

174 ELY 13.11 334,100,000

175 ALGN 13.11 1,190,000,000

176 CBOU 13.08 245,130,000

177 SCBT 13.07 332,770,000

178 UEIC 13.07 235,720,000

179 NCS 13.06 150,440,000

180 EBF 13.06 340,270,000

181 NATR 13.04 194,490,000

182 KSWS 13.03 151,130,000

183 USU 13.01 150,030,000

184 KNL 13.00 633,670,000

185 FUR 12.99 268,940,000

186 ININ 12.98 509,700,000

187 PRSC 12.97 138,380,000

188 HSII 12.95 293,450,000

189 VSEC 12.90 131,970,000

190 FMBI 12.88 545,160,000

191 RSYS 12.87 171,510,000

192 TCBK 12.87 196,050,000

193 COR 12.85 252,890,000

194 KFY 12.85 581,710,000

195 SBX 12.83 145,360,000

196 LIOX 12.83 142,220,000

197 CBEY 12.81 216,830,000

198 BOOM 12.80 210,310,000

199 CBK 12.80 126,380,000

200 MPG 12.77 104,570,000

No. Ticker % Change Market Cap

201 SWHC 12.77 151,840,000

202 HNR 12.77 292,450,000

203 XIDE 12.77 293,630,000

204 PAG 12.75 1,470,000,000

205 GLCH 12.73 136,470,000

206 PCRX 12.73 151,650,000

207 XRM 12.71 146,510,000

208 PBY 12.67 519,890,000

209 SXI 12.64 370,730,000

210 CBR 12.59 218,280,000

211 JASO 12.58 292,730,000

212 MCS 12.57 295,210,000

213 ABD 12.56 263,210,000

214 PKY 12.56 243,410,000

215 GST 12.55 189,400,000

216 UFCS 12.52 423,660,000

217 FTK 12.50 232,420,000

218 MG 12.50 485,900,000

219 ZEP 12.49 312,860,000

220 HTLF 12.49 210,620,000

221 IN 12.48 388,540,000

222 PSEM 12.45 181,350,000

223 STMP 12.45 276,620,000

224 MOV 12.44 302,890,000

225 ANAD 12.44 146,480,000

226 FIX 12.44 314,300,000

227 PKE 12.41 443,210,000

228 PGI 12.41 328,910,000

229 NGS 12.37 156,860,000

230 CLFC 12.33 187,220,000

231 PKT 12.32 122,240,000

232 ISSI 12.32 210,060,000

233 AEGR 12.30 254,240,000

234 SCS 12.30 803,720,000

235 TMP 12.30 365,550,000

236 FSS 12.29 274,850,000

237 MLNK 12.28 151,180,000

238 FBC 12.22 271,550,000

239 ARII 12.19 328,390,000

240 QLTY 12.17 208,580,000

241 EXL 12.17 277,460,000

242 HOTT 12.16 342,690,000

243 EPL 12.15 445,410,000

244 SPRD 12.15 841,290,000

245 XRTX 12.10 266,770,000

246 RST 12.10 186,510,000

247 VVI 12.09 328,620,000

248 ACCL 12.09 334,910,000

249 EXEL 12.07 704,200,000

250 ZINC 12.06 282,710,000

No. Ticker % Change Market Cap

251 TLB 12.05 176,070,000

252 LABL 12.02 285,390,000

253 AHS 12.02 161,930,000

254 IPAR 12.01 471,830,000

255 RTK 11.99 167,530,000

256 NAK 11.97 509,060,000

257 SIMO 11.96 330,350,000

258 RPTP 11.96 153,260,000

259 LMIA 11.94 197,160,000

260 STEL 11.93 215,950,000

261 URI 11.89 993,410,000

262 SHFL 11.89 415,130,000

263 DLX 11.86 949,210,000

264 AVNW 11.84 137,240,000

265 PERY 11.83 287,410,000

266 FFIC 11.83 332,880,000

267 OME 11.82 175,920,000

268 SHLD 11.79 6,120,000,000

269 KLIC 11.79 542,330,000

270 DK 11.74 653,480,000

271 ISLE 11.73 187,450,000

272 NCT 11.73 297,380,000

273 PEBO 11.70 105,950,000

274 LXU 11.69 638,020,000

275 BPFH 11.68 458,820,000

276 CMRG 11.67 170,910,000

277 SMCI 11.65 457,920,000

278 SASR 11.64 352,540,000

279 AMWD 11.64 173,340,000

280 DNDN 11.63 1,340,000,000

281 CONN 11.63 228,880,000

282 ACTV 11.60 770,650,000

283 BANF 11.57 505,890,000

284 SHOO 11.57 1,210,000,000

285 CHRS 11.57 302,830,000

286 OPWV 11.56 133,290,000

287 ARCL 11.54 204,770,000

288 NEWS 11.53 468,760,000

289 BWS 11.53 298,830,000

290 SSD 11.53 1,160,000,000

291 FSR 11.50 545,440,000

292 NP 11.50 212,540,000

293 ETH 11.50 391,860,000

294 KCP 11.47 195,690,000

295 BRKS 11.44 526,490,000

296 DAL 11.43 6,350,000,000

297 ASTE 11.41 664,220,000

298 CYNO 11.41 127,260,000

299 AF 11.39 715,420,000

300 OCFC 11.38 207,620,000

No. Ticker % Change Market Cap

301 RNST 11.36 319,030,000

302 NARA 11.36 231,250,000

303 MEA 11.35 185,060,000

304 NX 11.32 405,430,000

305 CATY 11.32 894,900,000

306 GRC 11.31 518,170,000

307 GTY 11.31 481,540,000

308 CWTR 11.30 115,860,000

309 WBS 11.30 1,280,000,000

310 ARRY 11.30 111,190,000

311 RNET 11.29 224,220,000

312 LCRY 11.29 112,580,000

313 EXAM 11.28 292,070,000

314 IPCC 11.28 641,460,000

315 FST 11.25 1,610,000,000

316 SMA 11.25 264,790,000

317 HURC 11.23 129,960,000

318 FOR 11.22 382,450,000

319 SFNC 11.21 355,980,000

320 BHE 11.21 775,300,000

321 CPLA 11.20 431,520,000

322 DM 11.18 270,990,000

323 INDB 11.17 466,630,000

324 BPOP 11.16 1,540,000,000

325 RECN 11.16 445,240,000

326 TBBK 11.15 217,430,000

327 FPO 11.15 624,210,000

328 CX 11.15 3,290,000,000

329 MTW 11.15 885,060,000

330 BGG 11.14 683,440,000

331 AYI 11.13 1,530,000,000

332 ICFI 11.13 371,690,000

333 ZAGG 11.13 274,550,000

334 PVTB 11.13 539,970,000

335 SSI 11.12 408,490,000

336 QTM 11.11 419,740,000

337 TCBI 11.09 817,900,000

338 GPK 11.08 1,340,000,000

339 BXS 11.03 733,020,000

340 FARO 11.02 524,230,000

341 ROLL 11.01 745,600,000

342 AAON 10.97 388,410,000

343 DDD 10.96 705,710,000

344 PJC 10.95 284,480,000

345 DY 10.93 512,410,000

346 MRCY 10.93 348,780,000

347 FIBK 10.93 424,480,000

348 TWI 10.92 582,490,000

349 HEES 10.88 286,990,000

350 QRE 10.88 656,740,000

No. Ticker % Change Market Cap

351 OSIS 10.86 657,030,000

352 GEOI 10.86 453,130,000

353 TRMK 10.85 1,100,000,000

354 HWKN 10.82 307,460,000

355 AMCC 10.81 345,680,000

356 AIR 10.81 647,810,000

357 HF 10.81 306,000,000

358 VIVO 10.81 611,660,000

359 ARX 10.80 771,580,000

360 COLB 10.78 565,580,000

361 MSFG 10.78 176,100,000

362 BBOX 10.76 385,180,000

363 MDCA 10.76 404,900,000

364 GLF 10.74 953,740,000

365 JOUT 10.74 150,400,000

366 SYUT 10.74 272,180,000

367 CYMI 10.73 1,130,000,000

368 CRIS 10.73 241,880,000

369 FORM 10.72 316,790,000

370 RBN 10.71 1,590,000,000

371 PLXS 10.71 801,470,000

372 WMS 10.71 921,200,000

373 ABMD 10.70 415,520,000

374 HSOL 10.70 202,220,000

375 SURG 10.69 130,820,000

376 HPP 10.69 364,260,000

377 WNR 10.68 1,050,000,000

378 DATE 10.68 178,750,000

379 MS 10.67 26,050,000,000

380 CLF 10.66 7,470,000,000

381 CHOP 10.64 137,820,000

382 SEAC 10.63 236,360,000

383 EBIX 10.62 507,520,000

384 AFCE 10.59 288,470,000

385 GBCI 10.56 673,840,000

386 WASH 10.55 304,090,000

387 HAYN 10.55 524,790,000

388 TGH 10.54 965,700,000

389 CAB 10.53 1,420,000,000

390 RMBS 10.52 1,530,000,000

391 ACO 10.52 759,210,000

392 UBNK 10.51 203,010,000

393 UFPI 10.51 451,610,000

394 SUP 10.51 400,540,000

395 CAP 10.51 226,140,000

396 STL 10.49 206,260,000

397 PCBK 10.47 121,470,000

398 ENTG 10.47 861,300,000

399 ARIA 10.46 1,170,000,000

400 ARO 10.45 872,760,000

No. Ticker % Change Market Cap

401 NFP 10.44 468,190,000

402 ENV 10.42 304,730,000

403 FFIN 10.41 822,760,000

404 ABCB 10.41 207,000,000

405 LNDC 10.40 140,470,000

406 SNHY 10.40 498,400,000

407 PRTS 10.39 142,710,000

408 VNDA 10.37 135,460,000

409 PLCM 10.35 3,250,000,000

410 AVL 10.33 227,730,000

411 WAL 10.31 415,670,000

412 UTEK 10.30 413,690,000

413 AKAM 10.29 3,670,000,000

414 LSE 10.28 245,680,000

415 MSA 10.27 987,440,000

416 MCHX 10.26 284,940,000

417 UEC 10.25 173,420,000

418 AEIS 10.24 376,110,000

419 TMH 10.23 1,070,000,000

420 PRGS 10.23 1,170,000,000

421 FFIV 10.22 5,740,000,000

422 BID 10.22 1,860,000,000

423 WIRE 10.22 471,660,000

424 IIIN 10.21 177,380,000

425 FTEK 10.19 141,620,000

426 CPWM 10.18 140,620,000

427 SBNY 10.17 2,200,000,000

428 CODI 10.17 569,100,000

429 BMTC 10.15 214,560,000

430 TITN 10.15 319,120,000

431 ARB 10.15 900,370,000

432 WWWW 10.12 182,690,000

433 EXAR 10.11 255,510,000

434 FMER 10.08 1,240,000,000

435 MSCC 10.07 1,390,000,000

436 ASCA 10.07 523,890,000

437 GCO 10.06 1,250,000,000

438 ONB 10.06 883,080,000

439 CUB 10.06 1,040,000,000

440 OUTD 10.04 142,220,000

441 AUDC 10.04 129,820,000

442 SMSC 10.04 425,090,000

443 HLIT 10.03 492,890,000

444 FFG 10.03 777,930,000

445 RGR 10.03 491,260,000

446 CCBG 10.02 172,880,000

447 MPW 10.01 999,770,000

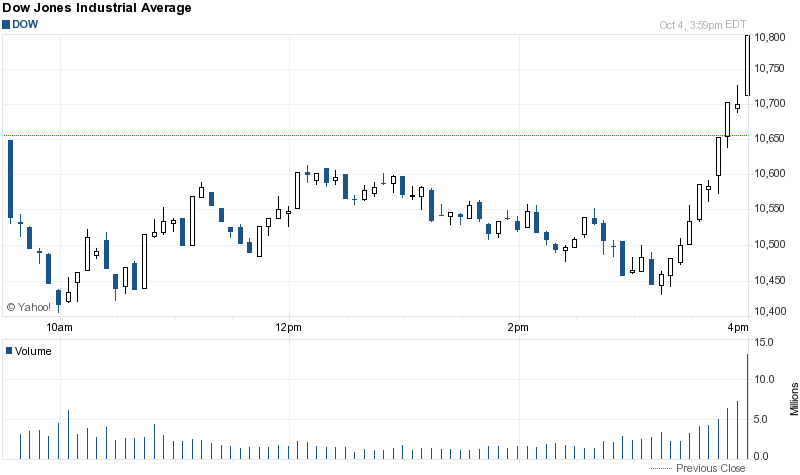

FLASH: The Market Stages an Incredible Late Day Rally

Citadel Performing Quite Nicely

Tax Holidays Do Not Correlate to Hiring

Large banks and other corporations who received tax holidays laid off workers as early as 2004-2005. So fuck your tax holiday lobbying. these lay offs came well before any mainstream acknowledgement of a real estate debacle turning into a global financial crisis.

The only thing that may make sense here was the business community had a heads up on the upcoming crisis and tried to get ahead of the curve. Or growth statistics were not indicative of the true economy.

Comments »AMR Soars After Bankruptcy Surprise Rumors

First EK now AMR. Shares of AMR are up 21% after yesterday’s plunge due to bankruptcy rumors.

Comments »FTSE Closes Down 2.6%

FLASH: NASDAQ GOES GREEN

S&P forming an intra day cup and handle

Comments »Leuthhold: This is a Non Economic Bear Market; We May be Close to the End

Chart Analysis on Where This Selloff Could Stabilize

The Clam Testimony Live

Gucci and Tiffany Launch A Lawsuit Against Chinese Banks

Factory Orders: Prior 2.4%, Mkt expects -0.1%, Actual -0.2%

PAUL MCCULLEY: The New Obsession With Austerity Is Ludicrous

Bears In Emerging Markets Turn Bullish

Upgrades and Downgrades This Morning

Upgrades

HELE – Helen of Troy upgraded to Neutral from Sell at Wedbush

CMG – Chipotle Mexican Grill initiated with an Outperform at Credit Suisse

BEAM – Beam upgraded to Buy from Neutral at Goldman

CVC – Cablevision upgraded to Hold from Sell at Hudson Square

AXP – American Express assumed with a Hold at Jefferies

AMR – AMR upgraded to Buy from Hold at Capstone

MA – MasterCard initiated with a Buy at Guggenheim

SODA – SodaStream upgraded to Buy from Hold at Deutsche Bank

EXPE – Expedia upgraded to Positive from Neutral at Susquehanna tgt raised to $30 from $28

ERIC – LM Ericsson upgraded to Buy from Hold at Citigroup

FST – Forest Oil upgraded to Buy from Hold at Canaccord Genuity

Downgrades

SON – Sonoco Products downgraded to Hold at Argus

MDR – McDermott removed from Conviction Buy List at Goldman

BHP – BHP Billiton upgraded to Outperform from Neutral at Credit Suisse

NIHD – NII Holdings downgraded to Neutral from Buy at Mizuho

IRM – Iron Mountain downgraded to Neutral from Outperform at Macquarie

V – Visa initiated with Neutrals at Guggenheim

DFS – Discover Financial Services initiated with a neutral at Guggenheim

SWC – Stillwater Mining removed from U.S. Focus List at Credit Suisse

CLI – Mack-Cali Realty downgraded to Sell at Stifel Nicolaus

RVBD – Riverbed Technology target lowered to $28 from $33 at RBC Capital Mkts

FFIV – F5 Networks target lowered to $100 from $140 at RBC Capital Mkts

DNDN – Dendreon initiated with an Underperform at Imperial Capital Research

LO – Lorillard downgraded to Neutral from Buy at Goldman

HOG – Harley-Davidson target lowered to $46 from $52 at RBC Capital Mkts

PLCM – Polycom target lowered to $28 from $35 at RBC Capital Mkts

PPDI – PPD Inc. downgraded to Equal Weight from Overweight at First Analysis

JNPR – Juniper Networks target lowered to $24 from $33 at RBC Capital Mkts

Comments »Gapping Up and Down This Morning

Gapping up

KCI +0.6%, SOMX +47.5%, AMR +10.6%, UAL +1.9%, DFS +0.6%, LCC +1.5%.UBS +4.5%, TISI +4.3%, MCP +2.9%,

SLV +1.6%, YHOO +1.4%, STP +4.7%, SODA +3%, ERIC +1.4%,

Gapping down

the world, FIG -5.2%, RVBD -1.9% , DB -3%, COF -2%, BCS -2%, AXP -2.3%, CRH -2%, CAG -1.2%, C -1.2%, BP -1%,

CLI -3%, EK -9.7%, SDRL -3.6%, WFT -3.3%, CHK -3.2%, DANG -7.5%, YOKU -4.6%, SINA -3%, BIDU 2.7%, SOHU -1.3%,

Comments »