I’ll disagree on this one…at least for the foreseeable future

Comments »Upgrades and Downgrades This Morning

Upgrades

HANS – Hansen Natural target raised to $90 at Stifel Nicolaus

ACN – Accenture initiated with a Buy at Deutsche Bank

CTSH – Cognizant Tech initiated with a Buy at Deutsche Bank

WIT – Wipro initiated with an Underweight at Barclays

DF – Dean Foods upgraded to Outperform from Market Perform at Bernstein

WCRX – Warner Chilcott initiated with a Buy at CRT Capital

INFY – Infosys initiated with an Overweight at Barclays

OKE – ONEOK upgraded to Buy from Hold at Citigroup

AVB – AvalonBay upgraded to Buy from Hold at Deutsche Bank

AJG – Arthur J. Gallagher upgraded to Neutral from Underperform at BofA/Merrill

NFG – National Fuel Gas upgraded to Buy from Hold at Citigroup

UGI – UGI Corp upgraded to Buy from Hold at Citigroup

CAH – Cardinal Health upgraded to Positive from Neutral at Susquehanna

NLSN – Nielsen initiated with an Outperform at Raymond James

AMD – Advanced Micro upgraded to Perform at Oppenheimer

BRE – BRE Properties upgraded to Buy from Hold at Deutsche Bank

WYNN – Wynn Resorts upgraded to Outperform from Neutral at Credit Suisse

MA – MasterCard initiated with a Buy at Deutsche Bank

CHK – Chesapeake Energy upgraded to Outperform from Market Perform at Wells Fargo

V – Visa initiated with a Buy at Deutsche Bank

NGG – National Grid upgraded to Neutral from Underweight at HSBC

Downgrades

G – Genpact initiated with a Hold at Deutsche Bank

ITC – ITC Holdings downgraded to Hold from Buy at Deutsche Bank

LM – Legg Mason downgraded to Underperform from Neutral at BofA/Merrill

SNI – Scripps Networks Interactive downgraded to Neutral from Overweight at JP Morgan

VE – Veolia Environnement downgraded to Sell from Neutral at UBS

ICE – IntercontinentalExchange downgraded to Market Perform from Outperform at Keefe Bruyette

ILMN – Illumina downgraded to Neutral from Overweight at Piper Jaffray

EC – Ecopetrol downgraded to Neutral from Buy at BofA/Merrill

ONNN – ON Semiconductor resumed with Neutral from Outperform at Wedbush

CP – Canadian Pacific downgraded to Outperform

GIB – CGI Group initiated with a Hold at Deutsche Bank

IPCC – Infinity Prpty & Casualty downgraded to Underperform from Neutral at BofA/Merrill

Comments »Gapping Up and Down This Morning

Gapping Up

SREV +12.4%, ANGO +1.6%, TOT +1.1%, AOB +9.4%, TTM +2.7%, SDRL +1.3%, ETFC +4.3%, SWHC +8.3%,

NUAN +1.5%, UGI +1.3%, ATVI +0.6% , WYNN +0.4%, since the employment report came out futures went from red to green taking many stocks and Europe higher….

Gapping Down

RGP -4.4%, MWE -3.7%, AFFX -7.7%, ESRX -5%, DB -1.7%,UBS -2.9%, ILMN -26.1%, ANEN -13.3%, CMG -1%,

BCS -1%, IRE -8.8%, NBG -3.1%, UBS -2.9%, BCS -2.8%, DB -2.2%, ING -2.1%, RBS -2.1%, VE -4.4% , WRE -1.6% ,

HRBN -0.7%, ITC -1.4%,

Comments »In Play and On the Wires

John Paulson Finds Another Hand Grenade in His Portfolio

Germany’s Industrial Production Falls Less Than Expected

Canada’s Unemployment Rate Falls in September

France and Germany Disagree Again Over Best Course for Bank Aid

Asain Markets Hold Gains While Europe and U.S. Futures Fluctuate

Banks and Exporters Help Hong Kong Market Go Maximum Boom-Boom

Asian Markets Gap Up Full Retard

Bulls Manage The Hat Trick

Today’s Top Performing ETF’s

No. Ticker % Change

1 RUSL 14.21

2 AGQ 9.84

3 LBJ 9.58

4 EDC 8.94

5 FAS 8.71

6 COWL 8.14

7 PSLV 7.68

8 DRN 7.47

9 YINN 7.35

10 UCO 7.15

11 DZK 6.66

12 REMX 6.58

13 JJT 6.54

14 TNA 6.41

15 MWJ 6.29

16 CU 6.26

17 MATL 6.20

18 SIL 5.96

19 TAN 5.88

20 UYG 5.83

21 ECH 5.65

22 PALL 5.64

23 EEMS 5.55

24 BJK 5.43

25 BRIL 5.40

26 BGU 5.34

27 DBS 5.34

28 RSX 5.25

29 UVU 5.17

30 SLV 5.16

31 THD 5.08

32 UPRO 5.06

33 URE 4.99

34 TMV 4.89

35 EWZ 4.85

36 ICLN 4.81

37 EET 4.75

38 MVV 4.75

39 TYH 4.72

40 GDXJ 4.50

41 DCE 4.50

42 ERX 4.48

43 KBE 4.39

44 TQQQ 4.37

45 NCZ 4.34

46 UGA 4.34

47 EWA 4.31

48 LIT 4.29

49 EIDO 4.25

50 ROOF 4.24

Today’s Winners and Losers

No. Ticker % Change

1 FEED 54.71

2 YRCW 47.00

3 CYDE 44.44

4 LEI 25.42

5 ZOOM 23.02

6 SCEI 22.34

7 XG 21.50

8 RITT 21.24

9 RSOL 20.57

10 PAL 20.09

11 GTIV 19.49

12 PMI 19.45

13 MGH 18.75

14 SHZ 18.70

15 EK 18.44

16 SOL 18.29

17 MTG 17.93

18 YOKU 17.23

19 OPTT 16.94

20 CDTI 16.83

21 LNET 16.67

22 GMR 16.63

23 DANG 16.43

24 OINK 15.62

25 EGI 15.33

26 REFR 15.28

27 PRST 14.71

28 CHGS 14.61

29 CVGI 14.31

30 CDY 14.27

31 DQ 14.25

32 MPEL 14.13

33 DRYS 14.11

34 MNTG 13.91

35 ANO 13.84

36 CPY 13.72

37 OCZ 13.68

38 NYT 13.19

39 TLR 13.17

40 DVR 13.13

41 GOK 13.13

42 ZNH 13.00

43 QPSA 12.97

44 WH 12.90

45 MERR 12.88

46 MCP 12.86

47 SRZ 12.85

48 IGOI 12.82

49 KBX 12.60

50 BIOF 12.50

—————————–

No. Ticker % Change

1 WHRT -23.68

2 HRZ -21.95

3 WTSLA -12.74

4 WEBM -12.39

5 ADGE -10.06

6 IDI -9.13

7 OBCI -8.84

8 BPZ -8.51

9 DGLY -8.00

10 FSII -7.73

11 ANCI -7.69

12 ONSM -7.66

13 AMCN -7.60

14 PDO -7.12

15 BDSI -7.00

16 LEE -6.67

17 XFN -6.64

18 HSWI -6.33

19 ADAT -6.32

20 NEXS -6.26

21 SAAS -6.21

22 GIGM -6.18

23 MNEL -6.07

24 RELL -6.05

25 HELE -5.96

26 OSG -5.91

27 IRIX -5.80

28 SGMO -5.80

29 SINO -5.26

30 III -5.26

31 TSTC -5.18

32 CVGW -5.14

33 BONT -5.05

34 NNA -5.00

35 HMPR -4.82

36 TAYC -4.81

37 FCBC -4.76

38 OVTI -4.75

39 CNTY -4.74

40 ARRY -4.69

41 UQM -4.65

42 MERU -4.53

43 ADUS -4.41

44 MG -4.40

45 EDS -4.39

46 ARTX -4.38

47 PURE -4.35

48 ONE -4.26

49 GGS -4.18

50 NABI -4.17

The Housing Hat Trick

The Yin and Yang of Equities

The yin and yang of equities can also be described as overbot and oversold.

The recent volatility has investors confused. If you had The PPT you would easily be able to identify when the market is at these pivot points and thus take advantage instead of being a part of mutual fund outflows or just sitting on the sidelines.

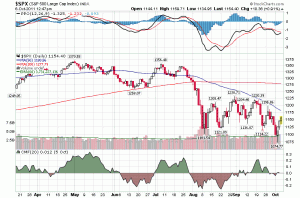

Looking at the chart of the S&P we have a similar scenario to last June. The question is will we repeat history and rally hard into the end of the year or will we continue the same pattern ?

Of course if i had this answer then i would not be posting this article and would be counting my expected billions.

At any rate, last year we knew the EU crisis was coming, but at that time it was still largely on the horizon. We also did not have the possibility of seeing global growth downgrades coupled with earnings estimate downgrades.

The S&P has had a trading range only to be met with a lower trading range; and recently this week we entered bear market territory marking a low of about 1075. Looking at the chart the average price i would expect the S&P to grab on the upside is 1165. As a matter of fact we got close to this level this morning.

As always we never see an exact line and could expect upside to as much as 1180. Beyond that is complete froth land IMO.

The key points to determine if this mornings pundits are right, (all calling for a market to scream higher into the years end with high estimates of 1325 S&P,) is of course Europe first. Any real move towards leveraging the EFSF will send markets higher. The second point, at least for our markets, are earnings guidance.

To play it safe look to sell rips in the 1160-1180 range and buy the dips in the 1075 -1100 range.

FYI The PPT is now reading 3.60 on the SPY which is the threshold of overbot territory.

Given tomorrow’s important employment number i will refrain from making any moves until after the data comes out.

After covering shorts Monday & Tuesday morning and making a killing there was no need to play in a sketchy market.

GLT

[youtube:http://www.youtube.com/watch?v=yXPCp48nYGw 450 300] Comments »S&P Strategists See Huge 4th Quarter Gains For Equities

Upgrades and Downgrades This Morning

Upgrades

EGN – Energen initiated with a Buy at Caris

ABX – Barrick Gold upgraded to Outperform from Market Perform at BMO Capital

SXCI – SXC Health Solutions upgraded to Outperform from Market Perform at BMO Capital

MON – Monsanto upgraded to Overweight from Neutral at JP Morgan

OXY – Occidental Petroleum upgraded to Overweight from Neutral at JP Morgan

PLCM – Polycom upgraded to Buy at Argus

PCG – PG&E upgraded to Buy from Hold at Citigroup

UL – Unilever PLC initiated with a Buy at Societe Generale

SIVB – SVB Financial Group initiated with an Outperform at Raymond James

RL – Polo Ralph Lauren upgraded to Buy from Hold at Citigroup

WES – Western Gas Partners upgraded to Buy at Stifel Nicolaus

Downgrades

ADSK – Autodesk initiated with a Neutral at Cowen

XOM – Exxon Mobil downgraded to Underweight from Neutral at JP Morgan

CVX – Chevron downgraded to Underweight from Neutral at JP Morgan

BBG – Bill Barrett downgraded to Neutral from Buy at Suntrust

CLR – Continental Resources downgraded to Reduce from Neutral at Suntrust

GLW – Corning initiated with an Equal Weight at Morgan Stanley

HCP – HCP initiated with an Equal Weight at Morgan Stanley

CNW – Con-way initiated with an Equal Weight at Morgan Stanley

DYN – Dynegy downgraded to Underperform from Neutral at Macquarie

COST – Costco downgraded to Market Perform from Outperform at William Blair

PFCB – PF Chang’s downgraded to Market Perform from Outperform at William Blair

REN – Resolute Energy downgraded to Reduce from Neutral at Suntrust

CS – Credit Suisse initiated with an Underweight at Banco Santander

CMG – Chipotle Mexican Grill downgraded to Sell from Neutral at Miller Tabak

WAG – Walgreens downgraded to Neutral from Buy at BofA/Merrill

AMX – America Movil SA downgraded to Hold from Buy at Banco Santander

Comments »FLASH: ECB Will Buy 40 Billion Euro in Covered Bonds

Being reported that this will not increase the money supply.

Comments »Gapping Up and Down This Morning

Gapping up

OCZ +20.7%, ZUMZ +14.4%, ESIC +9.6%, NDN +6.1%, NBG +3.6%, LYG +3%, BCS +2.4%, HBC +1.8%, UBS +1.2%,

C +0.8%, CS +0.5%, BAC, TGT +3.7%, ESRX +2.9%,CMTL +12.8%, AIXG +5.1%, GLW +4.8%, MT +4.4%, RIO +3.9%,

MCP +3.5%,LTD +0.5%, SLV +3.5%, BBL +3%, PZG +2.5%,BHP +2.4%, RIO +3.5%, AG +2.4%, BHP +2.4%, BBL +2.1%,

MT +1.8%, SLW +1.6%, MCP +3.5%, DANG +5.5%, BIDU +2.2%, SINA +1.6%, GLW +4.8%, ETN +0.7%

Gapping down

RT -10.1%, DRWI -7.9%, AAPL -2.1%, YHOO -1.9%, BP -1.6%,

Comments »