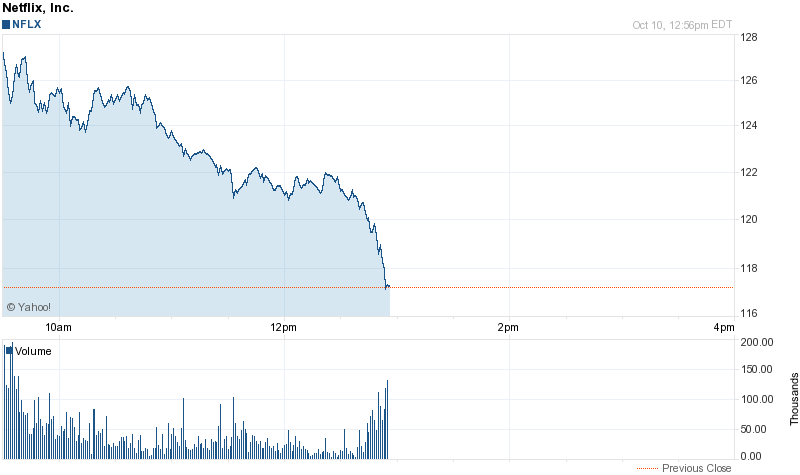

The stock is now down, after surging at the open on news they are scrapping their idiotic “Qwickster” idea.

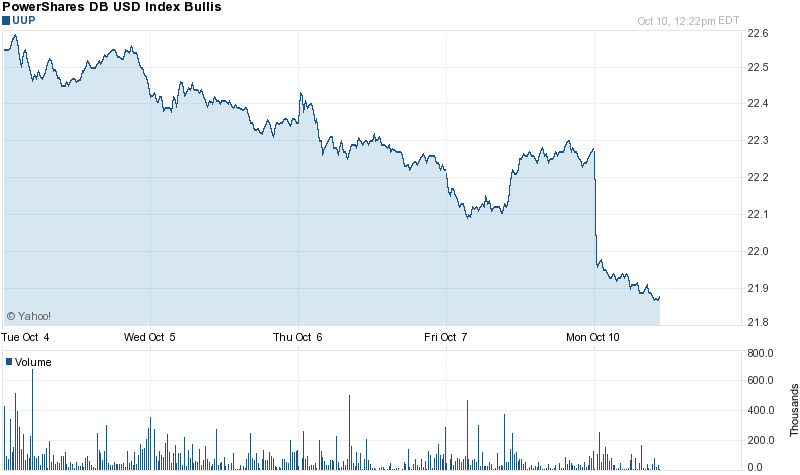

The Dollar Fell Off a Cliff Today

Beware of Deficiency Judgement; You Can’t Just Walk Away Anymore

Do not think you can just walk anymore. 30 states allow this type of lawsuit to be filed.

Comments »Equities Break Out Above the 50 Day Moving Average; Is it Time to Buy ?

I say froth for now until a clear picture emerges from Europe. Remember you do not have to catch the bottom, but rather rejoice in the fat middle.

Comments »Short Selling Rises the Most Since 2006

Today’s Top 50 Winners

No. Ticker % Change

1 CXM 138.38

2 GMR 47.06

3 WH 39.47

4 AMCF 37.92

5 CPX 35.72

6 BIOF 31.58

7 CHLN 25.00

8 ZA 21.25

9 AXAS 20.23

10 GRNB 17.88

11 CVV 17.46

12 TNCC 17.33

13 MAG 17.05

14 EMAN 16.90

15 YOKU 15.46

16 HAUP 15.35

17 PDC 15.25

18 CXZ 14.89

19 FREE 14.47

20 MHR 14.37

21 DVR 14.29

22 CETV 14.06

23 HNR 13.30

24 NBR 13.04

25 VVTV 13.03

26 FRO 12.73

27 ARTW 12.71

28 OSG 12.53

29 CIE 12.10

30 PVA 11.94

31 CWEI 11.78

32 RITT 11.52

33 HLX 11.39

34 CTCM 11.28

35 GEOI 11.28

36 BAS 11.16

37 MTG 11.16

38 MTL 11.11

39 GNOM 11.09

40 JVA 11.06

41 SGY 10.93

42 RIC 10.90

43 DYN 10.79

44 EGY 10.61

45 EXM 10.58

46 ANDS 10.53

47 DBLE 10.50

48 CTC 10.47

49 TITN 10.46

50 GNK 10.43

Refinery Stocks Soar

Buoyed by broad market rally and realization that crack spreads are wide for a reason, shares of refinery related companies are soaring.

DK +9.4%

HFC +8.3%

WNR +7.1%

ALJ +7%

Comments »

Lumber Now the New Copper

Copper has always been a global growth indicator, but has now fallen into the correlation everything up or down category. Lumber is now being touted as the new global growth /health indicator.

Comments »Everything is Kosher With Economic Data Lately….Right ?

That is what the pundits have been saying. I feel things have been looking up and then i read this…

Comments »Germany and France Risk AAA Rating; Downgrade Possible With New Bailout Plans

Not they have a conise plan yet, but the preliminary details show downgrade potential… especially after a U.S. downgrade.

Comments »Apple Gets 1 Million iPhone 4s Orders In a Single Day

Upgrades and Downgrades This Morning

Upgrades

SIVB – SVB Financial Group initiated with Market Perform at Fig Partners

MU – Micron upgraded to Buy from Hold at Citigroup

STJ – St. Jude Medical upgraded to Equal Weight at Morgan Stanley

NFLX – Netflix upgraded to Neutral from Sell at Janney

POT – Potash upgraded to Buy at Ticonderoga

BYI – Bally Technologies upgraded to Buy from Neutral at Janney

PER – SandRidge Permanian Trust upgraded to Strong Buy from Outperform at Raymond James

GBCI – Glacier Bancorp upgraded to Strong Buy from Outperform at Raymond James

ABB – ABB Ltd upgraded to Buy from Hold at Berenberg

PXD – Pioneer Natural Resources downgraded to Equal Weight from Overweight at Barclays

SGY – Stone Energy upgraded to Overweight from Equal Weight at Barclays

Downgrades

CPHD – Cepheid downgraded to Market Perform from Outperform at Raymond James

DGX – Quest Diagnostics downgraded to Market Perform from Outperform at Raymond James

HAS – Hasbro target lowered to $42 at Needham; still sees upside from current levels

CVE – Cenovus Energy downgraded to Equal Weight from Overweight at Barclays

MHS – Medco Health Solutions tgt cut to $55 from $70 at BMO

BMC – BMC Software target lowered to $50 at Collins Stewart

DIOD – Diodes target lowered to $22 at Collins Stewart

LOGI – Logitech Intl SA downgraded to Underperform from Neutral at BofA/Merrill

LUV – Southwest Air downgraded to Hold from Buy at Deutsche Bank

THS – TreeHouse Foods downgraded to Neutral from Buy at BofA/Merrill

SINA – SINA target lowered to $115 at Stifel Nicolaus

IGT – Intl Game Tech remains Sell rating at Goldman on industry and company specific concerns

S – Sprint Nextel downgraded to Outperform from Strong Buy at Raymond James

DANG – Dangdang initiated with an Underweight at Barclays

Comments »Gapping Up and Down This Morning

Gapping up

BBL +4.4%, SLV +3.9%, BCS +3.8%, BHP +3.8%, RIO +3.7%, MT +3.5%, RCL +2.8%, ING +2.7%, RF +4.4%,

DB +2.6%, BAC +2.5%, DB +2.4%, UBS +2.1%, GLD +1.8%, PAAS +1.5%, AAPL +1.3%, ING +2.7%, TCK +7.9%,

RIO +4.9%, GOLD +4.4%, MT +3.9%, BHP +3.8%, HMY +3.8%, SLV +3.3%, GLD +1.8%, PAAS +1.5%,

STO +4.2%, YHOO +3.9%, NFLX +4.5%TOT +4.1%, OMEX +14.1% , CJES +14.2%, SNY +3.3%, NVS +3.1%,

ARMH +4.3%, AMZN +1.4%, ABB +4.5%, NOK +4.1%, MU +4%, POT +2.9%,

Gapping down

NBG -8.3% , SPN -9%, INSM -19.4%, SNP -2.3%, S -2.1%, bear positions, hopes, and dreams

Comments »In Play and On the Wires

World Markets Celebrate a Marriage Between France and Germany

FLASH: S&P Futures Soar on Dexia Nationalization

Futures are up anywhere between 1.2-1.4% on the news that Dexia will be bailed out by the Belgium government.

ROFL

Comments »JPM Out With a Call of 1475 S&P by Years End; Explained in Charts

Funny cause this morning they said cash is better than emerging market exposure. If the S&P is going higher why would emerging markets not ? Inflation perhaps…..

Comments »Large Cap Stocks Getting Pounded Today

No. Ticker % Change Market Cap

1 S -8.80 9,010,000,000

2 A -8.71 11,650,000,000

3 SINA -8.25 5,170,000,000

4 FSLR -7.76 5,590,000,000

5 WAT -7.12 7,230,000,000

6 TMO -6.78 20,500,000,000

7 LIFE -6.60 7,110,000,000

8 CF -6.59 10,240,000,000

9 CLF -6.44 8,600,000,000

10 CTRP -6.41 5,070,000,000

11 UBS -6.40 45,330,000,000

12 MS -6.39 29,270,000,000

13 STI -6.38 10,170,000,000

14 KEY -6.34 6,240,000,000

15 HOG -6.05 8,320,000,000

16 BAC -5.97 63,640,000,000

17 MPC -5.92 11,870,000,000

18 FBR -5.89 6,750,000,000

19 TCK -5.83 20,080,000,000

20 CHL -5.79 198,230,000,000

21 FITB -5.76 10,220,000,000

22 ECA -5.63 14,650,000,000

23 BAK -5.55 6,900,000,000

24 SLW -5.53 10,990,000,000

25 C -5.50 75,930,000,000

26 IVN -5.50 12,020,000,000

27 DB -5.49 33,700,000,000

28 IVZ -5.45 7,610,000,000

29 AIG -5.36 41,790,000,000

30 MOS -5.25 23,810,000,000

31 MET -5.25 32,450,000,000

32 GS -5.21 49,530,000,000

33 RIMM -5.20 12,720,000,000

34 AEM -5.08 10,050,000,000