Oil Had Gains on China’s PMI Data

“Oil advanced for a second day in New York on signs that the economy is improving in China, the world’s second-biggest consumer of crude.

Futures rose as much as 0.5 percent after a purchasing managers’ index climbed to a one-year high in March. Oil capped a 4.2 percent gain in the first quarter as President Barack Obamasaid March 30 that world supplies are sufficient to proceed with new sanctions against Iran.

“The firmer tone relates to the official Chinese PMI reading, and that reverses the negative sentiment we’ve seen around China,” said Michael McCarthy, a chief market strategist at CMC Markets Asia Pacific Pty in Sydney. “That speaks well to demand. The Middle East seems to be quietly boiling away without any signs at this stage of a blow-up.”

Oil for May delivery gained as much as 56 cents to $103.58 a barrel in electronic trading on theNew York Mercantile Exchange and was at $103.12 at 3:05 p.m. Singapore time. Prices fell 3.8 percent in March, narrowing the first-quarter gain.

Brent oil for May settlement increased 26 cents, or 0.2 percent, to $123.14 a barrel on the London-based ICE Futures Europe exchange. The European benchmark contract’s premium to New York-traded West Texas Intermediate was at $20, up from $19.86 on March 30, the most since Oct. 24….”

Comments »Speculators Begin to Trim Bets in Commodities as China Slows and Goldman Issues Neutral Ratings

“Investors pared bullish commodity bets on signs of slowing growth in China and as Goldman Sachs Group Inc. cut its recommendation on raw materials.

Hedge funds and other money managers reduced combined net- long positions across 18 U.S. futures and options by 1.8 percent to 1.14 million contracts in the week ended March 27, Commodity Futures Trading Commission data show. Bullish wagers on hogs fell the most, dropping 31 percent to the lowest since June, while those on gold had the biggest gain, rising 15 percent, the largest increase since the end of January.

The Standard & Poor’s GSCI Spot Index of 24 raw materials tumbled 2.1 percent last week, paring this year’s advance to 6.8 percent. Goldman cut its three-month recommendation on March 28, warning that the economy will “soften” this quarter. Societe Generale SA said March 27 that Chinese corporate profits won’t grow at all this year, and Federal Reserve Chairman Ben S. Bernanke said two days later that the pace of the U.S recovery has been “extremely sluggish.”

“The story over the near term is probably one of weakness,” said Anthony Valeri, a market strategist at LPL Financial in San Diego, which oversees $330 billion of assets. “There are some renewed concerns over China’s economic growth. That’s been the negative for commodities.”

Comments »Why One Gas Is Cheap and One Isn’t

Floyd Norris

THE price of gas has risen rapidly this year.

The price of gas has fallen to the lowest level in a decade.

Both of those statements are true. The first refers to gasoline, the second to natural gas.

As the accompanying charts indicate, never in the two decades that natural gas and oil futures have traded have their prices diverged as much as they have now. On an energy equivalent basis, oil costs more than eight times as much as natural gas.

This week, the price of a million B.T.U.’s of natural gas fell below $2.20 for the first time since 2002, while oil prices slipped a little but remained above $100 a barrel. The last time natural gas was this inexpensive, oil cost about $20 a barrel.

The diverging prices reflect the fact that while oil and natural gas can substitute for each other in some uses, the markets for the two products are very different.

Read the rest here.

Comments »

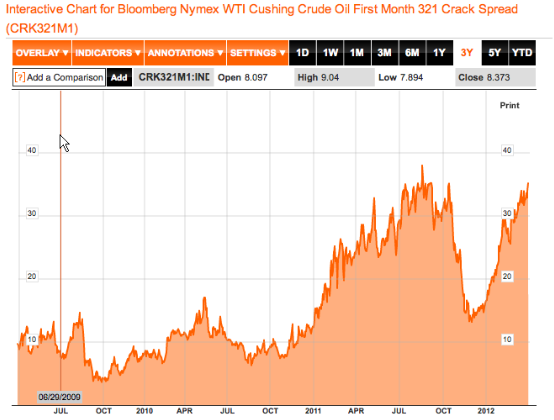

FLASH: CRACK SPREADS ARE ABOVE $35

Oil Rises After EU Bailout Funds Extended

IEA Says They Will Act on Oil Prices

“The executive director of International Energy Agency has released a statement this morning that is pushing crude prices down further today:

The oil market has been tightening in recent months; crude oil prices are very high again, and petrol prices have reached a record high level in some member countries. The International Energy Agency, like many others, is concerned by the impact of these high prices while the global economic recovery remains fragile.

The IEA is closely monitoring market developments and will remain in close contact with member countries to exchange views about the oil-market situation. As we have mentioned many times, the IEA was created to respond to serious physical supply disruptions, and we remain ready to act if market conditions so warrant.

This is a clear indication that the group’s members have reached at least some accord on another release from members’ strategic reserves. With elections on tap in France and later this year in the US and next year in Germany, rising pump prices threaten the re-election hopes of the current governments and nothing would soothe voters more than a drop, even if it’s temporary, in gasoline prices.

Crude prices have sinking again today, with WTI crude down about -2% at $103.28/barrel and Brent crude down about -1% at $122.81/barrel. US pump prices are $0.035 higher today than a week ago according to gasbuddy.com.”

Comments »Not Again: Chinese Firm Surpasses Exxon Oil Production

Commodities Indicate That China Will Curb Global Growth

“Please consider a series of chart my friend “BC” put together of various indices vs. the Morgan Stanley Commodity Related Equity Index ($CRX).

What is the Commodities Sector Seeing that the Stock Market Doesn’t?

The answer from my friend Pater Tenebrarum who also saw these charts is “the coming economic bust in China – which has likely already begun.”

That idea is in-line with several of my recent posts …

- Hidden Losses and Little Reform; China May Be Slowing More Than You Think

- World Bank Warns of Economic Crisis in China; Only 3% Growth for Decade Says Michael Pettis

- “Curbs Needed to Avoid China Property Chaos” Says China’s Premier; Chinese Economy Already in Hard Landing? Regardless, It’s Too Late to Prevent Chaos

- Michael Pettis: Long-Term Outlook for China, Europe, and the World; 12 Global Predictions

Below, the four charts that show it all.

$SPX vs. $CRX

|

$CYC vs. $CRX

|

$TRAN vs. $CRX

|

$DJUSRR vs. $CRX

|

Comments »

Investors Bet on Palladium Over Gold as Global Car Sales Rise

“Investors are buying palladium at the fastest pace in more than a year as analysts predict rising demand and declining supply will turn this quarter’s worst- performing precious metal into the best by December.

Holdings in palladium-backed exchange-traded products rose 14 percent this year, poised for the best quarter since the end of 2010, data compiled by Bloomberg show. The metal will average $850 an ounce in the final three months of 2012, 31 percent more than now, according to the median estimate of 11 analysts surveyed by Bloomberg. They expect a gain of 15 percent for gold, 13 percent for silver and 10 percent for platinum.

Palladium lagged behind other metals this year on concern about slowing growth in vehicle sales in China, the world’s largest car market. Autocatalysts account for 65 percent of demand, according to Barclays Capital. Prices are poised to rise because carmakers are still using the most metal ever, with the prospect of shortages because of less supply from state reserves in Russia, the biggest producer, the bank estimates.

“I like palladium the best among precious metals, it’s relatively cheap compared to the others,” said Bart Melek, the head of commodity strategy at TD Securities Inc. in Toronto and the most accurate price forecaster tracked by Bloomberg Rankings in the eight quarters through the end of 2011. “Autocatalyst demand for palladium should grow. Russian government stocks will limit supply growth.”

Comments »Oil Remains Weak on Supply and Growth Concerns

New EPA Rule will Block ALL New Coal-Electric Generation

by Alec Rawls

The upcoming rule:

… will require any new power plant to emit no more than 1,000 pounds of carbon dioxide per megawatt of electricity produced. The average U.S. natural gas plant, which emits 800 to 850 pounds of CO2 per megawatt, meets that standard; coal plants emit an average of 1,768 pounds of carbon dioxide per megawatt.

Can this stand, after Obama’s big energy-policy tour last week included not a single mention CO2, greenhouse gases, climate or global warming?

Read the rest here.

Comments »A Rational Reason for High Oil Prices

via Econbrowser

“There is no rational reason for high oil prices,” writes Ali Naimi, Saudi Arabian Minister of Petroleum and Mineral Resources, in today’s Financial Times. Well, I can think of one– if oil prices were lower, the world would want to consume more than is currently being produced.

The graph below plots total world oil production over the last decade. After growing rapidly in earlier years, production hit a bumpy plateau. In November 2007, just before the U.S. recession began, the world was producing 84.9 million barrels each day, a little less than was produced in the spring of 2005. Although production stagnated, the demand curve continued to shift out, with world GDP growing 5.3% in 2006 and another 5.4% in 2007. Consumption of petroleum by China alone was 800,000 barrels/day higher in 2007 than it had been in 2005, meaning the rest of the world had to decrease consumption over this period.

Read the rest here.

Comments »Natty No Gas Hits 10 year Lows 2Day

Crack Spreads Slowly Approach New Highs

Crude Oil Supplies Come in Double Expectations; A Build of 7.1 Million Barrels

Gasoline inventories were down 3.5 million barrels …

Comments »Goldman: Oil Could Be in for a Huge Sell Off

“A new report from Goldman Sachs’s commodities research team points to an imminent oil sell-off—or at the very least, a noticeable pause in the rise of oil prices.

According to that research, oil prices generally decline amid softer U.S. economic data, and (though analysts stop short of saying it) often in a big way. And that’s just what’s happening right now.

Goldman analysts argue that a negative turn in their proprietary economic surprise indicator—US-MAP—will probably precede a drop in oil prices, just as it has in the past. And from the graph of that indicator versus WTI crude oil prices, they appear to have a point:

Read more: http://www.businessinsider.com/goldman-oil-futures-could-soon-see-a-sell-off-2012-3#ixzz1qPynRTe9

Comments »France Considering Strategic Oil Release to Coordinate With the U.S. and the U.K.

“PARIS (Reuters) – France is in contact with Britain and the United States on a possible release of strategic oil stocks “in a matter of weeks” to push fuel prices down, Le Monde daily said on Wednesday, citing presidential sources.

France would join a UK-U.S. cooperation on a release of strategic oil stocks that is expected within months, two British sources said earlier this month, in a bid to prevent fuel prices choking economic growth in a U.S. election year.

The presidential office and the French energy ministry were not immediately available for comments.

Crude hit $128 a barrel this month, only $20 short of its 2008 peak, and is up more than 15 percent since January, largely because of sanctions against oil producer Iran.

They were down 0.6 percent to $124.85 by 0807 GMT on Wednesday.

Global oil supply outages are running at more than a million barrels a day, a Reuters survey has found, helping provide justification for the United States and Britain should they release strategic reserves in a bid to cut oil prices….”

Comments »Oil Falls Overnight on Global Growth Worries, Supply Build Up, and a Tapping of Reserves

Oil Futures Spark Debate: $100 Level Shortlived?

Oil contracts for delivery in three to five years’ time are trading at their biggest ever discount to spot prices, prompting a debate about whether the era of triple-digit oil prices will be a short-term phenomenon.

Spot oil prices have rallied nearly $20 since the start of the year and traded above $125 a barrel yesterday, on the back of supply disruptions and geopolitical fears over Iran.

Over the same period, oil for delivery in December 2018 has risen $1 to about $95. This has opened a record gap of more than $30 between spot and five-year contracts. “The market has the perception that oil supply will increase in the future and that is holding back the price of forward contracts,” said Mark Thomas, head of energy futures at commodities brokerage Marex Spectron, citing expectations of higher output in Iraq, Brazil, the US and Canada.

Read the rest here.

Comments »