No. Ticker % Change Short as % of Float

1 THO 21.02 13.50

2 AMSC 14.95 26.36

3 IOC 10.14 20.17

4 EXH 10.03 11.40

5 ETM 9.91 13.10

6 AMED 9.59 23.40

7 NYT 8.67 11.70

8 LOCM 8.64 11.80

9 ART 8.44 10.90

10 EK 8.39 37.60

11 CRZO 8.24 16.10

12 GCAP 8.12 23.10

13 SIGA 7.85 23.10

14 CRWN 7.46 12.40

15 PNFP 7.37 17.38

16 KIOR 7.31 21.20

17 ENTR 7.25 19.40

18 CONN 6.96 27.00

19 STEC 6.84 24.99

20 LEN 6.83 23.80

21 TWI 6.82 26.80

22 PPC 6.78 11.10

23 AF 6.77 10.50

24 STSA 6.74 43.10

25 UEC 6.37 13.25

26 BXS 6.12 13.50

27 RYL 5.79 18.00

28 ENOC 5.77 16.00

29 MVIS 5.71 12.70

30 SUSQ 5.65 14.18

31 FSII 5.65 11.00

32 UBSI 5.50 18.30

33 PACR 5.45 18.16

34 HMIN 5.36 20.64

35 HRBN 5.34 40.20

36 PRK 5.27 12.30

37 SKY 5.24 32.60

38 PRSP 5.24 13.50

39 HBHC 5.21 12.50

40 GMXR 5.21 13.50

41 WGO 5.19 22.60

42 AEL 5.19 12.10

43 VPHM 5.08 10.20

Brazilian iPAD Deal in “Serious Trouble”

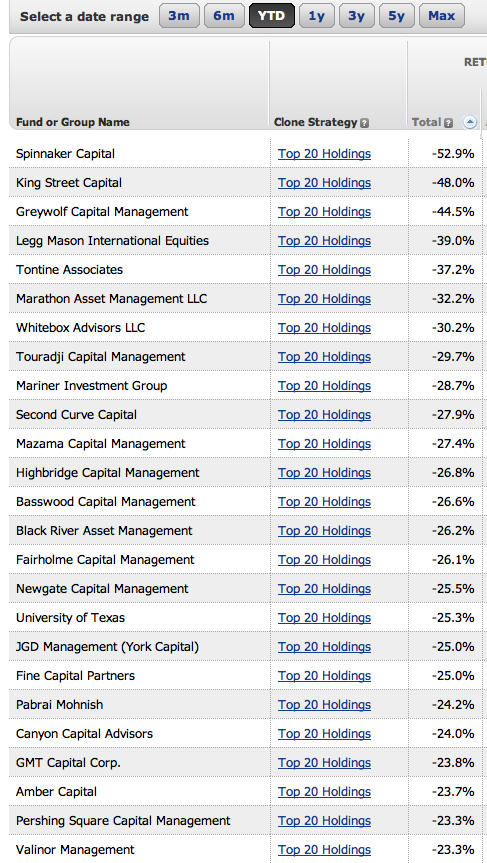

Worst Performing Funds, YTD

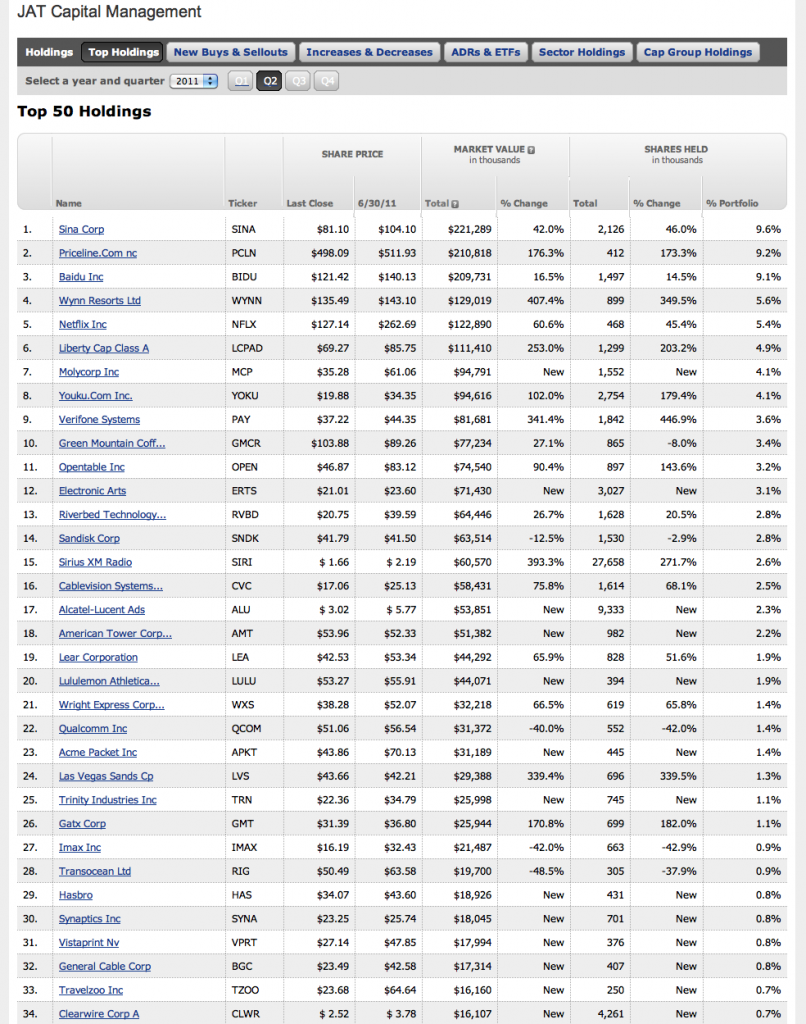

JAT Capital Management is Getting SMOKED!

Michelle Obama Invites You to Relax With Her Husband

From: Michelle Obama [mailto:[email protected]] Sent: Wednesday, September 28, 2011 2:34 PM

To:

Subject: These dinnersXXXX —

Not everyone knows how to prepare for a dinner like this. As someone who’s eaten countless meals with my husband, I want to tell you the one thing to do if you’re selected to join him…

Just relax. Barack wants this dinner to be fun, and he really loves getting to know supporters like you.

I hope you’ll take him up on it before Friday’s deadline.

Will you donate $3 or more today and be entered to have dinner with Barack?

These dinners mean a lot to Barack. They’re a chance for him to talk with a few of the people who are driving the campaign — and a chance for him to say thank you.

So come prepared to tell your story, and say whatever’s on your mind.

Don’t miss the opportunity to be there. Donate $3 today, before the September 30th deadline:

https://donate.barackobama.com/Dinner

Thanks,

Michelle

WTF?!

Comments »FLASH: Momentum Stocks Extend Intra-Day Losses

Staggering

No. Ticker % Change Market Cap

1 YOKU -22.48 2,870,000,000

2 EDU -15.63 4,160,000,000

3 AMD -15.37 4,380,000,000

4 FMCN -13.87 4,360,000,000

5 NFLX -13.08 11,820,000,000

6 BIDU -11.38 46,650,000,000

7 IPGP -11.23 2,690,000,000

8 FOSL -10.85 6,460,000,000

9 SOHU -10.28 3,040,000,000

10 TIF -10.19 9,130,000,000

11 ARIA -10.15 1,170,000,000

12 SINA -10.06 6,430,000,000

13 SIRI -9.94 6,780,000,000

14 WYNN -9.90 18,240,000,000

15 MAKO -9.76 1,450,000,000

16 DVA -9.73 6,720,000,000

17 GMCR -9.51 15,110,000,000

18 COH -9.36 15,200,000,000

19 TPX -9.23 3,910,000,000

20 NXPI -9.06 4,270,000,000

21 MPEL -8.76 6,680,000,000

22 SFY -8.53 1,270,000,000

23 GTAT -8.50 1,550,000,000

24 EW -8.36 8,580,000,000

25 MPC -8.21 12,830,000,000

26 HFC -7.98 7,590,000,000

27 CRR -7.96 3,330,000,000

28 CVI -7.89 2,210,000,000

29 WNR -7.79 1,570,000,000

30 ESI -7.75 1,970,000,000

31 ROC -7.71 3,800,000,000

32 JAZZ -7.56 1,670,000,000

33 UA -7.49 3,610,000,000

34 PWRD -7.38 1,070,000,000

35 PVH -7.30 4,350,000,000

36 SNDA -7.26 1,910,000,000

37 SPWRA -7.26 1,390,000,000

38 N -7.18 2,140,000,000

39 VRA -7.14 1,210,000,000

40 DECK -7.10 3,210,000,000

41 YUM -7.08 25,080,000,000

42 LVS -6.67 33,380,000,000

43 VCLK -6.62 1,240,000,000

44 FNSR -6.61 1,510,000,000

45 AMRN -6.59 1,420,000,000

46 YNDX -6.55 9,800,000,000

47 MU -6.29 6,170,000,000

48 PANL -6.28 2,330,000,000

49 EXPE -6.27 8,020,000,000

50 CROX -6.24 2,430,000,000

FLASH: The Market is Giving it All Back

Nasdaq is now off by 1%+, the S&P is flat and the Dow is only up 65.

Comments »Cocksuckers: BAC to Begin Charging $5 Per Month For Debit Cards

NFLX is Now Down 50%, Month to Date

Today’s 10% decline puts NFLX down 50% for the month of September.

Comments »High End Retailers Getting Smoked Today

TIF -8%

COH -7%

TRLG -5%

RL -5%

PVH -5%

LULU -3%

RUMOR: RIMM Stopped Production of Playbook

Best Buy slashed price by $200 and some hack analyst said he believes they stopped production.

Comments »Let’s See How Fairholme Capital’s Positions Performed Over the Past Three Months

No. Ticker Inst. Holdr. (% outstanding) Institutional Holder 3-month Return

1 RF 9.84 FAIRHOLME CAPITAL MANAGEMENT -42.08

2 MS 2.52 FAIRHOLME CAPITAL MANAGEMENT -37.49

3 JEF 2.04 FAIRHOLME CAPITAL MANAGEMENT -36.01

4 C 0.83 FAIRHOLME CAPITAL MANAGEMENT -35.82

5 RRR 11.42 FAIRHOLME CAPITAL MANAGEMENT -33.59

6 LUK 7.65 FAIRHOLME CAPITAL MANAGEMENT -30.76

7 CIT 9.68 FAIRHOLME CAPITAL MANAGEMENT -27.76

8 JOE 28.86 FAIRHOLME CAPITAL MANAGEMENT -26.77

9 GS 1.19 FAIRHOLME CAPITAL MANAGEMENT -25.69

10 WCG 8.39 FAIRHOLME CAPITAL MANAGEMENT -25.49

11 STD 0.06 FAIRHOLME CAPITAL MANAGEMENT -24.59

12 FUR 4.06 FAIRHOLME CAPITAL MANAGEMENT -23.82

13 GGP 9.06 FAIRHOLME CAPITAL MANAGEMENT -23.79

14 TAL 4.78 FAIRHOLME CAPITAL MANAGEMENT -23.00

15 AIG 5.44 FAIRHOLME CAPITAL MANAGEMENT -22.41

16 SPR 9.31 FAIRHOLME CAPITAL MANAGEMENT -20.00

17 SHLD 15.21 FAIRHOLME CAPITAL MANAGEMENT -19.95

18 MBI 23.80 FAIRHOLME CAPITAL MANAGEMENT -13.94

19 HUM 2.06 FAIRHOLME CAPITAL MANAGEMENT -6.87

Today’s Biggest Large Cap Winners

No. Ticker % Change Market Cap

1 LPL 12.18 7,210,000,000

2 ING 10.35 31,440,000,000

3 CS 7.30 33,190,000,000

4 PHG 7.05 19,940,000,000

5 DB 6.92 36,050,000,000

6 TI 6.72 23,260,000,000

7 UBS 6.22 52,640,000,000

8 STD 6.07 55,580,000,000

9 TTM 5.24 10,410,000,000

10 HIG 5.18 8,650,000,000

11 AEG 5.13 8,240,000,000

12 ABB 5.11 47,150,000,000

13 AV 5.02 15,520,000,000

14 BCS 4.53 29,960,000,000

15 MT 4.24 32,710,000,000

16 BBVA 4.23 40,090,000,000

17 LYG 4.21 43,320,000,000

18 CNP 4.11 8,330,000,000

19 AON 4.07 15,400,000,000

20 E 4.07 68,150,000,000

21 RCL 4.03 5,600,000,000

22 CRH 4.02 12,100,000,000

23 KEY 3.97 6,430,000,000

24 NOK 3.96 22,930,000,000

25 MS 3.95 33,390,000,000

26 AFL 3.84 17,020,000,000

27 ALL 3.74 13,010,000,000

28 IX 3.74 9,580,000,000

29 MET 3.62 35,230,000,000

30 LNC 3.59 6,480,000,000

31 SI 3.57 90,430,000,000

32 MFC 3.52 24,320,000,000

33 STI 3.49 10,540,000,000

34 FTE 3.41 50,570,000,000

35 TSN 3.38 6,570,000,000

36 TEF 3.37 93,220,000,000

37 VE 3.34 8,350,000,000

38 PGR 3.33 12,140,000,000

39 HDB 3.30 24,230,000,000

40 PRU 3.30 24,380,000,000

41 KB 3.29 13,970,000,000

42 FMX 3.25 24,130,000,000

43 BF-B 3.16 10,630,000,000

44 MFG 3.14 64,270,000,000

45 BT 3.10 21,510,000,000

46 MAR 3.06 10,260,000,000

47 BBT 2.96 14,320,000,000

48 LLL 2.93 6,940,000,000

49 SHG 2.92 19,220,000,000

50 USB 2.91 44,510,000,000

FLASH: Chinese Stocks Are Getting Crushed

This doesn’t look like an +200 day.

No. Ticker % Change Industry

1 CAGC.PK -31.25 Chinese Burritos

2 RCON -16.35 Chinese Burritos

3 SINA -13.38 Chinese Burritos

4 FMCN -10.97 Chinese Burritos

5 SOHU -9.83 Chinese Burritos

6 EDU -9.21 Chinese Burritos

7 BIDU -8.16 Chinese Burritos

8 YOKU -7.95 Chinese Burritos

9 XNY -7.33 Chinese Burritos

10 SCEI -7.08 Chinese Burritos

11 CIS -6.97 Chinese Burritos

12 TUDO -6.38 Chinese Burritos

13 SCOK -5.88 Chinese Burritos

14 TAOM -5.54 Chinese Burritos

15 SEED -5.45 Chinese Burritos

16 CIIC -4.95 Chinese Burritos

17 JOBS -4.64 Chinese Burritos

18 CCIH -4.62 Chinese Burritos

19 NQ -4.58 Chinese Burritos

20 CTRP -4.48 Chinese Burritos

21 CCSC -4.17 Chinese Burritos

22 CNAM -4.12 Chinese Burritos

23 SNDA -4.10 Chinese Burritos

24 DHRM -4.07 Chinese Burritos

25 NTES -4.07 Chinese Burritos

26 LIWA -3.67 Chinese Burritos

27 NEWN -3.11 Chinese Burritos

28 YONG -3.07 Chinese Burritos

29 ONP -3.04 Chinese Burritos

30 FENG -2.97 Chinese Burritos

31 CAAS -2.97 Chinese Burritos

32 OINK -2.76 Chinese Burritos

33 VISN -2.66 Chinese Burritos

34 DATE -2.63 Chinese Burritos

35 OSN -2.61 Chinese Burritos

36 PWRD -2.38 Chinese Burritos

37 SVA -2.17 Chinese Burritos

38 ASIA -2.12

Data provided by The PPT

Comments »Treasuries Are Rallying

TLT is +0.55%

Comments »Massive Liquidation is Underway in Momentum Names

Intra-day losses for stocks over $1 bill

No. Ticker % Change Market Cap

1 AMD -10.89 4,380,000,000

2 FOSL -9.32 6,460,000,000

3 FAZ -8.34 1,209,974,941

4 FMCN -8.20 4,360,000,000

5 NFLX -8.13 11,820,000,000

6 YOKU -7.95 2,870,000,000

7 WYNN -7.88 18,240,000,000

8 SINA -7.66 6,430,000,000

9 EW -7.61 8,580,000,000

10 DVA -7.41 6,720,000,000

11 SCO -6.83 2,528,487,273

12 BIDU -6.20 46,650,000,000

13 LVS -5.98 33,380,000,000

14 SFY -5.69 1,270,000,000

15 TIF -5.67 9,130,000,000

16 MOS -5.46 32,440,000,000

17 SOHU -5.40 3,040,000,000

18 MPEL -5.04 6,680,000,000

19 COH -5.04 15,200,000,000

20 VRA -4.91 1,210,000,000

21 IVN -4.76 15,380,000,000

22 WNR -4.63 1,570,000,000

23 GMCR -4.57 15,110,000,000

24 CRR -4.47 3,330,000,000

25 PCLN -4.22 25,930,000,000

26 MAKO -4.17 1,450,000,000

27 HFC -3.84 7,590,000,000

28 PIR -3.78 1,280,000,000

29 YGE -3.74 1,010,000,000

30 WLT -3.60 5,200,000,000

31 EXPE -3.57 8,020,000,000

32 DECK -3.54 3,210,000,000

33 FNSR -3.54 1,510,000,000

34 YNDX -3.36 9,800,000,000

35 ACTG -3.32 1,670,000,000

36 TPX -3.32 3,910,000,000

37 CROX -3.27 2,430,000,000

38 EDU -3.26 4,160,000,000

39 CBS -3.25 15,550,000,000

40 AMRN -3.24 1,420,000,000

41 IMAX -3.21 1,140,000,000

42 FDO -3.04 5,890,000,000

43 NTES -2.91 6,230,000,000

44 SWKS -2.87 3,870,000,000

45 RL -2.83 12,400,000,000

46 IDCC -2.82 3,250,000,000

47 YUM -2.76 25,080,000,000

48 GTE -2.69 1,730,000,000

49 NXPI -2.68 4,270,000,000

50 ARIA -2.64 1,170,000,000

FLASH: German Finance Minister Says “He Never Used the Word Lever”

Steve Liesman from CNBC reported that his sources said the ECB would lever the ESFS to $2 trillion. Immediately after that, the market soared. Now the German Finance minister is denying “suchness.”

Comments »Oracle Issues a Scathing Statement Regarding Autonomy

“After HP agreed to acquire Autonomy for over $11.7 billion dollars, Oracle commented that Autonomy had been ‘shopped’ to Oracle as well, but Oracle wasn’t interested because the price was way too high. Mike Lynch, Autonomy CEO, then publically denied that his company had been shopped to Oracle. Specifically, Mr. Lynch said, “If some bank happened to come with us on a list, that is nothing to do with us.” Mr. Lynch then accused of Oracle of being ‘inaccurate’. Either Mr. Lynch has a very poor memory or he’s lying. ‘Some bank’ did not just happen to come to Oracle with Autonomy ‘on a list.’ The truth is that Mr. Lynch came to Oracle, along with his investment banker, Frank Quattrone, and met with Oracle’s head of M&A, Douglas Kehring and Oracle President Mark Hurd at 11 am on April 1, 2011. After listening to Mr. Lynch’s PowerPoint slide sales pitch to sell Autonomy to Oracle, Mr. Kehring and Mr. Hurd told Mr. Lynch that with a current market value of $6 billion, Autonomy was already extremely over-priced. The Lynch shopping visit to Oracle is easy to verify. We still have his PowerPoint slides.”

Source: Oracle

UPDATE: Oracle puts the fucking slide shows online. lulz!

Comments »Germany Prepares to Vote on Greek Vacation Money Deal

Michael Savage Opines on Obama’s Solar Scams

[youtube:http://www.youtube.com/watch?v=aOt7q9BKXjo&feature=feedu 603 500]

Comments »