No. Ticker % Change

1 TVIX 12.03

2 CVOL 8.13

3 TVIZ 7.61

4 EDZ 7.35

5 BXDC 7.27

6 DPK 6.89

7 LHB 6.42

8 ERY 6.21

9 FAZ 6.02

10 EPV 6.02

11 VIXY 5.91

12 VIIX 5.88

13 YANG 5.87

14 VXX 5.85

15 BZQ 5.34

16 FXP 5.24

17 RUSS 5.11

18 MWN 4.85

19 EEV 4.81

20 SRTY 4.77

21 DRV 4.59

22 SMK 4.48

23 SMN 4.46

24 SPXU 4.44

25 BGZ 4.40

Spanish Yields Are Blowing Out

10yr yields are now 5.95%, the highest since 1997.

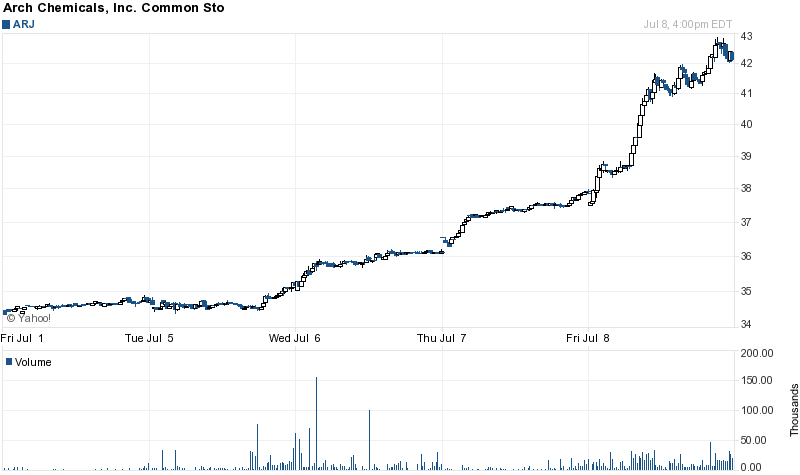

Comments »Flash: Lonza to Acquire Arch Chemicals

They are paying $47.20 or $1.4 billion, all cash deal for ARJ.

Someone leaked this info. Come on, look at the chart.

Comments »Italian Short Selling Rules Start Today

If you are short 0.2% of company market cap: you file forms. Every 0.1% increase: you file more papers.

Full article

Flash: Futures Sharply Lower on Italian Debt Concerns

S&P futs are 5.5 points below fair value, partly thanks to the growing concerns that Italy is next up on the European debt chopping block.

Comments »Flash: EU to Call Emergency Meeting to Deal with Italy

Crack and WTI-Brent Spreads Close at Record Highs

321 crack closed at $34 and WTI-Brent at 22.5, both incredibly bullish for refineries.

Comments »Today’s Winners and Losers

No. Ticker % Change

1 MRNA 23.16

2 SPU 20.75

3 JVA 19.64

4 NED 18.32

5 CSKI 16.03

6 FFN 15.64

7 MSHL 15.24

8 BPAX 13.84

9 MELA 13.39

10 ADLR 13.36

11 CRDC 12.80

12 DCTH 11.80

13 COMV 11.63

14 LOCM 11.57

15 GSVC 11.56

16 GBE 11.46

17 ARJ 11.21

18 HNSN 10.90

19 LEE 10.84

20 EFUT 10.52

21 GVP 10.23

22 GERN 9.63

23 FARM 9.57

24 PCYC 9.38

25 HOLI 9.31

———————————

No. Ticker % Change

1 ONAV -51.58

2 XXIA -24.06

3 ARWR -19.64

4 ARX -17.60

5 ECPG -14.72

6 SMCG -14.57

7 SYMX -12.70

8 CNET -11.54

9 ALV -10.73

10 BLDR -9.84

11 GGR -9.52

12 GMR -9.48

13 BONA -9.05

14 ADAT -8.47

15 FTWR -8.39

16 BTFG -7.57

17 CNIT -7.45

18 CDTI -7.41

19 HIL -7.37

20 PEIX -7.21

21 CHOP -7.19

22 CBMX -7.14

23 REVU -7.04

24 MEG -6.69

25 TBUS -6.67

Today’s ETF Winners

No. Ticker % Change

1 BXDC 7.27

2 SOXS 6.07

3 CVOL 5.21

4 RUSS 5.11

5 EDZ 5.05

6 TVIX 5.01

7 INDZ 4.93

8 LHB 4.85

9 SCO 4.80

10 DTO 4.69

11 DPK 4.39

12 FAZ 4.37

13 MWN 3.98

14 SIJ 3.75

15 SPXU 3.70

16 ERY 3.65

17 SQQQ 3.62

18 TMF 3.60

19 BGZ 3.58

20 EPV 3.54

21 TYP 3.53

22 DTYL 3.52

23 TVIZ 3.52

24 TYD 3.36

25 EEV 3.28

Crack Spreads Nearing New Highs

Up 8.8% today to $31.30.

Comments »Today’s Biggest Winners

No. Ticker % Change Industry

1 COIN 78.00 Agricultural Chemicals

2 MOBI 17.82 Business Software & Services

3 HTCH 17.62 Data Storage Devices

4 PMI 16.81 Surety & Title Insurance

5 VHC 13.05 Internet Software & Services

6 KCI 11.89 Medical Appliances & Equipment

7 PTIE 10.61 Drug Manufacturers – Other

8 JVA 10.52 Processed & Packaged Goods

9 DANG 10.47 Chinese Burritos

10 REDF 9.70 Internet Service Providers

11 RENN 8.45 Chinese Burritos

12 COOL 8.01 Multimedia & Graphics Software

13 AH 6.87 Health Care Plans

14 MTG 6.78 Surety & Title Insurance

15 DEXO 6.56 Publishing – Periodicals

16 RDN 6.35 Surety & Title Insurance

17 AVII 6.04 Drug Manufacturers – Other

18 HEV 6.00 Industrial Electrical Equipment

19 SIFY 5.95 Internet Service Providers

20 ICGN 5.87 Diagnostic Substances

21 SODA 5.82 Beverages – Soft Drinks

22 VRUS 5.69 Drug Manufacturers – Other

23 DPTR 5.69 Independent Oil & Gas

24 SQNS 5.59 Semiconductor – Integrated Circuits

25 GLUU 5.42 Multimedia & Graphics Software

Today’s Biggest Winners

No. Ticker % Change

1 BLUD 30.25

2 AMN 27.42

3 RXII 19.63

4 JVA 15.71

5 BQI 12.40

6 REDF 12.39

7 NOAH 12.18

8 INO 11.28

9 KIPS 11.01

10 ZLCS 10.73

11 SVM 10.56

12 CNTF 10.05

13 MGH 10.00

14 NG 9.92

15 AXAS 9.81

16 FENG 9.73

17 OSBC 9.57

18 EXK 9.51

19 ZAGG 9.49

20 ALTI 9.30

21 BORN 9.14

22 TZOO 8.81

23 DRL 8.65

24 ATRN 8.54

25 GENE 8.49

Claim: Sofitel Victim was Hotel Hooker

From day one I thought something was incredibly fishy about the IMF chief accusations. This story keeps piling on eggs on the stupid faces of the NY District Attorneys Office.

Comments »

Heng Seng Ripping to the Upside

It is now up more than 400 or 1.8%. China mainland is up 1.65% and Japan is up 1%.

Comments »Gadhafi Threatens to Attack Europe

“We can decide to treat you in a similar way,” he said of the Europeans. “If we decide to, we are able to move to Europe like locusts, like bees. We advise you to retreat before you are dealt a disaster.”

Comments »FLASH: Bears Utterly Destroyed in the Week Prior to America’s Birthday

Have a great weekend.

Comments »National Refinery Status

Biggest Big Cap Winners This Week

No. Ticker 1-week Return Market Cap

1 LNKD 33.70 8,510,000,000

2 SINA 20.87 6,550,000,000

3 LYG 18.68 52,840,000,000

4 V 17.83 59,450,000,000

5 NXPI 15.35 6,690,000,000

6 MPEL 15.28 6,800,000,000

7 CBD 14.97 11,960,000,000

8 EBAY 14.85 41,880,000,000

9 NXY 14.68 11,850,000,000

10 YNDX 14.04 11,410,000,000

11 FSLR 14.00 11,400,000,000

12 NBG 13.74 6,830,000,000

13 BBVA 13.28 54,000,000,000

14 GIB 13.26 6,530,000,000

15 RVBD 13.19 6,080,000,000

16 ING 13.04 46,790,000,000

17 ALU 12.52 13,060,000,000

18 CRH 12.38 15,970,000,000

19 WYNN 12.14 17,760,000,000

20 SIRI 12.12 8,640,000,000

21 APOL 11.97 6,190,000,000

22 NKE 11.87 42,660,000,000

23 MA 11.79 38,340,000,000

24 MGM 11.72 6,450,000,000

25 AEG 11.72 12,780,000,000

26 TCK 11.66 29,980,000,000

27 FTI 11.49 10,760,000,000

28 BCS 11.42 48,970,000,000

29 DISH 11.32 13,640,000,000

30 IVN 11.22 16,570,000,000

31 NOV 10.98 33,090,000,000

32 COH 10.93 18,770,000,000

33 HAL 10.90 46,670,000,000

34 CVE 10.82 28,390,000,000

35 MFC 10.80 31,490,000,000

36 STD 10.79 102,510,000,000

37 CGV 10.66 5,540,000,000

38 MON 10.52 38,880,000,000

39 SJR 10.52 9,920,000,000

40 LVS 10.23 30,530,000,000

41 X 10.23 6,620,000,000

42 GGB 10.12 15,810,000,000

43 CTRP 10.10 6,180,000,000

44 JOYG 10.03 10,000,000,000

Biggest ETF Winners/Losers This Week

2 XIV 20.13

3 ERX 19.50

4 LBJ 18.94

5 SOXL 18.55

6 TQQQ 17.59

7 DZK 17.33

8 TYH 16.81

9 EDC 16.72

10 RUSL 16.53

11 FAS 16.02

12 UPRO 15.16

13 MATL 15.02

14 BGU 14.96

15 TNA 14.52

16 MWJ 14.43

17 COWL 13.51

18 DIG 12.92

19 USD 12.34

20 BRIL 11.55

21 QLD 11.44

22 EET 11.07

23 DRN 10.96

24 ROM 10.93

25 UYG 10.48

26 EWD 10.32

—————————–

2 TVIX -32.47

3 TVIZ -18.89

4 VIXY -17.64

5 VIIX -17.45

6 VXX -17.33

7 YANG -17.27

8 ERY -17.21

9 SOXS -16.86

10 BXDC -16.49

11 DPK -16.08

12 TYP -15.03

13 EDZ -14.89

14 FAZ -14.49

15 BGZ -13.54

16 LHB -13.53

17 SPXU -13.51

18 EPV -13.45

19 SQQQ -13.39

20 MWN -13.26

21 TZA -13.20

22 SRTY -13.12

23 BZQ -12.42

24 DUG -11.89

25 RUSS -11.61

26 BRIS -11.46

Biggest Winners/Losers This Week

2 ICGN 147.50

3 TBSI 115.38

4 CHBT 75.72

5 HNHI.OB 67.78

6 SERV 49.56

7 RENN 48.64

8 CCIH 42.88

9 GSVC 38.27

10 TELK 38.18

11 EFUT 36.25

12 LBIX 36.14

13 XFN 35.00

14 LNKD 33.70

15 ATRN 33.47

16 GENE 32.98

17 P 32.73

18 CNU 29.98

19 HOV 28.00

20 YOKU 27.59

21 QIHU 27.52

22 HAFC 26.97

23 CCSC 26.78

24 EMKR 26.03

25 PLM 25.18

26 SFUN 24.60

27 NQ 24.49

28 NNBR 23.45

———————————

No. Ticker 1-week Return

1 JGBO -54.10

2 CWS -52.19

3 MMS -48.38

4 AMX -47.34

5 CEU -35.47

6

7 PEIX -32.22

8 COIN -30.44

9 HMPR -29.28

10 BWOW -28.48

11 ASTI -26.76

12 CYDE -26.47

13 SYNM -26.13

14 RBY -25.77

15 PTIE -25.66

16 CVC -25.51

17 ENMD -25.17

18 MRNA -23.96

19 DMAN -21.18

20 AXK -19.62

21 SYSW -19.44

22 TNGN -19.26

23 ROSG -18.18

24 BXC -16.73

25 ANO -16.54

26 NBS -16.28