“I have long held the opinion that the markets, all of them, have been buoyed by what the Fed and the other central banks have done which was to pump a massive amount of money into the system. There are various ways to count this but about $16 trillion is my estimation. The economy in America has been flat-lining while the economies in Europe have been red-lining and while China has claimed growth their numbers did not add up and could not be believed.

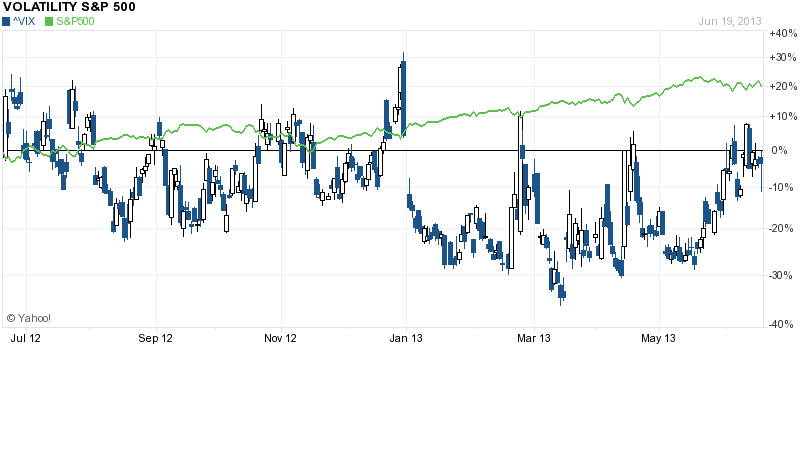

In other words, the economic fundamentals were not supporting the lofty levels of the markets which had rested upon one thing and one thing alone which was liquidity. I have also stated often enough that the long awaited reversal would take place either due to an “event” or due to a change in the Fed’s position where the liquidity was going to be stopped. In one of the clearest and most open meetings ever conducted by the Fed, in my opinion, they said quite clearly that the end to its liquidity operations was coming and while the postulated this and that if the markets did this and that the message was quite clear; we are going to unwind what we have we have done.

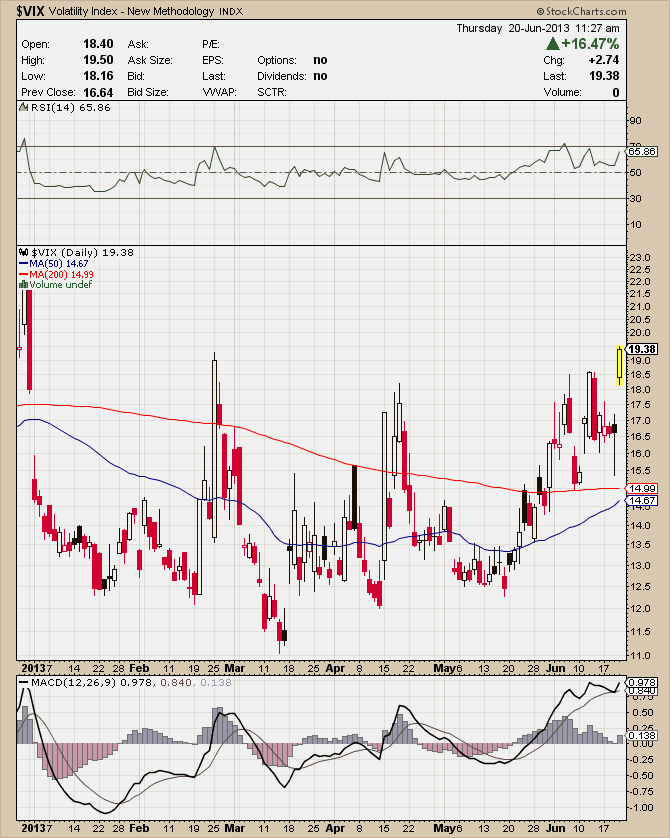

Yesterday was the first day of the reversal. There will be more days to come.

What you are seeing, in the first instance, is leverage coming off the table. With short term interest rates right off of Kelvin’s absolute Zero there was been massive leverage utilized in both the bond and equity markets. While it cannot be quantified I can tell you, dealing with so many institutional investors, that the amount of leverage on the books is giant and is now going to get covered. It will not be pretty and it will be a rush through the exit doors as the fire alarm has been pulled by the Fed and the alarms are ringing. There is also an additional problem here.

The Street is not what it was. There is not enough liquidity in the major Wall Street banks, any longer, to deal with the amount of securities that will be thrown at them and I expect the down cycle to get exacerbated by this very real issue. Bernanke is no longer at the gate and the Barbarians are going to be out in force….”

Full article

Comments »