Developing…

Comments »Prosecutors Say j/k About DSK Rape Charges

Comments »Prosecutors filed a motion on Monday to dismiss all charges against Dominique Strauss-Kahn, stating that the Manhattan maid who accused him of sexual assault had told so many lies that her story could no longer be considered reliable.

Strauss-Kahn was believed to be a top French presidential contender until he was accused of attacking the maid when she entered his room to clean it.

The development comes more than three months after the former head of the International Monetary Fund was arrested, and more than seven weeks after a judge released him from house arrest as investigators admitted they had discovered significant problems with her credibility.

“The physical, scientific and other evidence establishes that the defendant engaged in a hurried sexual encounter with the complainant, but it does not independently establish her claim of a forcible, nonconsensual encounter,” the motion says.

FLASH: EX-DUANE READE CEO SENTENCED TO 3 YEARS IN FEDERAL POUND-ME-IN-THE-ASS PRISON

“Hey Peter, watch your corn hole!” -Lawrence, Office Space

________________

Former Duane Reade Chief Executive Officer Anthony Cuti was sentenced Monday to three years in prison after a jury convicted him last year in connection to an accounting fraud at the drug store chain.In sentencing Cuti, U.S. District Court Judge Deborah Batts in Manhattan called him a “gifted, arrogant, driven, and entitled individual” who “bullied people into committing fraudulent acts to make the company look better than it actually was.”

Read more: http://www.foxbusiness.com/industries/2011/08/22/ex-duane-reade-ceo-sentenced-to-3-years-in-prison/#ixzz1VoAJcqJu

Comments »Flash: Nikkei Opens with Half Price Sushi Bargains Bought

Comments »The Nikkei average rose on Tuesday on broad-based bargain hunting after ending at a five-month low Monday, though lingering fears about the U.S. economy and the strong yen still weighed.

The benchmark Nikkei .N225 was up 0.9 percent at 8,706.93. The broader Topix index .TOPX rose 0.8 percent to 748.71.

Goldman’s Stock Craters Into the Close on Blankfein News

FLASH: LLOYD BLANKFEIN HIRES ATTORNEY TO AVOID FEDERAL POUND-ME-IN-THE-ASS PRISON

Comments »Goldman Sachs Chief Executive Lloyd Blankfein has hired Reid Weingarten, a high-profile Washington defense attorney whose past clients include a former Enron accounting officer, according to a government source familiar with the matter.

Blankfein, 56, is in his sixth year at the helm of the largest U.S. investment bank, which has spent two years dodging accusations of conflicts of interest and fraud.

The move to retain Weingarten comes as investigations of Goldman and its role in the 2007-2009 financial crisis continue.

The Securities and Exchange Commission scored a $550 million settlement against the bank in a fraud lawsuit in July 2010, but other investigations continue.

“Why do you bring in someone like that?” said the source, who was not authorized to speak publicly. “It says one thing: that they’re taking it seriously.”

Blankfein has not been charged in any civil or criminal case, and it was not immediately clear why he hired Weingarten.

David Wells, a spokesman for Goldman, declined to comment.

Weingarten did not respond to requests for comment.

A partner with Steptoe & Johnson LLP, Weingarten has represented a wide array of clients in criminal cases. They include former WorldCom Inc chief Bernard Ebbers, who was later convicted, and former Enron accounting officer Richard Causey, who pleaded guilty in exchange for a 5 to 7-year prison term.

In May, Weingarten won the acquittal of former GlaxoSmithKline lawyer Lauren Stevens on charges of lying and obstructing a probe into the company’s marketing practices.

“I’m used to these monstrously difficult cases where everybody hates my clients,” Weingarten told AmericanLawyer.com in May, although he described Stevens as a “beloved figure.”

Controversy has continued to swirl around Goldman Sachs and Blankfein in the aftermath of the credit crisis in which Goldman was accused of favoring some clients over other investors and of sometimes trading against the interest of clients.

The Senate’s Permanent Subcommittee on Investigations in April released a scathing report that criticized Goldman for “exploiting” clients by unloading subprime exposure onto unsuspecting clients in 2006 and 2007, and concluded that its top executives misled Congress during testimony in 2010.

The company said it disagreed with many of the report’s conclusions, but took seriously the issues addressed.

In June, New York prosecutors subpoenaed the bank to explain some of its actions in the run-up to the financial crisis. It is also the target of probes by the Justice Department, the New York Attorney General and the Securities and Exchange Commission.

It was not immediately clear what charges, if any, Blankfein could face personally.

One former federal prosecutor, who was not authorized to speak publicly, said Blankfein may have hired outside counsel after receiving a request from investigators for documents or other information.

The Senate report raised questions about inconsistencies between testimony from Blankfein and other Goldman executives to Congress and emails unearthed in the Senate investigation. The subcommittee’s chairman, Senator Carl Levin, has said the question of whether Blankfein and others committed perjury is up to the relevant federal agencies.

The former prosecutor cautioned that perjury cases were difficult to prove, adding that prosecutors would not bring charges unless they had a “rock solid case.”

Goldman earlier in August lowered its estimate for future legal costs to $2 billion from its $2.7 billion estimate three months earlier. It said it expects such costs to remain high for the foreseeable future.

Goldman shares have lost a quarter of their value this year, underperforming the broader stock market and other bank shares.

FLASH: INTERVIEW WITH GADDAFI’S SON PRIOR TO GETTING SHOT!

[youtube:http://www.youtube.com/watch?v=gZ2BheZHvAs&feature=youtube_gdata_player 550 412]

Comments »Verizon Strikers Hang it Up

Thousands of striking Verizon workers will return to work Tuesday, though their contract dispute isn’t over yet.The 45,000 employees, who have been on strike since Aug. 7, agreed to return to work while they negotiate with Verizon Communications Inc. on the terms of a new contract. The workers are employed in nine states from Massachusetts to Virginia in the landline division.Among the issues in dispute is the company’s move to freeze pensions and its demand that workers contribute to their health insurance premiums. The company argues that it has to reduce benefits as the landline business deteriorates. More Americans are forgoing such lines in favor of mobile phones.

FULL STORY HERE

Read more: http://www.nypost.com/p/news/local/verizon_workers_going_back_to_work_kXlDmn7sK7NqC6agt2p97N#ixzz1VcrZPuvK

POWER OUTAGE: Costco Pulls Plug on Electric Cars

FLASH: TRIPOLI BESIEGED IN LIBYA–LIVE COVERAGE HERE

Euro Bonds to the Rescue?

Investors around the world are quickly losing faith that policymakers will find a credible solution to end Europe’s most serious crisis since the euro’s inception more than a decade ago.As stock markets plunge and fear ratchets higher, some are clinging to an intriguing concept: euro bonds. In an effort to bring Europe towards fiscal, not just monetary union, bonds would be jointly sold by the euro area’s 17 nations — likely at far lower interest rates than those offered to troubled countries like Greece.

While the idea of euro bonds is staunchly opposed by the current German government, some believe these securities could help heal Europe, but only if they are linked to painful and politically unpopular steps to wean nations off their addiction to debt and get their economies growing faster.

Read more: http://www.foxbusiness.com/markets/2011/08/19/are-euro-bonds-key-to-solving-europes-debt-disaster/#ixzz1VasJtA1R

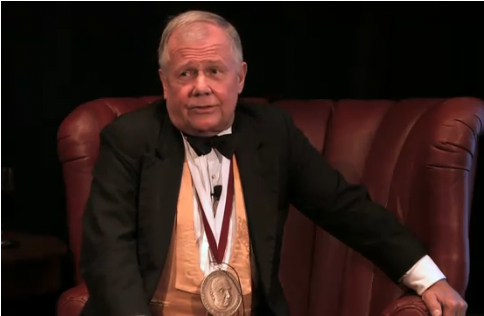

Comments »THE BOW TIE DIARIES: JIM ROGERS’ UTOPIA COMES TO FRUITION

____________________

The overall economy may be struggling against a double-dip recession but in farm country the boom times have rarely been better.

Farmland prices are setting records and farmer incomes have been buoyed by exports and biofuels, easing the pain of some rough summer weather from drought, floods and fires.

Amid China’s voracious appetite for grains and worries about climate hurting crops and food supplies in many countries, U.S. agriculture’s attraction as the world’s breadbasket has become a beacon for Wall Street.

Firms like Omaha-based Gavilon, owned by Ospraie, a hedge fund associated with George Soros and Canada-listed Ceres Global Ag have been buying up grain elevators from Wyoming to Toronto.

That is unusual: investors owning grain silos. But analysts say it’s not what it seems. No one wants to hold corn as a long-term asset, like gold bullion. But storing and moving grain for others has now become a very profitable business.

William Wilson, a consultant and professor at North Dakota State University, said that 10 years ago you could store grain at elevators 2-1/2 to 3 cents per bushel per month. Now costs can be 8-10 cents a month depending on location or grain.

“We’ve seen a lot of big new entrants into the agricultural commodity industry including White Box, Gavilon and others who are expanding,” Wilson said, referring to Minnesota-based hedge fund White Box Advisers, once an owner of grain storage.

“One reason has been the shift to ethanol having a bigger part of the market, where they demand quick access to corn on a 12-month basis,” Wilson said.

“Most of the time when you hear of private capital moving into agriculture they are talking about buying farms. But storage is a logistical function of the marketplace,” he added.

Wilson said special market factors, such as changes to the Chicago Board of Trade wheat contract, have also had the cumulative effect of raising prices for grain storage.

“It’s very important that in the last five years the market price of storage has increased,” Wilson said. “That has provided incentives to construct storage and has provided incentive for new players to enter into this world.”

Don Grambsch, president of Riverland Ag Corp, a Minnesota firm owned by Ceres, operates 14 grain facilities in Minnesota, North Dakota, Wyoming, New York and Ontario with capacity to store 50 million bushels of grain. He said they don’t have investors storing grain as long-term holdings.

“I have not heard of them wanting to buy physicals,” he said. “We are a conventional grain company and store for third party users … They are not financial people, they are processors, beverage companies and so on.”

FARMLAND PRICES SOAR

Wall Street investors and hedge funds also continue to push money into speculative vehicles like grain-related indexes and funds that trade grain derivatives. Corn gains in the last five years look almost as impressive as gold’s.

But the traditional asset play on agriculture by Wall Street — farmland — has also pushed to dizzying heights.

The Chicago Federal Reserve Bank on Wednesday said farmland prices in the Midwest in the second quarter were up 17 percent from a year ago — the biggest jump in 34 years.

Most of the 226 bankers questioned in its quarterly survey said they expect prices to level off in the next three months — but a third also said they expected even more gains.

“Demand for farmland remained strong from both farmers and investors,” the Chicago Fed said.

It is the same story in the Plains. The Kansas City Fed on Monday released its own banker survey showing similar results with farmland values up more than 20 percent from a year ago.

University of Illinois economist Gary Schnitkey attributes the soaring value of farmland to the sluggish economy and the inability of the United States, the European Union and other sovereign debtors to come to grips with fiscal imbalances.

“The threat of long-run instability places a premium on real assets over financial assets. This suggests that a more stable general economic outlook would lead to less aggressive growth in farmland prices,” Schnitkey said.

DRUG SHORTAGE ROCKS AMERICA

WASHINGTON — Federal officials and lawmakers, along with the drug industry and doctors’ groups, are rushing to find remedies for critical shortages of drugs to treat a number of life-threatening illnesses, including bacterial infection and several forms of cancer.

FULL STORY HERE–SOURCE: THE NEW YORK TIMES

Comments »Animation of China vs. Georgetown Basketbrawl

[youtube:http://www.youtube.com/watch?v=A5o6z1fXwRw&feature=player_embedded 550 412]

Comments »DSK Accuser Ponders Dropping Criminal Case for Money

Lawyers for the woman who accused former IMF chief Dominique Strauss-Kahn of sexual assault have explored a deal in which they would scuttle the criminal case in exchange for a monetary settlement in the civil lawsuit, the Wall Street Journal reported Friday.The woman’s lawyer, Kenneth Thompson, strongly denied the report, which the Journal sourced to unidentified people briefed on the matter.The report comes ahead of Tuesday’s scheduled court hearing in which Strauss-Kahn, once seen as a leading contender to be the next president of France, was due to appear before a judge for the first time since he was freed from house arrest on July 1.

Read more: http://www.foxbusiness.com/industries/2011/08/19/strauss-kahn-accuser-mulls-dropping-case-for-money-wsj/#ixzz1VWe31M4D

Comments »FLASH: GOLDMAN SACHS SLASHES ITS U.S. GDP GROWTH FORECAST AGAIN

5,000 People Wait in Hotlanta Heat for Job Fair

Comments »Thousands of unemployed waited overnight, camping out in their business suits and office heels and braving the tormenting heat in Atlanta to stand in line for a job fair Thursday. Authorities treated 20 people for heat exhaustion as they struggled to keep the line moving and get people moved inside.

The incredible turnout at the job fair comes on the heels of the state labor commissioner’s announcement that Georgia’s jobless rate rose.

The state unemployment rate increased to 10.1 percent in July from the 9.9 percent in June. The unemployment rate for African-Americans stands at 15.9 percent, far above the national rate of 9.1 percent.

July marks the 48th consecutive month that Georgia has exceeded the national unemployment rate.

FLASH: APPLE IS WORTH AS MUCH AS ALL EURO ZONE BANKS

____________________

(Reuters) – Technology company Apple is now worth as much as the 32 biggest euro zone banks.

That’s the stark result from a steep fall in the share price of banks including Spain’s Santander, France’s BNP Paribas, Germany’s Deutsche Bank and Italy’s Unicredit, compared to a steady rise in Apple’s valuation, according to Thomson Reuters data.

Earlier on Friday the DJ STOXX euro zone banks index fell 4 percent, valuing its 32 members at $340 billion. That’s based on the market capitalization of their free-float shares, which for some French banks in particular is less than 100 percent.

The index has crashed by a third since the start of July, hammered by fears banks will lose billions from their holdings of euro zone government bonds and a failure of policymakers to stop a euro zone debt crisis from spreading.

The euro zone banks have lost three-quarters of their value since peaking in May 2007.

In contrast, Apple’s market capitalization has soared to $340 billion on the back of the success of innovative technology products like iPods, iPhones and iPads.

(Reporting by Steve Slater; Data analysis by Scott Barber; Editing by Hans-Juergen Peters)

China Loves Us Long Time

(Reuters) – The head of Bank of China, the country’s biggest foreign exchange bank, said on Friday he was concerned about the debt crisis in the United States but expected Washington to deal with the issue.

“We are a little concerned, but we are confident that the U.S. government should be able to solve this problem,” said bank president Li Lihui, when asked whether he was concerned about the stability of the dollar and the U.S. debt situation.

Li told reporters at a business roundtable.