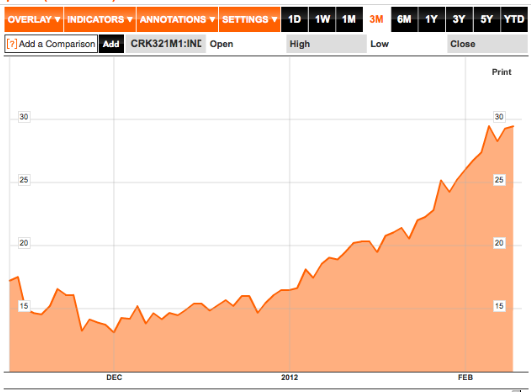

+1.9% for the day, thus far.

Comments »Monthly Archives: February 2012

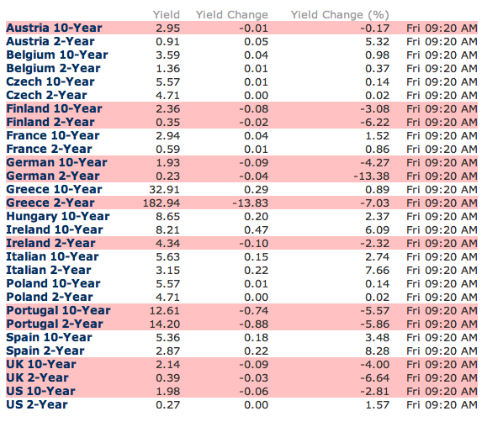

FLASH: Italian, Spanish and Irish Sovereign Bond Yields Spike

U.S. Equity Preview: XL, TRLG, PL, NUAN, LKND, LEA, LF, & ATVI

Activision Blizzard Inc. (ATVI) : The largest video-game publisher posted fourth-quarter profit that exceeded analysts’ estimates on sales of “Call of Duty.” The company’s forecast for this quarter fell short of projections.

Leapfrog Enterprises Inc. (LF) : The maker of electronic educational products for children forecast 2012 earnings would be 40 cents to 45 cents a share, compared with the average analyst projection for 43 cents, data compiled by Bloomberg show.

Lear Corp. (LEA) : The maker of seats and other automobile parts boosted its quarterly dividend to 14 cents a share, from 12.5 cents a share. The Bloomberg forecast was for 15 cents.

LinkedIn Corp. (LNKD) (LNKD US): The biggest professional- networking website reported fourth-quarter sales that more than doubled and profit that topped analysts’ estimates as advertising and subscription revenue increased.

Nuance Communications Inc. (NUAN) : The developer of voice-command technology reported first-quarter earnings excluding some items that missed the average analyst forecast by 5 percent.

Protective Life Corp. (PL) : The Birmingham, Alabama- based insurance company reported fourth-quarter earnings excluding certain items of $1.02 a share, beating the average analyst projection of 83 cents.

True Religion Apparel Inc. (TRLG) : The seller of jeans’ 2012 earnings and revenue forecasts missed the average estimate of analysts surveyed by Bloomberg.

XL Group Plc (XL) : The insurer and reinsurer reported a fourth-quarter loss of 25 cents a share, compared with the average analyst estimate for a profit of 15 cents, data compiled by Bloomberg show.

Comments »Gapping Up and Down This Morning

Gapping up

ALU +16%, SWIR +13%, LNKD +9%, NXPI +6.4%, BRKS +6.3%, VPFG +5%, CBB +4.6%, AKRX +4.5%, BCS +4.4%, CBOE +3.9%, PMC +3.7%, CIE +2.9%, CARB +1.7%,

Gapping down

NGSX -23.8%, TRLG -22.4%, VALV -15.6%, XIDE -14.3%, NUAN -11.3%, GSVC -10.2%, LF -9.1%, UNIS -8%, EXPE -6.7%, LGF -6.4%, GDI -6%, HALO -5.4%,

EXEL -4.6%, EVEP -4.1%, CPST -3.6%, XL -2.9%, STMP -2.8%, AMKR -1.9%, TOT -1%

Comments »Upgrades and Downgrades This Morning

Altera Corporation (NASDAQ: ALTR) Cut to Underperform as Bear of the Day at Zacks.

American Superconductor Corporation (NASDAQ: AMSC) Raised to Buy at Citigroup.

Biogen Idec Inc. (NASDAQ: BIIB) Started as Overweight at Morgan Stanley.

Celgene Corporation (NASDAQ: CELG) Started as Overweight at Morgan Stanley.

Coach, Inc. (NYSE: COH) Started as Buy at Citigroup.

Coinstar, Inc. (NASDAQ: CSTR) named as Value stock of the day at Zacks.

ConocoPhillips (NYSE: COP) Raised to Buy at Deutsche Bank.

First Solar, Inc. (NASDAQ: FSLR) Cut to Neutral at Collins Stewart.

Gilead Sciences Inc. (NASDAQ: GILD) Started as Overweight at Barclays; Started as Overweight at Morgan Stanley.

Hain Celestial Group (NASDAQ: HAIN) maintained Outperform and named as Bull of the Day at Zacks.

MasterCard Inc. (NYSE: MA) Reiterated Buy and raised target to $450 at Argus.

Regions Financial Corporation (NYSE: RF) Raised to Outperform at Credit Suisse.

True Religion Apparel, Inc. (NASDAQ: TRLG) Cut to Hold at Brean Murray.

In Play and On the Wires

U.S. Trade Balance: Prior -$47.8 Billion, Market Expects -$48.2 Billion, Actual -$48.8

No Surprise At All: Fed Plays Favorites To Bid For Assets Held by Taxpayers

Dick Bove: $25 Billion ‘Mortgage Deal From Hell’ Punishes Responsible Homeowners

“A “mortgage deal from hell” between federal and state governments with big banks under which the latter will fork over more than $25 billion to aid struggling homeowners will do mainly one thing: punish responsible borrowers, says banking analyst Dick Bove.

Money will compensate victims of alleged foreclosure fraud and those who owe more on their homes then they’re worth.

It’s basically unfair and populist, says Bove, the vice president of equity research at Rochdale Securities, as those who made down payments and kept up with payments will see nothing while those who didn’t will be rewarded.

“Those people lucky or smart enough to stop making payments on their homes may get their loan balances reduced,” Bove tells CNBC. ”

Comments »Not So Fun Times in the Gulf; 7 Year Ongoing Oil Spill

BAC Becomes the Focus of High Frequency Trading

The Euro Falls on the Debt Withholding to Greece

The Eu is insisting on $430 million more in cuts and that austerity will be applied even after the changing of the guard, (government,) in April.

The Euro is down 0.0096 @ 1.3186

Comments »U.S. Money Markets Double Short Term Loans to French Banks

Germany Says Greece Will Miss Debt Targets

“Greece is missing its debt-cutting targets, German Finance MinisterWolfgang Schaeuble told lawmakers today, intensifying pressure on Greek politicians to deliver on austerity promises.

Schaeuble said in Berlin that Greece’s plans would leave its debt as high as 136 percent of gross domestic product by 2020, according to two people who took part in the meeting and who spoke on condition of anonymity because it was private. That compares with the 120 percent foreseen in a 130 billion- euro ($172 billion) bailout being negotiated.

Signs that Greece is falling short underscored euro-area officials’ frustration with the country’s bickering leaders and the prospect that they may again backtrack on fiscal pledges not first passed into law. Greek lawmakers begin voting on austerity measures this weekend after European finance ministers last night held back the rescue package demanding further commitments from Athens.

“The Greek offer is not sufficient and they have to go away to come up with a revised plan,” Bertrand Benoit, a spokesman for the German Finance Ministry in Berlin, said by telephone today.

The emergency talks of finance chiefs broke up late last night with Luxembourg Prime Minister Jean-Claude Juncker saying Greece must turn its latest budget-cutting plan into law, flesh out 325 million euros in spending reductions and have its major party leaders sign up to the program so they don’t retreat after upcoming elections.

Juncker’s Condition

“In short: no disbursement without implementation,” Juncker said. He set another extraordinary meeting for Feb. 15. “We can’t live with this system while promises are repeated and repeated and repeated and implementation measures are sometimes too weak,” he said….”

Comments »