Monthly Archives: October 2011

Black Swan Funds Return Excellent Performance

The Housing Hat Trick

Del Monte and Barclays Settle With Shareholders for $89.4 Million

Boeing Settles Toxic Cabin Air Lawsuit

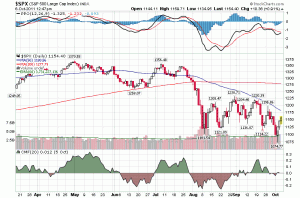

The Yin and Yang of Equities

The yin and yang of equities can also be described as overbot and oversold.

The recent volatility has investors confused. If you had The PPT you would easily be able to identify when the market is at these pivot points and thus take advantage instead of being a part of mutual fund outflows or just sitting on the sidelines.

Looking at the chart of the S&P we have a similar scenario to last June. The question is will we repeat history and rally hard into the end of the year or will we continue the same pattern ?

Of course if i had this answer then i would not be posting this article and would be counting my expected billions.

At any rate, last year we knew the EU crisis was coming, but at that time it was still largely on the horizon. We also did not have the possibility of seeing global growth downgrades coupled with earnings estimate downgrades.

The S&P has had a trading range only to be met with a lower trading range; and recently this week we entered bear market territory marking a low of about 1075. Looking at the chart the average price i would expect the S&P to grab on the upside is 1165. As a matter of fact we got close to this level this morning.

As always we never see an exact line and could expect upside to as much as 1180. Beyond that is complete froth land IMO.

The key points to determine if this mornings pundits are right, (all calling for a market to scream higher into the years end with high estimates of 1325 S&P,) is of course Europe first. Any real move towards leveraging the EFSF will send markets higher. The second point, at least for our markets, are earnings guidance.

To play it safe look to sell rips in the 1160-1180 range and buy the dips in the 1075 -1100 range.

FYI The PPT is now reading 3.60 on the SPY which is the threshold of overbot territory.

Given tomorrow’s important employment number i will refrain from making any moves until after the data comes out.

After covering shorts Monday & Tuesday morning and making a killing there was no need to play in a sketchy market.

GLT

[youtube:http://www.youtube.com/watch?v=yXPCp48nYGw 450 300] Comments »Senate to Vote Today on Obama’s Jobs Bill

US Senate will vote today on Obama’s jobs bill, the original bill that does not include millionaire tax – @NBCNews @libbyleist

Sen. Reid agreed to Sen. McConnell request to have vote on Obama’s stimulus bill, as amendment to Chinese currency bill – @NBCNews

from breakingnews.com

Comments »

Lunch Break: The First Pics From the Deepest Realms of Space

S&P Strategists See Huge 4th Quarter Gains For Equities

EU Working Feverishly To Prevent Crisis

FedEx CEO: US Economy Is Not Recession Bound

CCJ signs MoU to cut Cigar Lake project operation costs

Comments »Oct 5 (Reuters) – Cameco Corp said it signed a new milling arrangement with its joint venture partners which will help it cut operating cost at its Cigar Lake project.

Canada’s top uranium producer said it signed a non-binding memorandum of understanding with its joint venture partners — AREVA Resources Canada Inc, Idemitsu Resources Canada Inc and Tepco Resources Inc– to mill all Cigar Lake ore at the McClean Lake mill.

Cigar Lake, located about 660 kilometres north of Saskatoon, is the world’s largest undeveloped high-grade uranium deposit, according to Cameco’s website.

The company said estimated average cash operating cost would drop to about $18.60 per pound from $23.14 per pound due to the new milling arrangement.

Cameco, which owns a 50 percent stake in the Cigar Lake project, said it continues to expect production to start in mid-2013. (Reporting by Swetha Gopinath in Bangalore; Editing by Muralikumar Anantharaman)

Apartment vacancies fall to 5 year low

Comments »U.S. apartment vacancies declined to 5.6%, a five year low, in Q3 according to Reis Inc. (REIS), reports Bloomberg. The average monthly effective rent rose to $1,004 from $997 in Q2 and $981 in the same period of 2010.

FLASH: Shares of Apple are Now Green

AAPL reversed early losses and are now up $4.5 dollars or 1.3%

Comments »Civil Forfeiture is a Crime

This issue keeps popping up and warrants some media attention…

[youtube:http://www.youtube.com/watch?v=FcQlF-zDEL0&feature=player_embedded#! 450 300] Comments »State of the Union: Multi Generational Households Increases Over 10%

I never understood why this was a bad thing. So long as you have separate living quarters this is an opportunity to hang with the ones you love and it should also boost personal balance sheets.

Comments »A Look at Mario Draghi; The New ECB President to Replace Trichet

Euro Zone Officially in Contraction Mode

Nearly Half of U.S. Households Received Government Benefits in Q 1

Analyst Comments on Recession or Depression

You must make your own decision as to who is closest to being correct. I’ll go with a slowdown and not a recession or depression. However, it is worth noting that bifurcation has many people feeling like it is a recession or worse.

Comments »