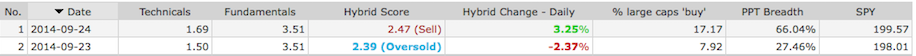

In case you’re wondering, yes, my computerized version of my brain, The PPT, called yesterday’s bottom. Did I go balls to the wall long? No. Why not? Because I am dealing with issues.

I was already invested in ETR, EXC to name a few. A few days prior I had bought a large position in SOL, in the $3.50’s, so I had to buy it here lower.

Why?

Because if the reflation trade takes hold and oil moves up, solar will give you twice the returns. It’s like a derivitive version of a premium driller. There aren’t any news events that might shock it, so if the market is good here–so am I.

I did not sell my TLT or utilities, as they now serve as a hedge against my other large positions, namely SOL, ARWR and GILD.

In summary, I consider TLT and my utilities to be cash equals, low beta plays designed for a bad market. There is still time left in September and I committed myself from 9/1 to seeing this through. We’re almost there.

Comments »