We all want prosperity. The idea of buying a stock and seeing it run is an ideal worth striving for. Since the beginning of the year, I’ve taken a more visceral approach to stocks, casting away the hyper-active trading style for more of a macro, algorithmic based system, one that is predicated around the idea that markets are in fact prisoner to the negative rate conundrum, which is plaguing the world.

This great change in style has caused many of you to question my methods. But you’re not seeing the bigger picture, one that is undeniably ominous.

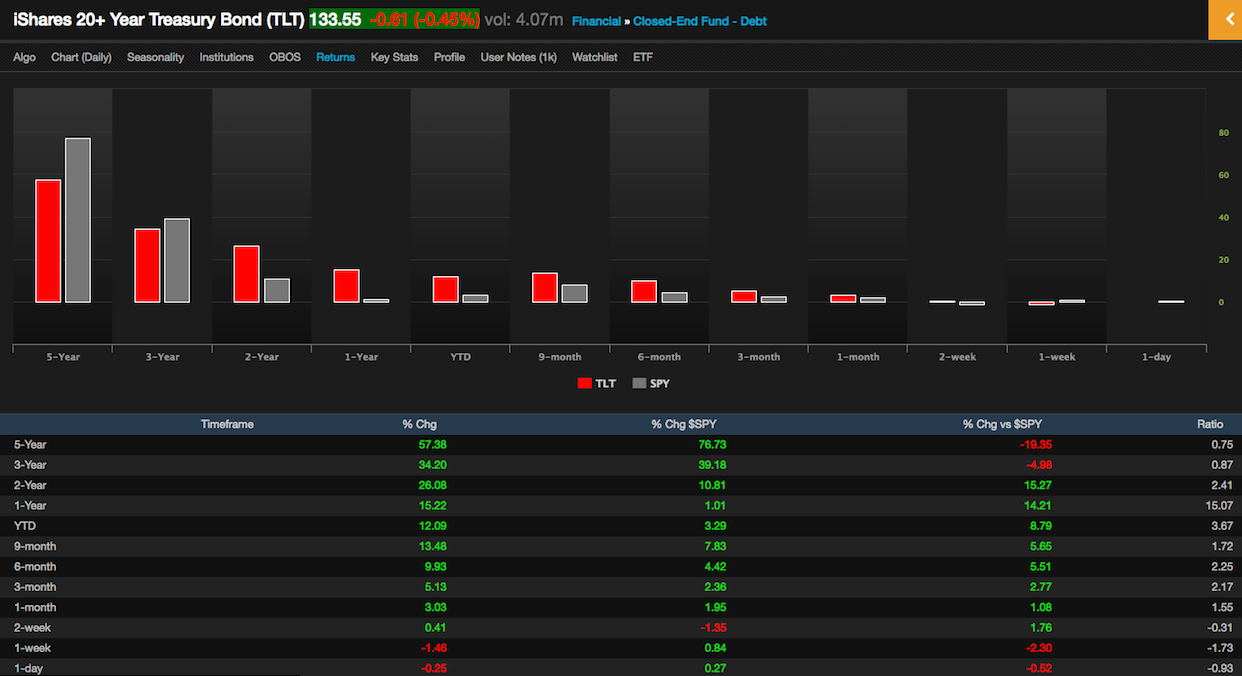

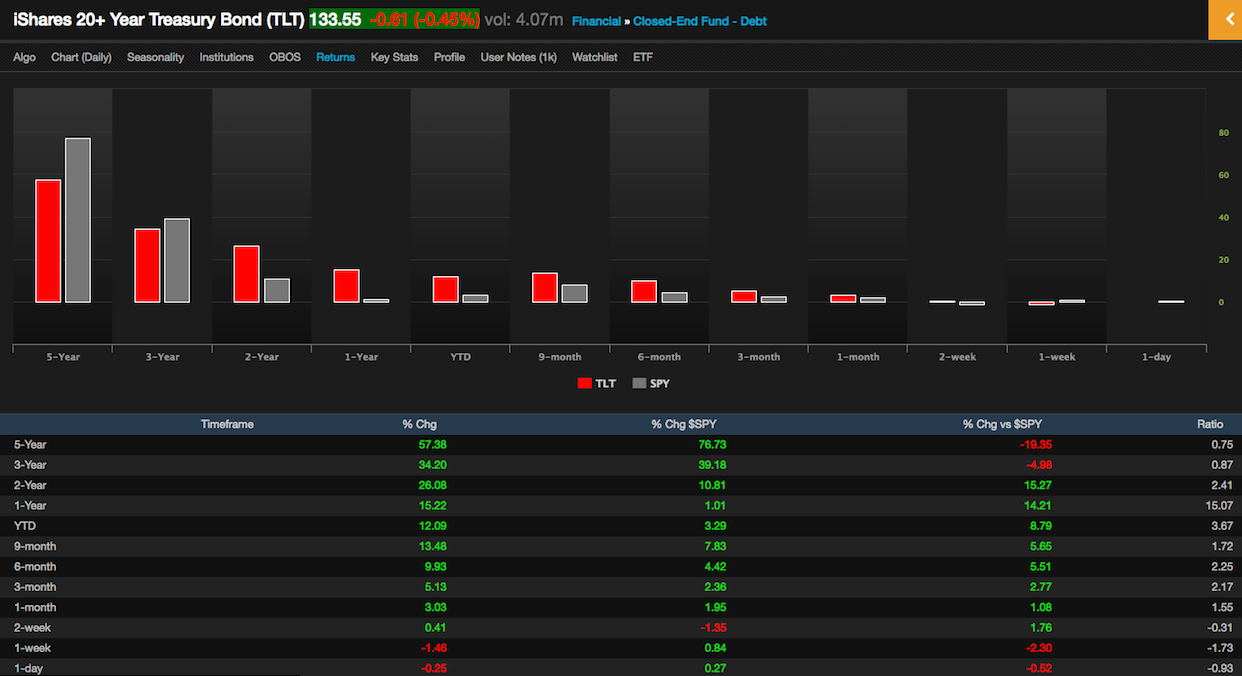

Over the past two years, stocks have done nothing. As a matter of fact, the only sectors worth writing home to Mom about are one’s beholden to yield and/or a risk off factor. The vast amount of risk assets, by which many of you make a living trading from their wellspring, have traded with an arc-type maleficence, often seen in onerous bear’d markets.

For those of you trading for a living, the pool from which you’ve opted to make a living has been a dying one, filled with scams and warnings, a minefield for those with a penchant for losing limbs. My stated goal is to build wealth. I’ve traded for most of my life, all the way back to the age of 10, while most of you were busy climbing and falling out of trees. I am not interested in preservation of capital, however. At least not now. Instead, I am merely following a core thesis, which has been thoroughly examined and enacted through years of professional training and asset management. Moreover, my position in TLT is a logical one, simply following a trend that has been extremely predictable, almost without pause. The question I have for many of you is, why are you fighting this pattern?

Including dividends, TLT is higher by 30% over the past two years. The bull case for bonds surrounds itself around the seemingly neverending plunging rates in Japan and Europe. While I am unsure as to when markets will explode or implode, I am keenly aware that markets are in a rut of inertia and have blessed those positioned in bonds, NOT stocks.

Comments »