Making fun of hedge funds is something of a hobby for most people across the internets. If you were truly being honest with yourselves, you’d realize that, for the most part, successful hedge fund managers know more about the market than the layman traversing Stocktwits all day long. And two, you’d come to realize that you’re jealous of their fame and fortune. Therefore, whenever you read about me talking extreme shit about Montauk Bill Ackman, you click and eat it up.

For the third quarter, investors pulled $28.2b from funds, the most since the financial crisis.

For the first 9 months, the industry has given birth of a maelstrom of redemptions — equalling an staggering $51.5b.

Those large numbers are woefully misleading, since the pie has gotten much, much bigger. Total assets are in the ballpark of $3t, placing the headline grabbing outflows as nothing more than a rounding error.

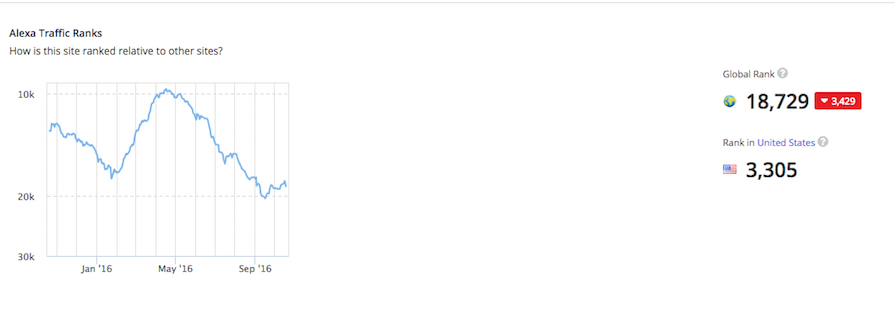

Investors are pulling money because the market has been hard. But also, many people are deciding to invest their money without help. I’m seeing this first hand with Exodus. As a matter of fact, a friend of mine called me just last week to tell me his client was also a member of Exodus — totally random coincidence.

This isn’t the 1990s when computers were idiot boxes and hedge fund managers had exclusive access to companies to game the system, or when guys like Icahn extorted companies for greenmail to make hefty returns. The playing field, more or less, is even.

If you can’t afford a $2,500 per mo Bloomberg Terminal, so what? Odds are, you’d only use 5% of the functionality anyway. There are literally endless ways to game a modern, technological edge, when investing your money. From reading the missives of talented traders, like OA and RC, to gleaning info from your Twitter feed, to extracting information from whichever software service you are a member of, the hedge fund industry is ripe for the picking.

Nevertheless, much of that money is institutional and they’d never invest it themselves, for legal reasons. So they create a moat by passing on the fiduciary responsibility to Ackman and others. But, that doesn’t mean an entrepreneurial investment advisor, running his own firm, can’t compete for that money — because he can and will.

This is a very convoluted discussion, one with risks and opportunities. People will always need some form of help to make investments. I just don’t think the managers of hedge funds are inherently bad investors. Instead, I think the market has been very difficult for people managing more than 4 figs and also the 2/20 model is broken, arrogant, and in need of reform.

Comments »