If you only listened to the Fed, you’d never know what the economy was really doing. Here’s our Fed Chair, Jerome Powell, attempting to have his cake and eat it too today.

Source: CNBC

In his semiannual testimony on the state of monetary policy, the central bank chief noted that he and other officials are watching the state of affairs closely and are prepared to adapt policy if warranted.

“While we view current economic conditions as healthy and the economic outlook as favorable, over the past few months we have seen some crosscurrents and conflicting signals,” Powell said in his prepared remarks to the Senate Committee on Banking, Housing and Urban Affairs. “Financial markets became more volatile toward year-end, and financial conditions are now less supportive of growth than they were earlier last year.”

China and Europe are particular areas of concern, and the Fed also is watching how Brexit negotiations and trade talks play out.

“We will carefully monitor these issues as they evolve,” Powell said.

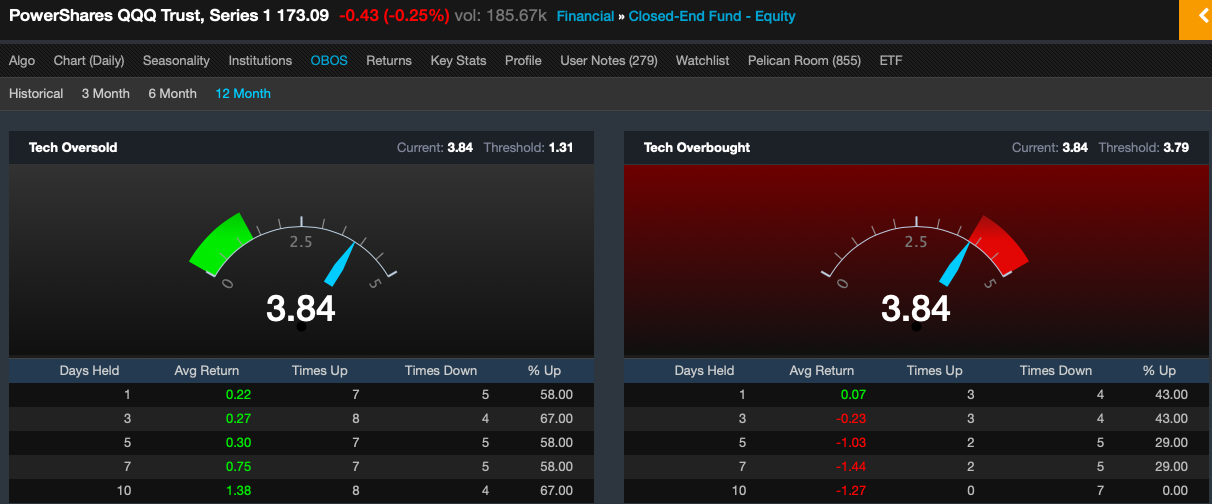

In other words, and I touched on this before, heading into 2019, the economy was slowing in a very abysmal way. However, since then, things have improved. Alas, we circle back to the narrative I am trying to compel you to consider. Everything we’ve just undergone is at a cross-roads now. If Q2 ends up being a disappointment, we’re heading back towards the fucking lows, and much more.

Having said that, I’m not shorting this shit now — knowing fuckheads like Powell are out there trying to grab the market’s jock-strap. Best thing for me to do is eat some eggs, some black coffee, and perhaps smoke my estate pipe — waiting for resolution.

I sold out of my NUGT position today for a +5.6% gain on a triple sized position.

Top pick: Cash (presently 55% cash in trading account).

Comments »