Now that I’ve been in NC for more than 2yrs and have a better understanding of the area, I’m in the market for a new home. Lucky me, I get to pack all of my shit again and deal with mortgage lenders combing thru my finances with a fine tooth comb, all the while buying at runaway prices with elevated rates into what might be a complete collapse of the housing market.

Have you seen the housing prices recently, +50% in price over the past two years due to inflation jacking up the replacement value? The prices of everything needed to build a home has nearly doubled since COVID, so of course the price of your home is up. But that value isn’t exactly real, since you can’t just sell and live out of a box.

We had a great week for the market and everybody is feeeeeeling optimistic again. Let me remind you, during bear markets the bull rallies are always the best and they make you remember the past and lure you back into the riskiest trades, before dropping the hammer on you. Bear markets are more than terrible, but demoralizing because they give you false hope.

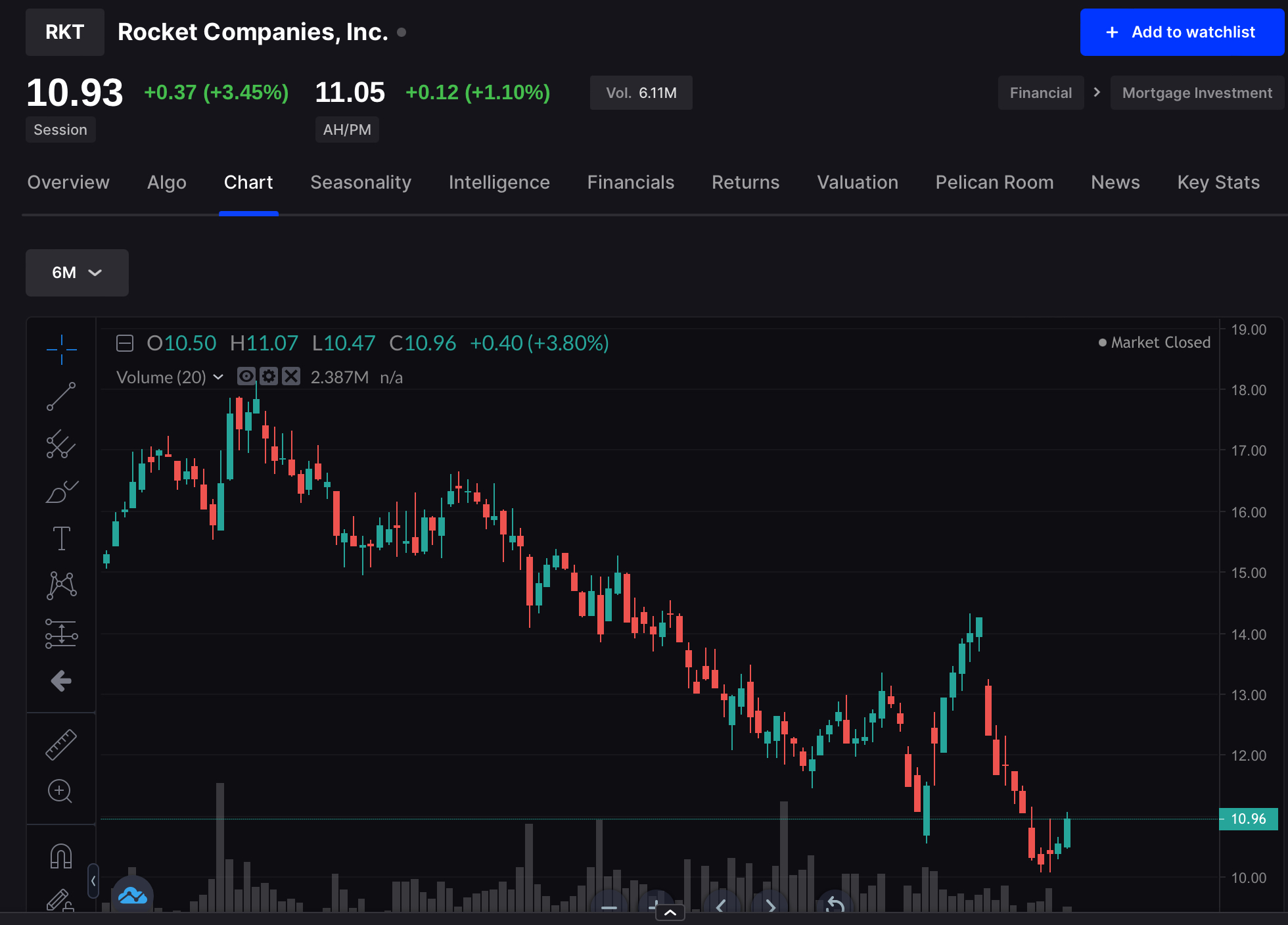

The issue of whether the market will continue to be in a bear market or not, at least the way I see it, lies with the Russian threat and also the housing market. You will be able to see the stress first in mortgage lenders, weak regional banks, and then the big banks like WFC and JPM. You cannot have a recession without weak bank stocks, period.

The bears this weekend will point to a flattening yield curve because it usually precedes recession. That’s all well and fine, but what I’m really interested in is this year’s housing market. The elevated prices, coupled with soaring mortgage rates, might be laying a trap for buyers into what might be an elevated unemployment rate by 2023.

If you enjoy the content at iBankCoin, please follow us on Twitter

Fed stops asset purchases and repurchases and instead lets it run off passively…that portfolio could cause some stresses depending how crappy are the mortgage securities at redemption time.