Do not be fooled by the futures markets on some of your commercial outlets. There is a significant ‘fair value‘ of more than 350 points that needs to be accounted for and most people aren’t aware of this. After FV, Dow futures are -680, Nasdaq -120.

The VIX markets have blown up after years of complacency, spending most of its time in the low double digits. Early going, VIX is trading at 50, which has laid waste of inverse vol ETFs, such as XIV, ZIV, and SVXY. What is being talked about by people on Wall Street this morning is the over-the-counter vol markets or ‘shadow volatility markets’ — which has been used to sell premium in volatility, boosting returns for hedge funds all around the world. The ramifications of this trade blowing up aren’t known yet, in spite of the fact that Credit Suisse says they’ve got the whole trade covered and is entirely hedged. There are many others who aren’t hedged and are now naked volatility into a market screaming lower, blowing out standard deviations — putting the fear of the devil into traders.

The downside move in XIV, which was triggered by a termination event that caused Credit Suisse to buy volatility between 4-4:15pm during yesterday’s trading session, literally broke charts.

What people will be watching next is the plumbing of the system, credit default swaps, bond yields, and especially the junk markets — which have also been used as a place to achieve easy returns in a non-volatile market. Now with the OTC vol market blowing up, in addition to the retail vol ETNs, there could be ancillary victims that may pop up in these areas.

WTI is -1.2%, Gold +0.1%, Dollar +0.3% v Euro, and BTC -10%.

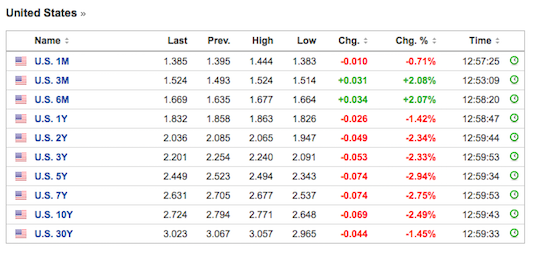

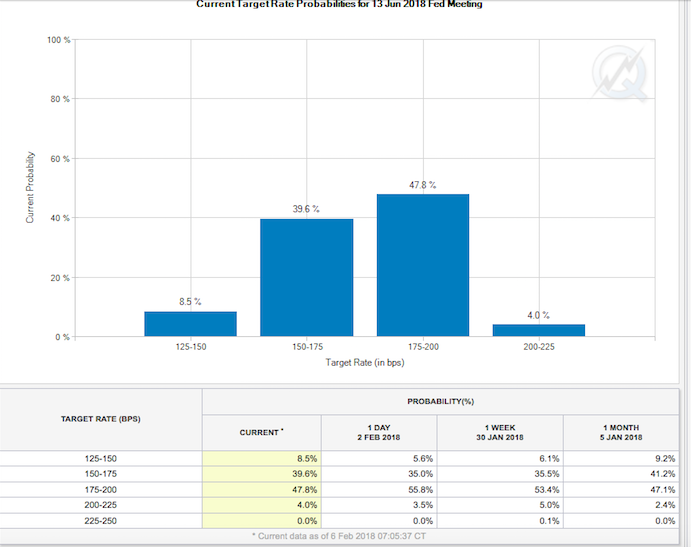

Bond yields are going lower and the market is no longer pricing in 4 hikes, but 2.

Zerohedge has a research note by Morgan Stanley up, discussing the debacle.

- Some of the selling on Monday likely reflected investors anticipating systematic supply on Tuesday – this means the $30 to $35bn QDS estimates for sale Tuesday (detailed below) may net down to $15 to $25bn. This is still enough to have negative impact on markets though and will be compounded by dealer short gamma positions.

- Anticipation of further supply later in the week from both annuities and risk parity funds could bring in more fast money sellers Tuesday.

- The near bankruptcy of the inverse VIX ETPs will be a very negative headline, and the several billion dollar loss for holders, largely retail, will scare some out of the market or force liquidations of other products to raise cash.

- Institutional vol sellers will likely cover exposures as well in the coming days and weeks. While these positions will not take losses on the same scale of the VIX ETPs (because they are generally scaled more conservatively) unless there is a quick snap back many investors will likely take down risk, supporting implied volatility in the process.

- On the positive side, much of the short gamma exposure in the VIX market has been wiped out, leaving less risk of a further volatility spike from here.

- Investors were not in panic mode despite the selloff, as this move has ‘only’ wiped out one month of P/L. As noted earlier in one sense this is good as it might slow discretionary supply, but it also highlights that discretionary investors are still very long risk and could easily turn sellers.

- Who are the incremental buyers here? Macro funds betting on the vol unwind that has now happened could cover and turn buyers, but for real support the market needs deep pocket asset allocators to step in. Vol target supply will eventually wane as volatility peaks and/or leverage comes down, but they likely remain sellers for the next several days.

- Net-net: more supply likely pushes markets lower Tuesday and potentially Wednesday, and buyers will need to see signs of slowing supply and stabilization to come back in. Short-dated implied volatility has likely peaked, while the back end of the vol curve likely rises over the next week and realized volatility will continue to move higher. This is unlikely the turn of the cycle as the selloff is largely technical and positioning driven, and likely not large enough to feed back into the real economy and become fundamental, so dips will be bought after the systematic supply and vol unwinds abate.

QDS came into Monday expecting nearly $5 to $10bn of equity supply from systematic funds, principally annuities as they tend to react quickest to recent increases in realized volatility. That supply likely contributed to the move lower, but it was then compounded by dealers having to hedge their short gamma exposures. QDS estimates that in total dealers likely had to sell $11bn of S&P 500 futures on the way down today.

The VIX market saw the net buying pressure on record. For background on the risks that materialized Monday see If the VIX Goes Bananas, this is What it Might Look Like from July 2017. Details and implications:

- The ETPs had to buy 282,000 VIX futures to rebalance their short gamma… needless to say this is the largest VIX buy in history, dwarfing Friday’s previous record of 78,000. Dealers hedging their short gamma exposures likely contributed to VIX futures demand as well.

- Most of the rally in VIX futures happened after the 4:00 pm cash close, not leaving a lot of time for investors or the issuers of the VIX ETPs to react.

- This move was incredible particularly because VIX and VIX futures were already elevated – and the amount of volatility to buy exceeded QDS estimates (below shows what QDS estimated coming into Monday) and speaks to the size of the short vol exposures in the market:

- Whether the inverse ETPs continue to exist tomorrow is up for debate at time of this writing (contact us for details), but for the broader market the implication is clear: the inverse ETPs have effectively delevered down to zero, going from short 230,000 VIX futures to short just 4,000. (note exact numbers will need to be updated to reflect creations / redemptions reported overnight).

- On a positive note this means there is much less risk going forward of further vol to buy from rebalancing of these products. On a negative note holders of the inverse ETPs lost $3.4bn as the products went nearly bankrupt and this removes a steady source of volatility supply over the last year.

The fact that CS says they have no loss on this is crazy? who did they off load it to, and does that firm have the balance sheet to withstand the loss? This is getting real.

Risk party needs to adjust now as well, which means further selling on the equity side.

Prolly some big outlet that was reasonably sure they will get bailed out by the usual suspects…same as it ever was. Repeat of 2007-8 blackmail. Sad.

socialization of losses, privatization of profits.

The real question here is if this was triggered by the deep state (i.e. PPT) as a political ploy to get one on Trump and his investigating FBI/DOJ. It would fit the pattern. I have no idea how these synthetic scams work internally and how they can be triggered at will. Any guesses….?

Bought SVXY in the last hour of trading. Didn’t want to book the $900 loss so held thru the close. Will now lose $30,000. This sucks donkey balls.

So do you think we, the ever wise hodlers of XIV are getting back $0 per share or, something more?

~$4/share is my bet

“Blackhand iBankCoin” has always been my favorite iBankCoin. There’s something about a meltdown that just spices the flavor.

Arguably, hedge funds have some sense of the risk involved. Pension funds, that’s where I look for the real OTC vix derivative problems.