Lots of fake headlines out there this morning, blaming the drop in futures to comments by the Fed. Let me remind you that the Fed has been jawboning about higher rates for years. The reason why stocks are pointing to a -140 open is because there are more sellers than buyers. I realize there isn’t anything aesthetic about that — but it’s the truth.

We were hotly overbought and now we’re working it off. Relax.

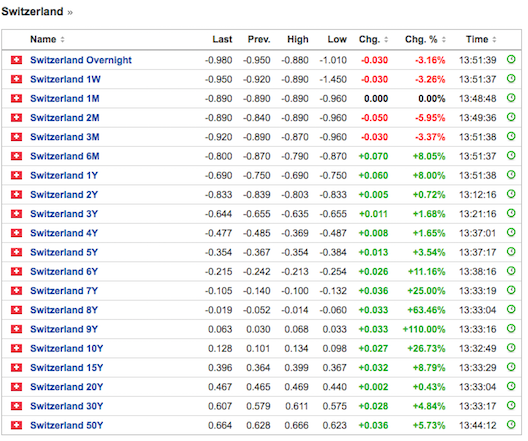

Bond yields are spiking, but nothing too crazy. In Europe, both Swiss and German yields are up way more, yet Spanish and Italian yields are lower. In other words, people are buying shitty higher yielding German bonds and selling the quality. Makes sense.

WTI is higher by 1%.

If you enjoy the content at iBankCoin, please follow us on Twitter

SP down .46% in premarket. Panic not seen.

Just did the math. Since market peak last Friday, we are down an appalling one and a quarter percent.

At the margin, the spike in bond yields does not need to be too crazy – just enough to break the camel’s back… or be the last snowflake that sets off the avalanche; the last grain of sand that causes a massive slide – phase transition, that’s all it takes.

“In Europe, both Swiss and German yields are up way more, yet Spanish and Italian yields are lower. In other words, people are buying shitty higher yielding German bonds and selling the quality”

I think the word “German” in the second sentence is a typo.

Of course, any Euro bond is basicalyl just as stable as any other Euro bond.: EU buys PIGS bond, Germany funds EU.