I’ve often said that OSTK is the CMGI of this era for cryptos. They were first to commit to the sector and now we’re starting to see extraordinary shareholder value realized. Today Davidson, albeit a shit shoppe, came out with boolish notes — upping their price target to $110.

$OSTK Incr. Valuation for Blockchain-Related Holdings, Raising PT to $110 from $85 • CONCLUSION: We are increasing our price target to $110 from $85. The change is a reflection of raising our valuation for Medici Ventures, Overstock’s portfolio of investments in ten companies that to varying degrees leverage the blockchain; in particular, tZERO and we made an initial effort at valuing Bitt (beyond our prior of carrying it at book value based on the amount of capital invested, to date, by the company). With shares trading above our valuation for Overstock’s legacy home e-commerce business ($58 per share), we believe it is important for investors to understand that buying and owning shares at current levels is a bet on its blockchain-related investments. Given our view that not only is there tremendous value in its holdings, but it owns, by far, the best portfolio of blockchain-related assets among current publicly-traded equities, we believe the stock merits such a valuation. • Additionally, to provide greater insights on the potential value of shares depending on the outcome of a number of items (such as the possible sale of its legacy home e-commerce business to a bricks and mortar retailer), we have updated not only our base case scenario (new $110 price target), but also our bear case ($34) and bull case ($261). (See Figure 1 on page 4.) • We recommend investors purchase shares at current levels and reiterate our BUY rating.

I think it’s a foregone conclusion that OSTK is going to trade inexorably higher, don’t you think?

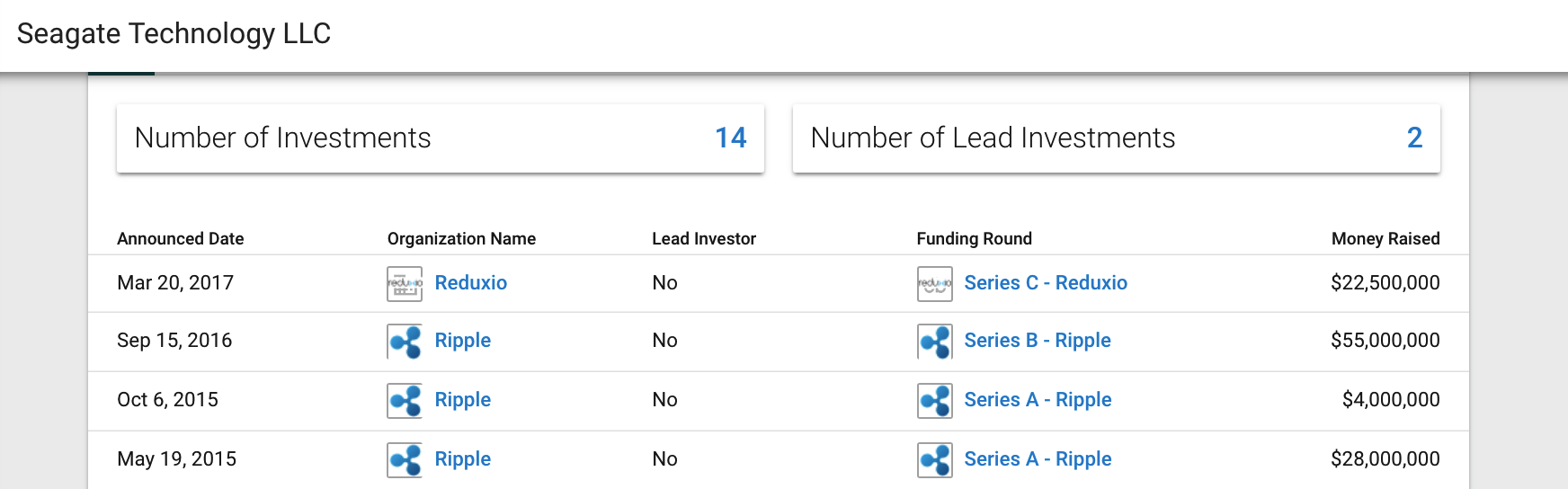

In other news, Seeking Alpha is out with an article this morning, claiming Seagate owns upwards of 4% of Ripple — the super hot crypto currency, #2 in crypto land.

In the Ripple Series B, there were 10 investors in the round, which was led by SBI Investments. Doing the same calculation as above, dividing the 33% expected equity sale to 10 investors, we can estimate that Seagate bought around 3.3% of Ripple at that point.

Therefore, across the two rounds, a rough estimate is that Seagate bought and owns 4.3% of Ripple.

Multiplying that figure by the $183B of XRP that Ripple currently owns, we can estimate that the current value of Seagate’s investment in Ripple is approximately $7.8B, or roughly two-thirds of the market capitalization of the company.

It seems the market has accepted Seagate as a stodgy old-technology company and has overlooked the value of its investment in Ripple. Otherwise, if we assume that the market has fully priced in the value of the Ripple investment, the rest of the company is trading at less than 6x earnings.

Furthermore, the price action in the last year doesn’t reflect the value that a 4% investment in Ripple would add to the company. Ripple increased by 30,000% in 2017, which should have added billions to the share price of STX, had it been priced in. Instead, STX was up 9.6% in 2017.

STX is +8% in the pre-market. OSTK is off by 0.7%.

If you enjoy the content at iBankCoin, please follow us on Twitter