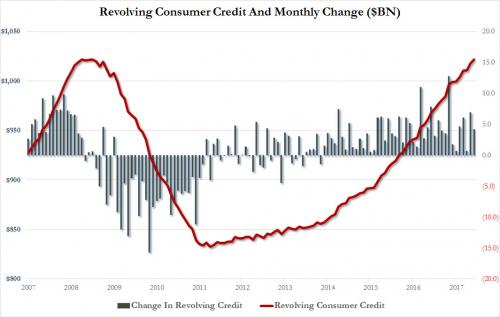

The Federal Reserve just release consumer credit figures for the month of July, answering my question as to why people weren’t shopping at BBBY.

Revolving credit just hit a new record high. The last time people had this much debt was right before the financial crisis. Ergo, history is repeating itself and you’re all going to lose enormous fortunes.

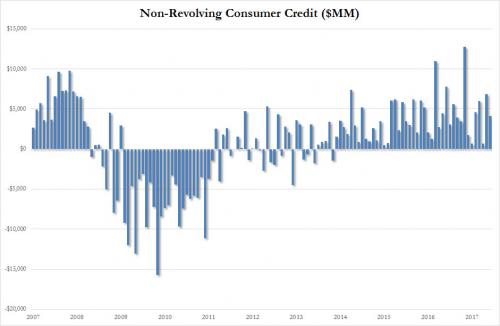

On top of that, non-revolving debt (autos, students, special home repair credit lines) surged during the month of July too.

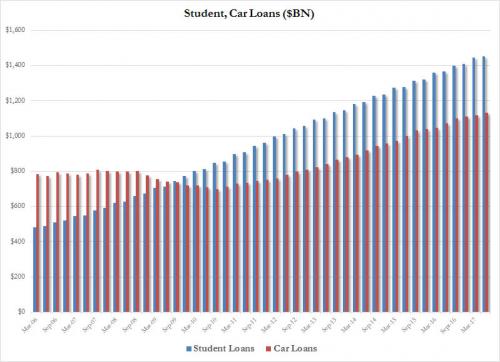

College is expensive and Mercedes Benz rarely offers discounts. Hence, America is drowning in student and auto loan debt. They’ve hit fresh record highs of $1.45t and $1.31t, respectively.

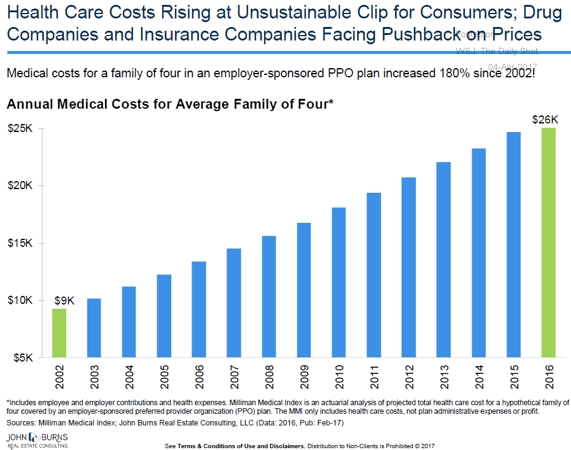

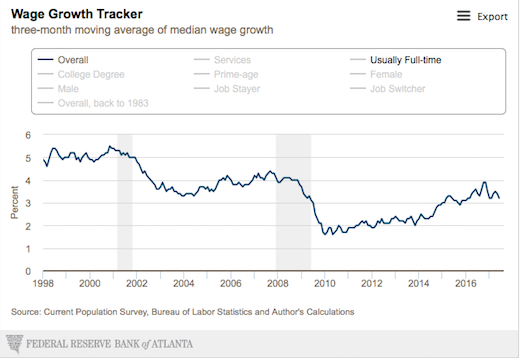

Couple that with the fact that wage growth is stagnant, with most of the new jobs in America being created in bars and eateries, and healthcare expenses soaring to over $26,000 per annum for a family of four, one should presume the average normie is without expendable income for random items at BBBY.

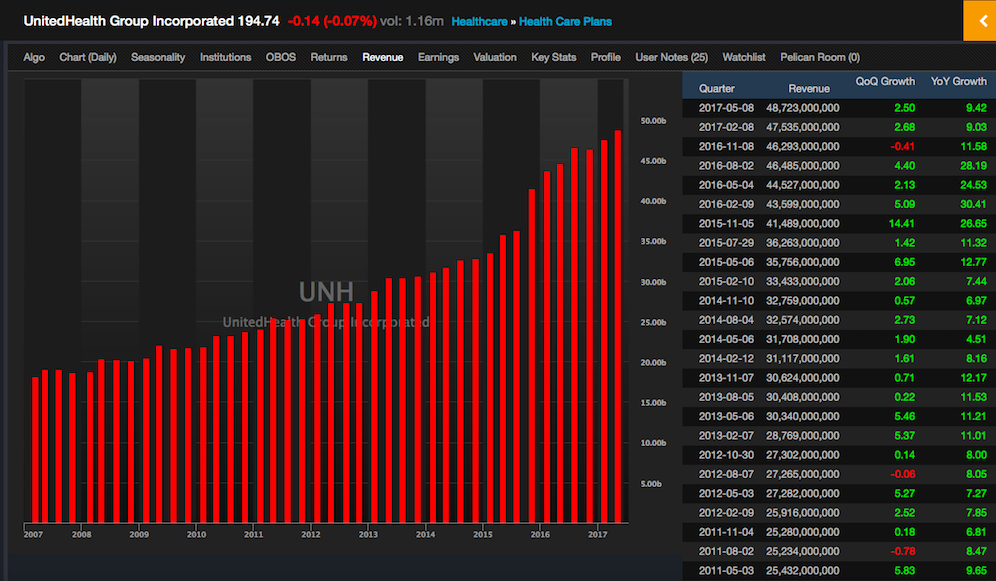

Our beloved healthcare system.

Dead wages.

So where is the money going? Find Waldo.

$48billion per quarter to United Healthcare.

And look at this chart, almost as nice as America’s revolving credit trend.

bear bait

bear bait

bear bait

Juicy. Delectable. Huzzah.

9TH CONSECUTIVE GREEN DOW CLOSE

it’s all controlled. it’s controlled. it’s programmed.

CAN’T GET MANY MORE. YOU CAN’T GET MANY MORE

I love how people think the market is efficient and therefore assume normal diistributions of returns, like it’s a coin flip. No, it’s the fat tails and market inefficiencies that give us the trends that are our friends. We can have 18 straight up days (or down days) and it shouldn’t surprise us.

To the overseers playing the vix suppression game, trying to Vaporize bears:

you.cant.get.under.11.vix.much.longer.NOW

i can wait

Seems like I have seen too many articles talking about a top here for an actual top to be put in.

Besides, whatever is left out of that $48bn UHC didn’t pay out in bonuses is probably just used to bid up the share price.

In the words of Ric Ocasek: Let the good times roll!

These charts make my blood boil. Especially UNH. How long are the Eddies gonna take this shit ?

MMI says 2017 had lowest growth since 2001. Huh.

Look at the chart. When did the rate of increase start to decline more sharply. Maybe around 2010/2011?

http://www.milliman.com/uploadedImages/insight/Periodicals/mmi/2438HDP_Fig02_Web_1000px.jpg

Did anything big happen in healthcare in that timeframe?

Employer sponsored PPO increases maybe due to employers pushing more onto employees. I meant they have to due to the crippling taxes and regulations.

Oh wait. Corp profits near record high levels as %GDP

https://fred.stlouisfed.org/graph/?g=8cl

I guess they just did it because they could.

Maybe if we give them more tax cuts and less oversight they’ll treat workers better?

Ha ha ha.

Who would have thought that when you outsource millions of jobs to China thus relegating those lost souls whose jobs have now been vaporised and who now are only beginning to fully enjoy the many benefits of globalization thanks to their new career stocking shelves at $WMT or selling trinkets on eBay that something like this could happen? Shocking and totally unpredictable. I ask you how could anyone have possibly seen this coming? Throw in a little annual 20%+ increase in annual hospitalization expense, which I might add you will probably never see the deductible limit of these “if you like your policy you can keep your policy” policies exceeded unless you find yourself receiving your last rights on your deathbed. Now throw in the never ending, sky is the limit boyah rent increases. And who could forget the perpetual, neverending smaller size packages at the grocery store, all for the same price of course.

But needless to say all of us realize that what’s really important here is not the consumers increasingly dire financial condition but what really important here is whether or not those tried and true American symbols of capitalism, the corporations like $KHC or $GIS (whose motto is: the price of wheat or corn goes up we raise our price, The price of wheat & corn go down we raise our price) can “beat the number'” this upcoming quarter.