The research monkeys at Goldman were tasked with the duty of combing over 10-ks to find which companies domiciled in the US had the most international exposure. If they left before midnight, someone was stationed outside the offices to throw hot coffee on their necks, as a medieval form of punishment for working lazily.

The theory here is to buy companies who collect revenues in non-dollars, because they’re going up, which will then translate into higher profits once the money is brought back into the United States to report quarterly earnings. Bookmark this post, for it will become useful when the dollar starts to soar again and you’re looking for stocks to sell short.

Goldman summarizes.

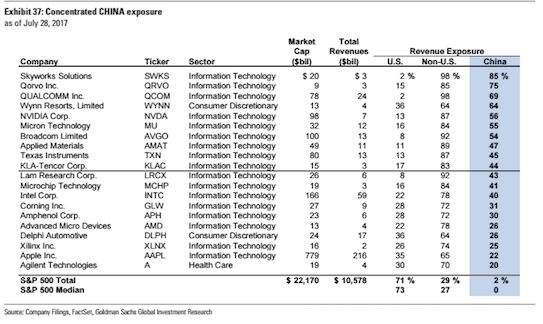

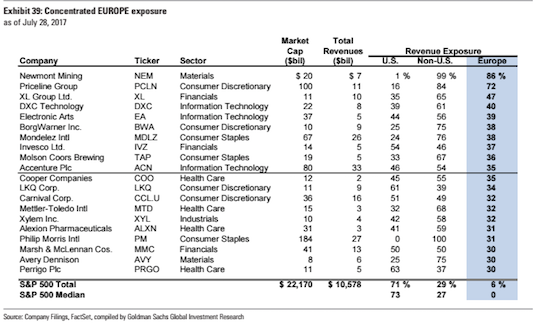

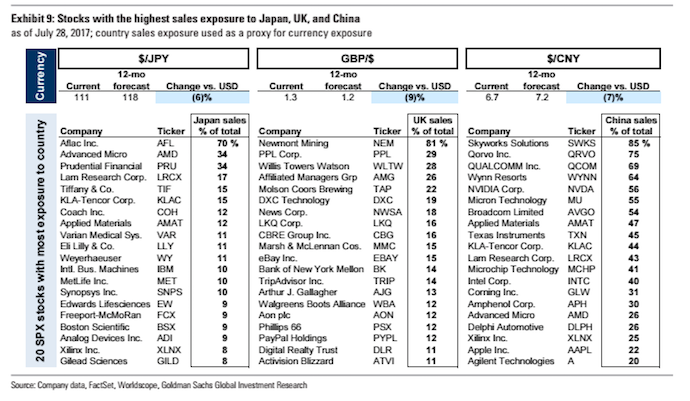

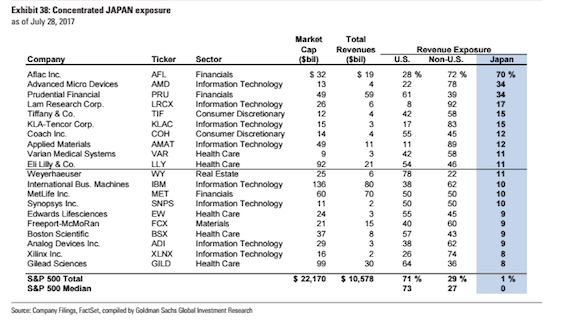

Foreign sales accounted for 29% of aggregate revenue for the S&P 500 in 2016.The

median stock reported 27% of sales outside the US. Both of these figures are similar

to those in 2015. Companies reported that 10% of revenues came from EMEA (Europe,

Middle East, and Africa), with 6% directly attributable to Europe. Approximately 8% of

revenues stemmed from the Asia Pacific region with 1% disclosed as coming

specifically from Japan and 2% from China. Roughly 7% of revenues were foreign but

unclassifiable.We analyzed company 10-K filings to determine the geographic revenue exposure

of stocks in the S&P 500. The Financial Accounting Standards Board (FASB) requires

companies to disclose any geographic segment contributing 10% or more of sales.

Firms have discretion over regional classifications, so precision varies by company and

analysis excludes some foreign revenues that are not divulged due to this limit. We

supplement exposure disclosed in 10-K filings using company presentations and

Goldman Sachs analyst estimates.Our analysis includes the revenues of all S&P 500 companies, including those with

purely domestic sales. Statistics regarding S&P 500 geographical exposures are

frequently cited based only on companies that report international exposure. As

explained above, firms must report geographic segments accounting for at least 10% of

sales, and many firms even report exposures totaling less than 10%. However, many

S&P 500 firms sell only to customers in the United States. For example, in our data

more than 100 companies have zero international exposure. Excluding these companies

results in an overstatement of foreign exposure for the aggregate S&P 500 index.

And here is the fruits of their labor.

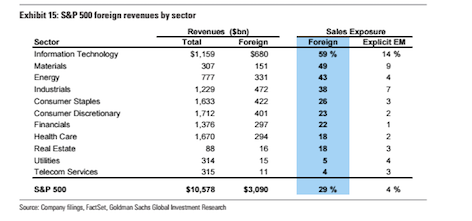

This is the breakdown, per sector.

Year to date, these companies have crushed domestic oriented companies. Whether this trend can continue, I leave up to you to decide.

If you enjoy the content at iBankCoin, please follow us on Twitter

Thinking WB, BABA, BIDU or maybe KWEB, QQQC?

Screw US Stocks with international exposure. Just get long international stocks and Chinese tech burritos! I like heaterman’s picks. I also like buying Europe and India ETFs.

prepare for a $usd bounce

…cue up extra muppets at the curb.

But the cash is sitting offshore and not being repatriated