The tech heavy NASDAQ is leading the fray down the toilet bowl. The Coriolis Effect has affected a wide basket of sectors — with 80% of stocks lower for the day. None have been damaged more than high flying semis and tech stocks, however. The distribution is heavy and the pain for those who top ticked palatable.

Amidst the carnage, it’s important to take note of the mega cap stocks, since they’ve served as hubs of liquidity and profit for our beloved hedge fund industry. The entry into these stocks was extremely accommodative during periods of excess. However, if we’re entering into a summer lull, you will quickly find the funnel narrowing as traders take flight — serving as a noose of sorts for those desperate to get liquid and stem the bleeding.

According to Exodus, there are roughly 100 stocks lower by 2.5%+, whose market caps exceed $10b.

Some are attributing today’s sell off to a ‘rotation’ out of tech into banks and oils. This makes some sense, since the yield curve has recently widened from 78bps to 90bps; but the oil sector is beset by a horrible price of crude. If the price of WTI doesn’t continue bouncing, this entire rally in crude will be revoked inside of a few days, or less.

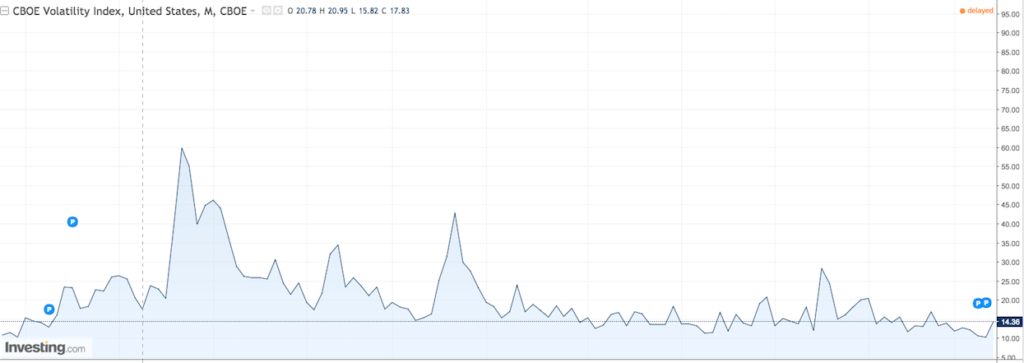

On the extreme upside is volatility, higher by 40%. That $10 level has been a level of support. In the big scheme of things, the $14 level is still extremely low.

Both UVXY and TVIX are higher, but not nearly as high as one would expect — given today’s monstrous spike in VIX.

If you enjoy the content at iBankCoin, please follow us on Twitter

doesnt look at all as psycho markets , but as planned co-designed descent

by the FED

fed&co

lot of stocks performing still in the ” carnage ”

do not know if this is a sign , and know we have to take out qqq nvda etc gaps

Check out a chart:

Market wants to go to March, April lows. That will be a great entry point.

Nasdaq – 5900-5800

SPY 2320-2340

DJIA 20500

We are going at least to levels of May 17th selloff.

more easily we go close the tech-gaps ( aapl nvda qqq etc)

simple market , again

likely energy/oil/banks/infrastr will suffice stability for the descent

I would take AAPL and leave out NVDA for the next rally

I would take some tech shorts if you did not still ..just a starter ..and revisit later if working

( not much upside left , risk contained)