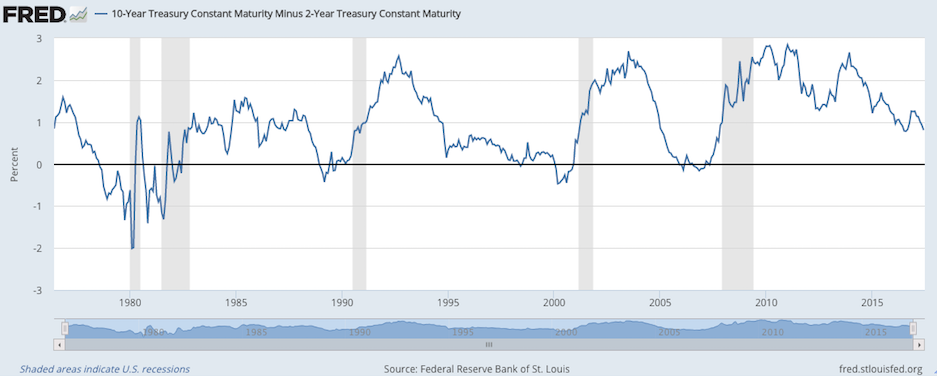

Today is actually a very negative day for banks, as it pertains to their bottom line — but the stocks don’t care. The US yield spread (2s,10s) have tightened again by more than 2bps to 78bps, yet bank stocks are acting like the exact opposite is occurring. This is the definition of a Costanza trade — doing the opposite for the sake of doing the opposite.

Why is this important?

Because when that yield curve inverts, it’s a virtual guarantee that the economy will soon sink into recession.

Everything feels and looks good now. But with US spreads tightening on a daily basis, US auto sales flagging, and both the retail and oil and gas sectors mired in depression, risk averse folks should pay attention and start thinking about ways to hedge or lock in gains.

If you enjoy the content at iBankCoin, please follow us on Twitter

So, Costanza is now the code word for FED/Citadel?