Why isn’t anyone talking about this? Oil stocks are getting murdered this year — yet all the media seems to talk about are the gains in NVDA. There are serious consequences to the stock price declines in a sector beset with so much debt. How much debt?

Hundreds of billions.

Year to date, the oil drillers are doing even worse than the retail stocks — off by 40%.

Big cap stocks like CLR, CVE and AR are down 30-50%. There are at least a dozen stocks down more than 50%, as oil drops on a daily basis — now sporting a $43 handle.

Here you can see the losses of the drillers vs the SPY, scaling out over 5 years.

Tech stocks now represent 25% of the overall market value. It’s very tempting to think ‘buy oils, sell tech’. But I can’t think of a catalyst at the present time that would cause a major rotation out of cash rich tech into poor oils.

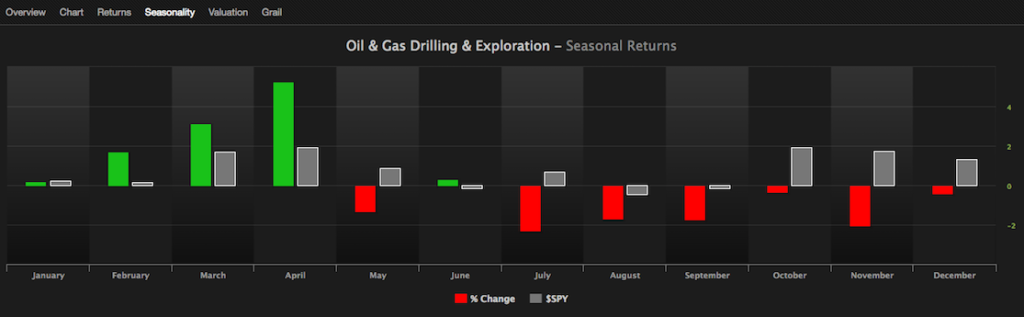

Seasonally speaking, we’re heading into the worst months of the years for oil — so maybe take a shot at them during the end of summer.

With the FED hellbent on hiking rates, many of the indebted domestic drillers will go bankrupt – unable to service debt in oversupplied market. Only a good old fashioned war can fix this – bomb ME oil production and disrupt supply lines in ME.

Saudis will prop oil prices before Aramco IPO. Still too early though. End of summer maybe.

Ive repeated myself several times on here on how oil stocks/prices will head lower and lower. I laugh at all the bottom-callers who tout oil stocks as cheap and a great time to buy. Ill buy when I see some bankruptcies–just way too much capacity out there and I can tell you first-hand that management teams across the board are still in denial about how low oil prices will only get lower.

Yes. When WTIC bottoms Mid-20’s After some S/T bounce’s.

have oil investors become the new gold bugs?

because someone with money ,state sponsored or not , has interest in demolishing oil / productors , and will play it until the blood is spilled

oil= bearish hibernation+oversupply+lack of demand(normally higher demand in summer season=extremely bearish)+still too many boolish bottom callers+ fed hikes and multiple global moving pieces = much more blood, bottom in the 20’s or high teens

imho, new normal will be 30-50 for years to come

Many producers have cut costs. Example is in Permian Basin where costs all in are $28. However, you raise some good questions. Oil /WTI is heading to the $36-$38 range.

Cross-overs need gas to run. Ever venture out mid-day? The women drivers are insane and they all have a fucking horrible vehicle to drive. But drive them they will, until world ends. Long oil and gas as usual.