This is shameful on behalf of the underwriters. Both Morgan Stanley and Goldman Sachs (who the else, huh?) should go fuck themselves, for pricing the Snapchat IPO the way they did. There is no reasonable explanation as to why they’d price it so expensively, other than greed.

Greed on behalf of the venture capitalists in SNAP, such as Lightspeed Ventures, Benchmark, Institutional Venture Partners, General Catalyst, Coatue Management, Tencent, SV Angel, Graph Ventures and later Kleiner Perkins Caufield & Byers, the government of Singapore’s investment fund, Rizvi Traverse, Yahoo, Grupo Arcano, as well as Alibaba and Fidelity.

Greed for high underwriting fees by the leads and supporting investment banks.

Greed for high concessions that were taken by the participating investment advisors, doing the dirty work for their banks, in order to curry the favor of management (look like a team player) — luring their clients into a deal that was priced inappropriately.

And greed on behalf of the insiders at SNAP, who probably thought it was a good idea to fuck over Joe Public, because they were so good at doing it in the private markets.

Well, guess what, fucked faces? You’re not. Unlike the private markets, which are operated by literal ponzi scheme artists in the venture capital world, here in the public world, numbers matter. You missed earnings and subsequently fucked over shareholders on the very first earnings report since coming public.

This isn’t a laughing matter. I find the present situation of high growth companies being incubated until maximum maturity in the private markets at absurd ‘unicorn’ prices to be both reprehensible and demoralizing. Gone are the days when you could buy an IPO in the after market and hold it for a few years and make money. When they’re coming public at 2-3x normal maximum valuations, based on historical norms, you’re being set up for disaster.

Some argue that Facebook came public at a high valuation and has since soared. Correct. But it first got cut in half and it only soared after that because mobile wasn’t factored into its private valuations. Zuckerberg executed on mobile and Instagram much better than anyone expected, which led to the rise in the shares.

Other than that, there are very few “hot IPOs” that have outperformed over the past 7 years. I’m afraid it won’t change until the venture capitalists and the private equity devils are broken.

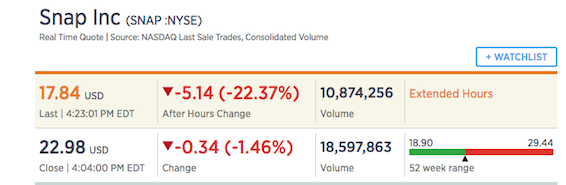

Snap misses by $0.26 (GAAP), misses on revs (22.97 -0.35)

Reports Q1 (Mar) GAAP loss of $2.31 per share, $0.26 worse than the GAAP Capital IQ Consensus of ($2.05); revenues rose 285.6% year/year to $149.6 mln vs the $158.32 mln Capital IQ Consensus.

Daily active users (DAU) — DAUs grew from 122 million in Q1 2016 to 166 million in Q1 2017 (roughly in-line with estimates), an increase of 36% year-over-year. DAUs increased 5% quarter-over-quarter, from 158 million in Q4 2016.

Average revenue per user (ARPU) — ARPU was $0.90 in Q1 2017, an increase of 181% over Q1 2016 when ARPU was $0.32. ARPU decreased 14% over Q4 2016 when ARPU was $1.05.

Hosting costs per DAU — Hosting costs per DAU were $0.60 in Q1 2017, as compared to $0.52 in Q1 2016 and $0.72 in Q4 2016.

FIG

Ha ha fuck snapchat. fuck fb. fuck nasdaq

People so quietly forget MySpace. This shit is all gimmicky fad stuff. There are very few sticky “customers” on these sites. Even with Facebook and Instagram. Once the hot new thing comes out they just move and its so easy to just stop using something that you don’t pay for. But hey, Uber is worth 60 billion, double what John Deere $DE is worth, so they got that goin for them.

Another factor is that snapchat caters to teenieboppers and young adults living in their mom’s basement (e.g., Peaches), all of whom have no jobs, no money and no developed brains.

Facebook, in contrast, caters to employed folks with discretionary income but, alas, also with undeveloped brains (e.g., Frog).

Here endeth the lesson, Mr. Fly. Millenials received a first-rate demonstration of the markets.

E Tard messaging is old hat. Bring on the future. Heroin needles stuck in the neck and balls along side Happy Birthday or any other generic message.

Told you so…well, on OA’s board.

This stock never sees it’s current all-time highs ever again. Short down to $10 via puts…just in case somebody takes them out.

Lol. I just wanted a sugar rush in between extremes.

Fuck told you so, I never argued this was a piece of shit. I agreed.

Lol…you actually got your pop – it was the second dip that didn’t work out and/or it didn’t spike as high as you thought. It was still a great call when you made it.

Did you get out at break even or a little lunch money OA? I entered around the same time and added a little lower…got some scratch.

I’ve never heard seasonality mentioned so much on an earnings call. Next thing they will be blaming the weather.

Bullshit gamblers stock that was so over valued, overpriced and overhyped. R.I.P.

Just about everybody under the age of 32 has a snap account in this country….I’m 30 and I don’t know anybody who doesn’t have one.In my opinion, this is going to be an instagram style pick up at some point. It’s all about, “add me on snap” with the millenials…validate me and let me know you’re looking. Twitter with visual stimulation. We’ll see if the company can capitalize. Worth keeping tabs on…

Wow. Well, who can be surprised. I consult the IBC for most of my finance news and Dr Fly said not to touch that POS with a 100 foot long pole