I don’t know why I bother looking for stocks, or even ETFs, when we have a vehicle to literally mint money: XIV.

Inverse volatility. What better way to profit from a rigged system, that is designed to cast aside doubt and fear, by betting against the fucking fear index.

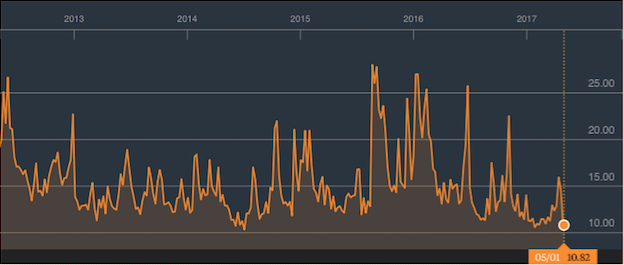

The Vix index is totally shit, approaching single digits.

Gains in XIV are in excess of 500% over the past 5 years. What have you done with your lives?

Record highs

Granted, during periods of obscene duress, being long XIV might feel suicidal. However, like religion, it’s important to keep faith in the Church of Anti-Fear. Whenever markets decline or scare people for a brief period of time, remember this post and always fall back on XIV as a tool to improve your lives for the better. Profits from this vehicle can power innovation, jobs, charity, cures for cancer. If used correctly, XIV can save the world from war, famine, pestilence and the coming of the apocalypse.

Simply bide your time over brimming coups of champagne and watch the money roll in, courtesy of XIV.

If you enjoy the content at iBankCoin, please follow us on Twitter

To wait for entry or not to wait

enter multiple times from front and back (if that’s your pleasure) until reaching climax

any news on 50cents?

He’s probably running a couple billion long and decided a VIX hedge was cheaper than SPX puts. He’s doing just fine

Is this the new FAZmobile?

If you look at the sequenced data back to when VIX futures were introduced, this really just looks like a ~3x leveraged S&P ETF. Peaked in 2007, suffered a 90%+ drawdown, regained all time highs in 2012.

If you really want good looking risk adjusted returns you’d buy a 1/3 position in XIV, put the rest in treasuries and pray VIX futures don’t spike 100% overnight.

It can’t be that easy, can it?