Thanks to our hawkish Fed, rates have been soaring — pressing the 10yr north of 2.6% — up from 1.75% on election night. By definition, this tightening his anti growth and poses as a risk to GDP. This is especially non semsical due to inflation saddled at 2% and GDP growth sub 3% — coupled with the fact that every other major central bank is easing and undergoing QE campaigns.

The net result should lead to a much stronger dollar, weaker US exports, and lower GDP — especially if Trump’s tax reform and infrastructure plans get delayed or inexorably cancelled by GOP shills.

Note: this isn’t bullish for prospective borrowing to fund stimulus.

As a result of this new narrative, illiquid closed end ETFs are getting dismantled today — following the lead of some of the higher profile bond funds getting blown out in recent days ($JNK, $HYG, $LQD).

Here are some of the lesser known closed end funds getting blown out today ($NCV, $PHK, $PTY).

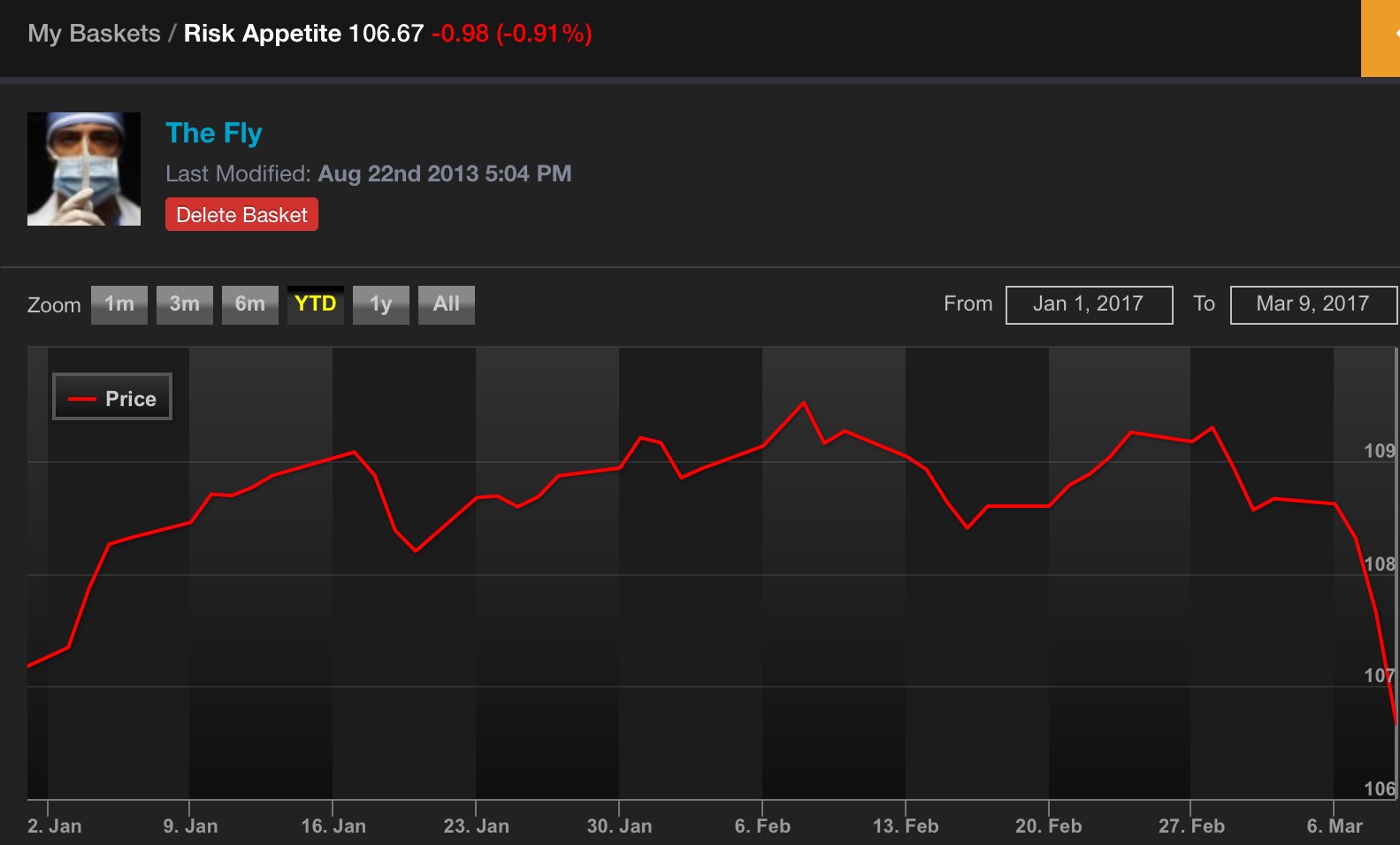

Inside Exodus, I keep a risk appetite index for this very thing. From time to time, bonds prices come under pressure and it doesn’t affect equities. However, this bond rout is also coinciding with some weakness in equities — something you should be paying attention to.

I’m at the golf

Course until this

Whole thing

Blows Over

HYG all the way back to late Jan 2017 yield. The horror.

It’s all fun and games until you’re visiting your own grave, as a ghost.

and yet the XLU….yield proxy- hasn’t really moved.

is that a reflection of the creditworthiness of the sovereign debt?

TBF

so far all the infrastructure build that has been discussed is private sector…XOM news about the Gulf, the keystone and DAPL…….so far the public purse hasn’t been tapped. Trump always said that funding would come from the private and public sectors….the debt ceiling issue has to be put to bed first I expect…

http://www.cnbc.com/2017/03/09/mnuchin-calls-on-congress-to-raise-debt-limit-as-deadline-approaches-reuters.html

Nobody knows! Everyone is welcome at the club where nobody knows, since they belong already no entrance requirements are involved.

I have been eying CLF. Does anyone think is goes much lower or has the damage been done?

think its an opp. next week they complete their debt buy back. also, there is a court ruling next week, where clf may be awarded mine contracts in mn.

Buying oil stocks today was a good idea.

If you want to see a meme movie of the times we have, watch: The Wages Of Fear. That might give you a little preparation for what we have coming in the future. It is a completely awesome movie. Keep in mind, this is all a game, and death is a minor “bump” in the rules. As is nitroglycerin. For you Maggots, it is available on Google Play Movies. Have fun. https://en.wikipedia.org/wiki/The_Wages_of_Fear