It looks like Target is having some pricing issues — as the welfare states of America bargain shop elsewhere. To remedy this, the company has announced a ‘new financial model’ and 12 new brands, investing in ‘lower gross margins’ to ensure competitiveness.

In other words, the company is very worried about the sales trends and have decided to retail items at lower prices — even though it hurts their margins.

What in the fuck is going on here?

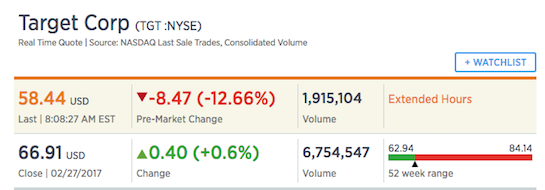

Shares are being menaced in the pre-market, off by 13%

Reports Q4 (Jan) earnings of $1.45 per share, excluding non-recurring items, $0.06 worse than the Capital IQ Consensus of $1.51; revenues fell 4.3% year/year to $20.69 bln vs the $20.69 bln Capital IQ Consensus, reflecting a 1.5 percent decline in comparable sales combined with the removal of pharmacy and clinic sales from this year’s results.

Comparable digital channel sales grew 34 percent and contributed 1.8 percentage points of comparable sales growth.

Segment earnings before interest expense and income taxes (EBIT), which is Target’s measure of segment profit, were $1,344 million in fourth quarter 2016, a decrease of 13.5 percent from $1,554 million in 2015. Fourth quarter EBITDA and EBIT margin rates were 9.5 percent and 6.5 percent, respectively, compared with 9.8 percent and 7.2 percent, respectively, in 2015.Fourth quarter gross margin rate was 26.9 percent, compared with 27.9 percent in 2015, reflecting markdown pressure from promotional and clearance activity and costs associated with the mix shift between the Company’s store and digital channels, partially offset by the benefit of the sale of the Company’s pharmacy and clinic businesses, a favorable merchandise mix, and cost of goods savings.

Warned on Jan 18: Guided Q4 EPS $1.45-1.55 vs. $1.65 consensus; comps (1.5)-(1%).

Co issues downside guidance for Q1, sees EPS of $0.80-1.00, excluding non-recurring items, vs. $1.33 Capital IQ Consensus Estimate.

Co issues downside guidance for FY18, sees EPS of $3.80-4.20, excluding non-recurring items, vs. $5.33 Capital IQ Consensus Estimate.

Target’s 2017 guidance reflects the impact of the Company’s transition to a new financial model, which will be covered in the Company’s meeting with the financial community later today.Under the current program, the Company invested $264 million in the fourth quarter, leaving ~$4.7 billion remaining under the current program at the end of the quarter.

“Our fourth quarter results reflect the impact of rapidly-changing consumer behavior, which drove very strong digital growth but unexpected softness in our stores,” said Brian Cornell, chairman and CEO of Target. “At our meeting with the financial community this morning, we will provide detail on the meaningful investments we’re making in our business and financial model which will position Target for long-term, sustainable growth in this new era in retail. We will accelerate our investments in a smart network of physical and digital assets as well as our exclusive and differentiated assortment, including the launch of more than 12 new brands, representing more than $10 billion of our sales, over the next two years. In addition, we will invest in lower gross margins to ensure we are clearly and competitively priced every day. While the transition to this new model will present headwinds to our sales and profit performance in the short term, we are confident that these changes will best-position Target for continued success over the long term.”

Someone made a killing off this miss.

$TGT getting hammered, around $4M in Jan. 2018 puts bought on Friday pic.twitter.com/kNMM9dqX8Q

— Joe Kunkle (@OptionsHawk) February 28, 2017

Look who nailed it.

If you enjoy the content at iBankCoin, please follow us on TwitterIronically there's a good chance Target blows up without any outside help when it reports earnings on the 28th. $TGT

— Jeff Macke (@JeffMacke) February 18, 2017

I DGAF about Target. I read this article hoping for a transgendered bathroom joke. Very disappointing. You rarely let me down Fly, but this morning, you did just that.

All that being said, I will still read the remainder of the posts today.

Good morning.

Go fuck yourself.

LOL Well played

I don’t leave a target without visiting women’s bathroom and pissing all over the stall, preferably when I see a fat liberal enter it

To much red.

Target’s policy of bathroom for perverts must have had something to do with this.

Funny, Kyle Smith at the NY Post says boycotts do not work.

Many Red Americans do not go there anymore. Gender neutral policies are not popular.

April marked their most recent tap in low 80’s…Policy was public on April 19.

I’d love to get Macke’s thoughts on this as well, dude is a retail maven

Macke needs to come back.

the puts were so cheap too. bears made a killing on this ER.

Steadily adding to my AMZN position as they devour the cesspool of brick and mortar. Zero desire to wade through a sea of “undocumented” persons on welfare. It’s become pig-trough style retail. No thanks. I will go out of my way to frequent non-chain small biz but fuck the TGTs of the world.