I’m a big fan of the steel markets. But instead of investing in that competitive shark pit, I’m buying the companies that make it possible. Think picks and shovels instead of mining for gold.

Twenty percent of my portfolio was long $CLF, heading into today. I did purchase an oil stock this morning, upping my net exposure to this wonderful market to 140%.

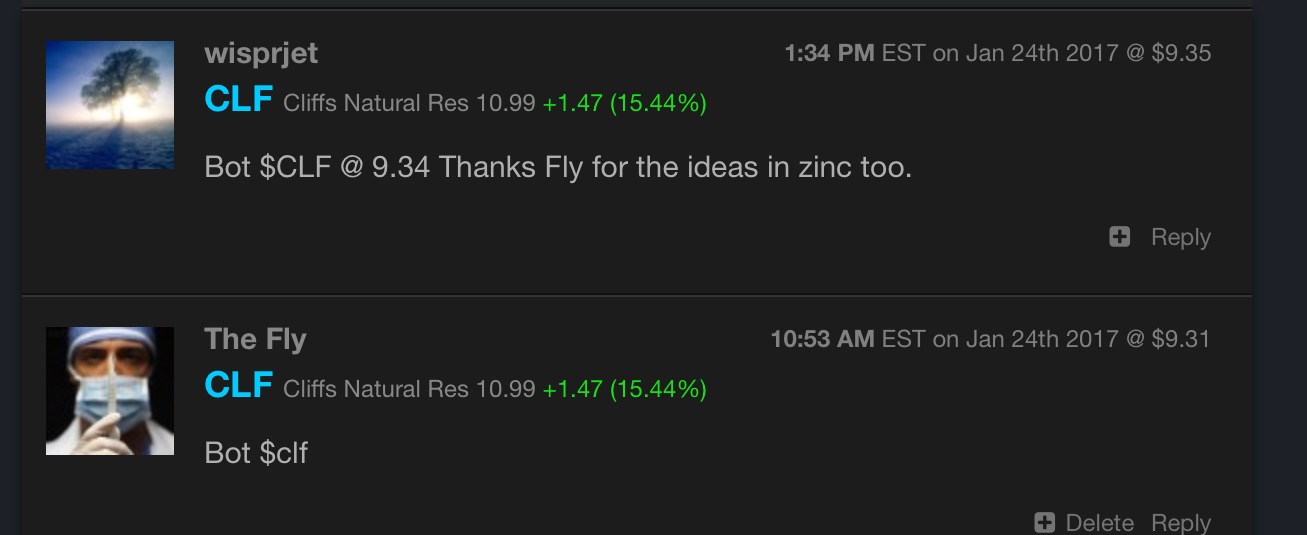

Here was my purchase of CLF, time stamped and emailed out to Exodus members a few weeks ago.

With today’s gains, I’m now up more than 10% for the year.

Aside from crushing estimates, CLF cited a newly rational behavior in the iron ore industry. If you’re not familiar, CLF provides the cokimg coal needed to produce steel.

Shares have exploded to the upside on this beat, especially since the stock is so heavily shorted.

Reports Q4 (Dec) earnings of $0.42 per share from cont ops, $0.16 better than the Capital IQ Consensus of $0.26; revenues rose 58.4% year/year to $754 mln vs the $668.21 mln Capital IQ Consensus.

“2016 was the year in which we finalized the execution of the operational, commercial and financial actions necessary to ensure Cliffs will have a great future. Among the actions accomplished last year are several new sales agreements entered with clients, including the renewal of our long-term supply contract with our largest customer, and a number of capital markets transactions that were successfully executed to reduce debt and extend our maturity runway.”

“the undeniable fact that the underlying business environment was far from ideal during almost all of 2016…A much more favorable business environment in the US and a newly adopted rational behavior in the international iron ore market support the work we have done internally in our company. With a much lower debt profile and extended maturities, and several new and more favorable commercial agreements that we put in place in 2016, we expect Cliffs to deliver strong and sustainable results in 2017.”

Outlook for 2017: Co expects to generate $510 mln of net income and $850 mln of adjusted EBITDA. This is based on the assumption that iron ore and steel prices will average levels consistent with the full month of January throughout 2017.

Key takeaway: the steel industry is on the cusp of extreme winship. Buy any company that helps galvanize steel, such as zinc plays. Currently, I’m long three: $TECK, $VEDL and $HBM.

Pardon my enthusiasm, but this is my core thesis, along with uranium.

If you enjoy the content at iBankCoin, please follow us on Twitter

Congratulations – that was a great call.

Great call. I remember your SLCA calls near the lows. Hope this explodes like that.

Congratulations, your positioning is on point.

Enjoy your afternoon, eat something you enjoy, even if it is not healthy.

Like pizza???

Nice.. would be ironic if infrastructure progress is impeded by lack of skilled construction workers.

That would make you happy wouldn’t it prick