Zinc is like the fat lady at the end of the bar. No one talks about Zinc, but it’s a really nice commodity. It’s up 85% over the past year, steadily climbing, making copper look like a shit metal in comparison. Most of you meatheads think Zinc is something your wife takes in her daily dose of multi vitamins, but you’d be wrong — because you’re an idiot.

Zinc is used to galvanize other metal and is a vital component in street lamps, bridges, tunnels, and all sorts of vital infrastructure. Most people gloss over it and head right to the crowded steel trade. But here is Zinc, working its fucking ass off and none of you bastards are paying attention.

I’ll do you all a favor right now and tell you what I’ve been buying: $HBM.

Even though the company is based in Canada, the home of the leaf, they’re the best damn Zinc company out there — highly leveraged like baboon lunatics into a Trump tailwind.

Here is what they had to say during the past quarter. It’s worth noting, RBC is very boolish.

Copper and precious metals production from the Constancia mine in Peru exceeded 2016 guidance and production of all key metals at the Manitoba Business Unit was within 2016 guidance ranges.

Production of zinc in concentrate in 2017 is forecast to increase by approximately 25% compared to 2016 production, primarily due to the ongoing ramp-up of the Lalor mine and the re-sequencing of the mine plan at 777 to mine stopes containing higher zinc grades and take advantage of favourable expected zinc prices.

Production of copper and precious metals contained in concentrate in 2017 is forecast to decrease by 17% and 5%, respectively, compared to 2016 production, primarily due to lower copper grades at Constancia, as per the recently released technical report, as well as lower ore production and copper grades at the 777 mine due to the age of the mine and the emphasis on higher value zinc ore production in the new mine plan.

Sustaining capital expenditures are expected to be $185 million in 2017. In addition, growth capital expenditures of $40 million on the Lalor paste backfill plant, $25 million on the development of the high-grade Pampacancha deposit near Constancia and $20 million on the advancement of the Rosemont project are expected in 2017.

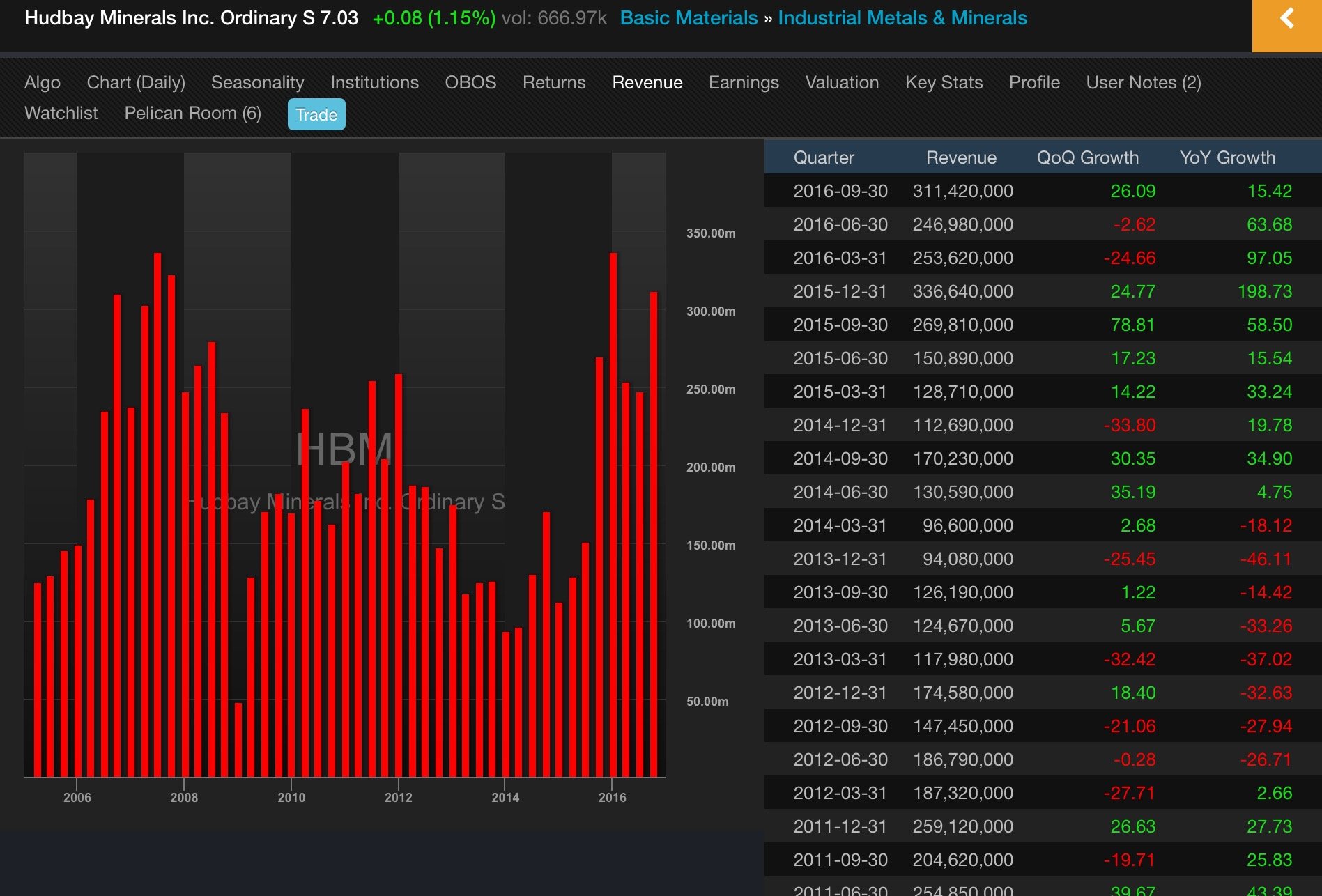

Revenues have been surging and the stock, in kind.

When investing, I like to keep things simple and not overthink things, since the landscape is constantly changing. What we have here is a roaring commodity, buoyed by a potentially massive infrastructure upgrade in America, and a company highly leveraging into the zinc space at the perfect time.

I smell winship.

NOTE: $TECK is another great Zinc play.

If you enjoy the content at iBankCoin, please follow us on Twitter

> Zinc, working its fucking ass off and none of you bastards are paying attention.

I am paying attention! I am going to run out right now and buy some so it’s in the cabinet for the wifey

> Zinc is something your wife takes in her daily dose of multi vitamins

and yours should take it too. It’s good for her. Keeps her well lubricated.

Fly. Regarding Zinc plays. Any thoughts on Lundin Mining? $LUNMF. Just sold stake in Tenke copper mine in congo. Strong balance sheet with good zinc and nickel exposure.