Most human beings spend their days and nights trying to figure out the keys to success and the quickest path to happiness. Speaking from a wealth of experience, managing money for two decades, I can’t think of an easier way to achieve the never-ending quest for monetary enrichment than to simply short volatility (it works until it doesn’t anymore, of course).

In a low volatility world, one that is overtly controlled by central banks for the explicit purpose of asset appreciation, could there be a better investment than $XIV?

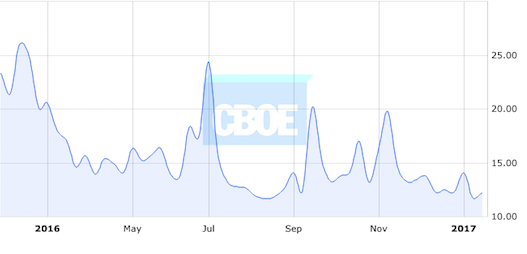

For those of you on the dumb end of the intelligence curve, bets on volatility is, essentially, a bearish bet on equities. I realize some purists out there will contend this simplification with meaningless bullet points. But, the bottom line is, without sharp pullbacks in the markets, and a wild spike in the purchase of put contracts, volatility is a doomed investment.

Now you could play this directly via the options market against the VIX index, or simply purchase XIV — which is a fucked up derivative version of the VIX — designed to fail — literally. Buying XIV permits buyers to short the doomed world of ETF based VIX contracts. It is, in a word, ‘perfect’personified.

What sort of returns are we talking about? 600% over the past 5 years — crushing the SPY by a mere 511%.

My natural tendency for cynicism leads to believe this trade is very long in the tooth and volatility shorts are due for a comeuppance. Don’t get me wrong, being long XIV into the teeth of a sharp pullback, such as the one endured this time last year, will make you want to find religion and perhaps toss yourself into a lit fireplace — wrapped in a burlap cloth.

But can anyone argue the fact, with a straight face, that volatility isn’t all but extinct now? When was the last time markets have truly gone lower for more than a few months? All declines are absorbed and bought — sending markets to new highs.

Nothing (and I mean this) can stop stocks from trading higher. Not Trump. Not Le Pen. Not even a nuclear detonation over Los Angeles and subsequent removal of all forms of human life in the great state of California.

If you enjoy the content at iBankCoin, please follow us on Twitter

oh boy oh boy

Red meat

Vix futures net spec positioning

http://www.zerohedge.com/sites/default/files/images/user3303/imageroot/2017/01/17/20170121_VIX.jpg

“The Day Of Reckoning Looms For VIX Shorts: Reminds Me Of Portfolio Insurance In 1987”

Yes and shhhh

As the saying goes ‘As soon as you find the key to stock market success some SOB changes the lock.’ With the huge increase in short volatility positions I get the feeling there are a lot of people who believe they have found the key….. perhaps to many people. Kind of reminds me of the no brainer belief of selling naked puts in mid 1987.

Sounds great, what could possibly go wrong?

OK, I have traded it a little bit and have made money each time. That’s why I avoid it.

Unless vix futures spike 100% in a day at which point XIV would be worth $0.

Vix futrues traded +70% overnight twice this past year and it wasn’t all that volatile in the grand scheme of things.

Shorting the middle part of the curve is probably the closest thing to risk free money out there. 3-7 month spread has only been in backwardation twice in the last 6 years.

You could also go short the double, triple short etfs SDS, SDOW right? They should be guaranteed to make money over time. Unless, or course, you short right before the market tanks.

This post will mark a low.