The VIX index has an 11 handle.

Literally, no one gives a shit about anything. Algos are loaded up to buy stocks daily, and traders suck off their milky tits. The perversion of markets has increased by a factor of 10 in recent weeks, with 50% runs in basic material stocks — led by oil and copper — because Trump is sooo friendly towards China (rolls eyes). It’s like a sick practical joke that will end up pulling the rug on everyone, at a time when the last bear concedes.

Socgen is warning investors that this complacency isn’t normal and has diverged from the traditional methods by which risk is priced into markets. Get it?

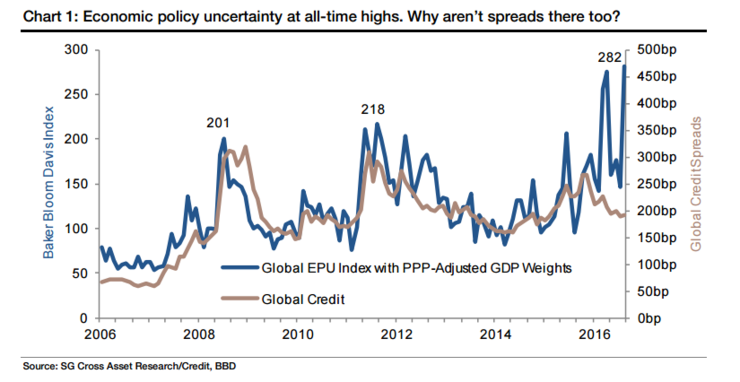

Here is the chart.

source: Bloomberg

Political upheaval and the economic policy uncertainty that’s accompanied it have left little impression on the corporate bond market in 2016. And that’s got researchers at Societe Generale SA concerned.Even as a wave of surprising election results and a rising populist tide ushered in regime changes in major economies, credit spreads globally are near their tightest levels of the year. Meanwhile, one measure of economic policy uncertainty — propelled upwards by the recent Italian referendum, incoming Trump administration, and a color-coded Brexit — has hit an all-time high.

That massive divergence is depicted in what SocGen Head of Emerging Market and Credit Research Guy Stear calls “the most worrying chart we know.”

Spreads should be twice as wide given the current level of economic policy uncertainty, the strategist reckons.

Global credit spreads were formulated using a weighted average of iBoxx U.S., euro, and U.K. corporate bond indexes relative to their respective benchmarks, while using an index developed by the researchers Scott Baker, Nicholas Bloom, and Stephen Davis to gauge economic policy uncertainty.

“This ought to worry the bulls,” Stear writes, who notes that credit markets are underestimating political risk compared to 2008 and 2011, two other occasions when the Baker, Bloom, and Davis index went parabolic. The measure is higher now.

“In 2008 and 2011, the correlation between economic policy uncertainty and credit spreads was very close,” the strategist writes. “As uncertainty rose, so did spreads – but something different is happening now. The Economic Policy Uncertainty index is up at all-time highs, but spreads are at the median levels of the period going back to 2008.”

Economic policy uncertainty might not ease in the near term, with elections next year in France, the Netherlands, and Germany having the potential to further testify to the populism that’s arisen as a major countervailing force to globalization across advanced economies.

In his year-ahead outlook (titled “The big hangover, part II”), Stear recommends that investors underweight credit in 2017 and wait for a buying opportunity to emerge around the middle of the year.

I promise you: buying up here will be ruinous to your net worth in the not too distant future. This complacency that you’re enjoying now will end in a raging river of tears — investors broken across the rocks — strewn out and ruined. Even the idea of a significant market sell off is somewhat laughable to most people, since it appears to be impervious to any and all negative forms of news. This is how tops are built, on the weak and hedonistic bodies of the overzealous.

If you enjoy the content at iBankCoin, please follow us on Twitter

Problem is you’ve been promising us for a very long time now… Not only did we miss out on very nice stocks gains, but we are also now losing money with the ark.

Are you somehow beholden to what I do with my money? Make your own decisions.