After every last morsel of meat has been picked clean from the American landscape, the globalist scum will need a new country to rape and pillage. By all measure, China is being groomed for such a gracious gift. Over the next century, if current trends persist, America will devolve into a true banana republic. We might even be forced to sell Hawaii one day to the Chinese, paid for with the dollars they made from pillaging from us.

According to new statistics, the globalist plot to convert Chinese savers into debtors is progressing very nicely.

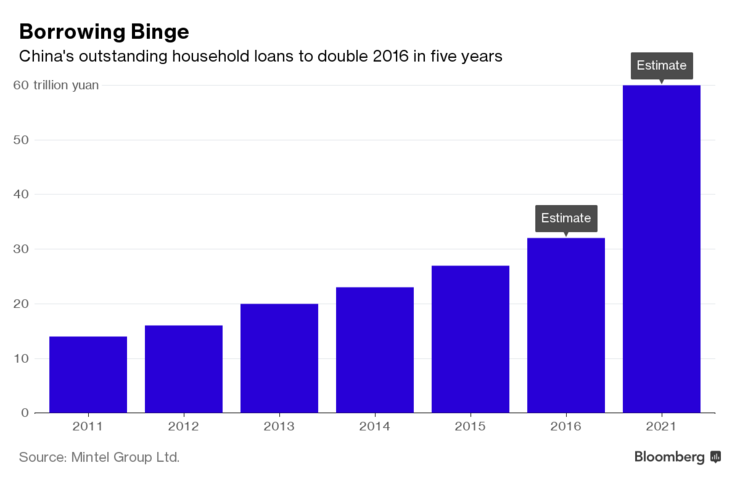

Look at all of that debt, boy.

Source: Bloomberg

China’s savers, who sock away cash like almost no one else in the world, are racking up more debt as borrowing options proliferate.

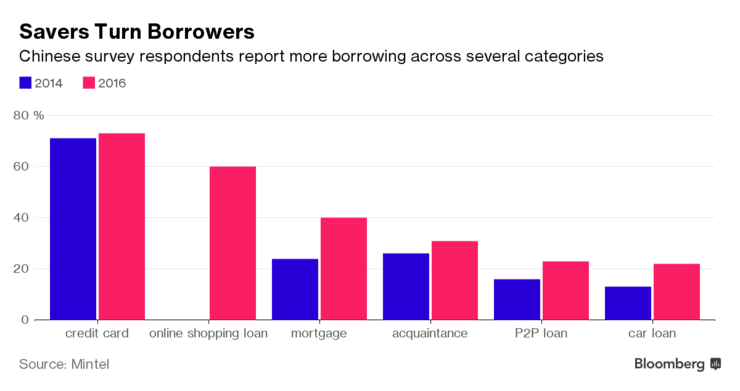

Ninety-four percent of consumers used a credit or loan in the past year, up from 85 percent two years ago, according to a survey by market researcher Mintel Group Ltd. Peer-to-peer lending via online lenders jumped, while car loans and mortgages nearly doubled, the poll showed.

Huo zai dang xia, or living in the moment, is the new buzzword. It’s especially prevalent among consumers in their 20s, according to Aaron Guo, a senior analyst for Mintel in Shanghai.

“Compared with their parents’ generation, who tend to save more and are sometimes thrifty, youngsters are willing to spend more on products with special features or tailored services,” he said.

That’s a profound shift in attitudes for a nation where saving has long been the bedrock principle of personal financial management and a prerequisite for big milestones like cars, homes and kids. Deposits stand at 59.6 trillion yuan ($8.67 trillion), People’s Bank of China data show.

The newfound willingness to borrow from the future to enjoy the present could help support consumption in coming years and nudge the nation’s rebalancing away from old traditional drivers. China’s gross domestic product rose 6.7 percent in the third quarter from a year earlier on the back of resilient retail sales, which expanded 10.3 percent in the year to date.

The borrowing could be just getting started. China’s household outstanding loans will continue to rise at a rate of 14 percent for the following five years and exceed 60 trillion yuan by 2021, the Mintel report said.

The joys of globalism and the culture to produce debt slaves.

If you enjoy the content at iBankCoin, please follow us on Twitter

“Living in the moment” is all fun and games, until you lose your job, your car, and your house. Who will bail your out? Your grandparents who have saved their whole lives? Or your precious PBOC? I see a generation with a rude awakening ahead.