There may be another reason why the Euro has been so damned weak v the dollar: it might not exist for too much longer. With Le Pen from France surging in the polls and Prime Minister Renzi from Italy promising to fire himself should a drastic and very aggressive constitutional realignment fail to pass in a referendum on December the 4th, the anti EU five star movement might takeover and tell Germany to fuck off.

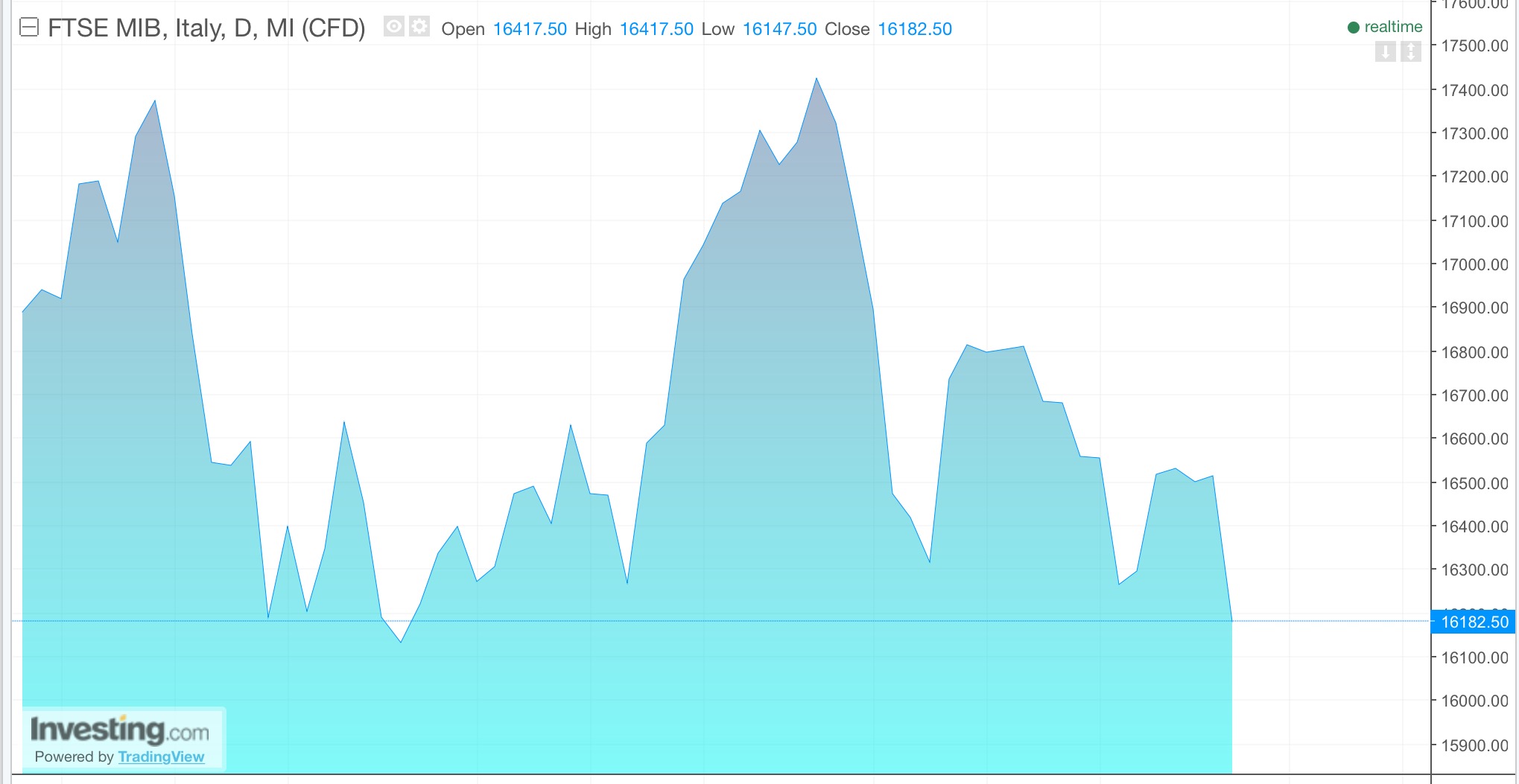

All of this is weighing heavily on Italian stocks, one of the worst performing indexes in the world this year, off by 23% — somewhat immune to the greatness of QE and all of its grandiose splendor.

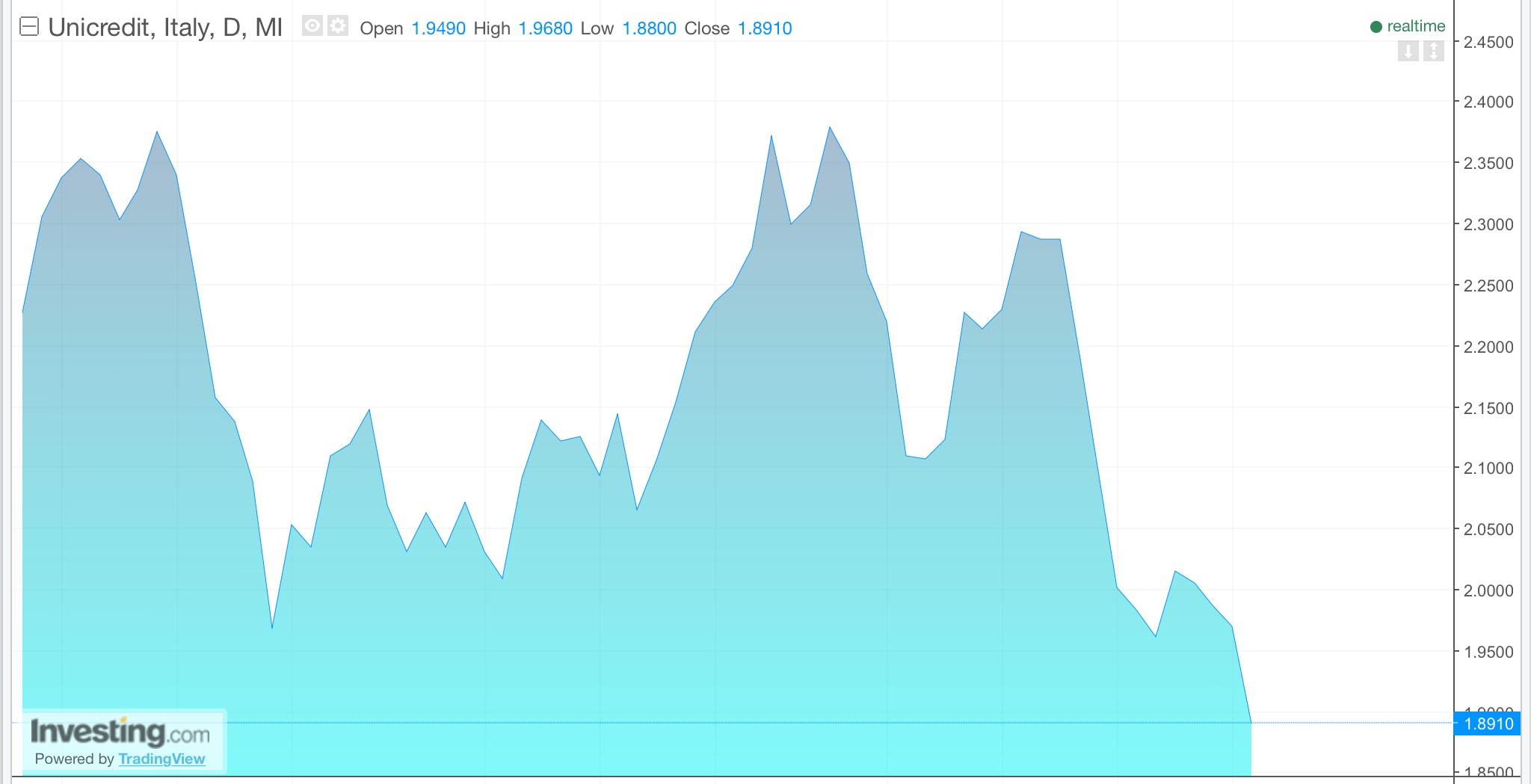

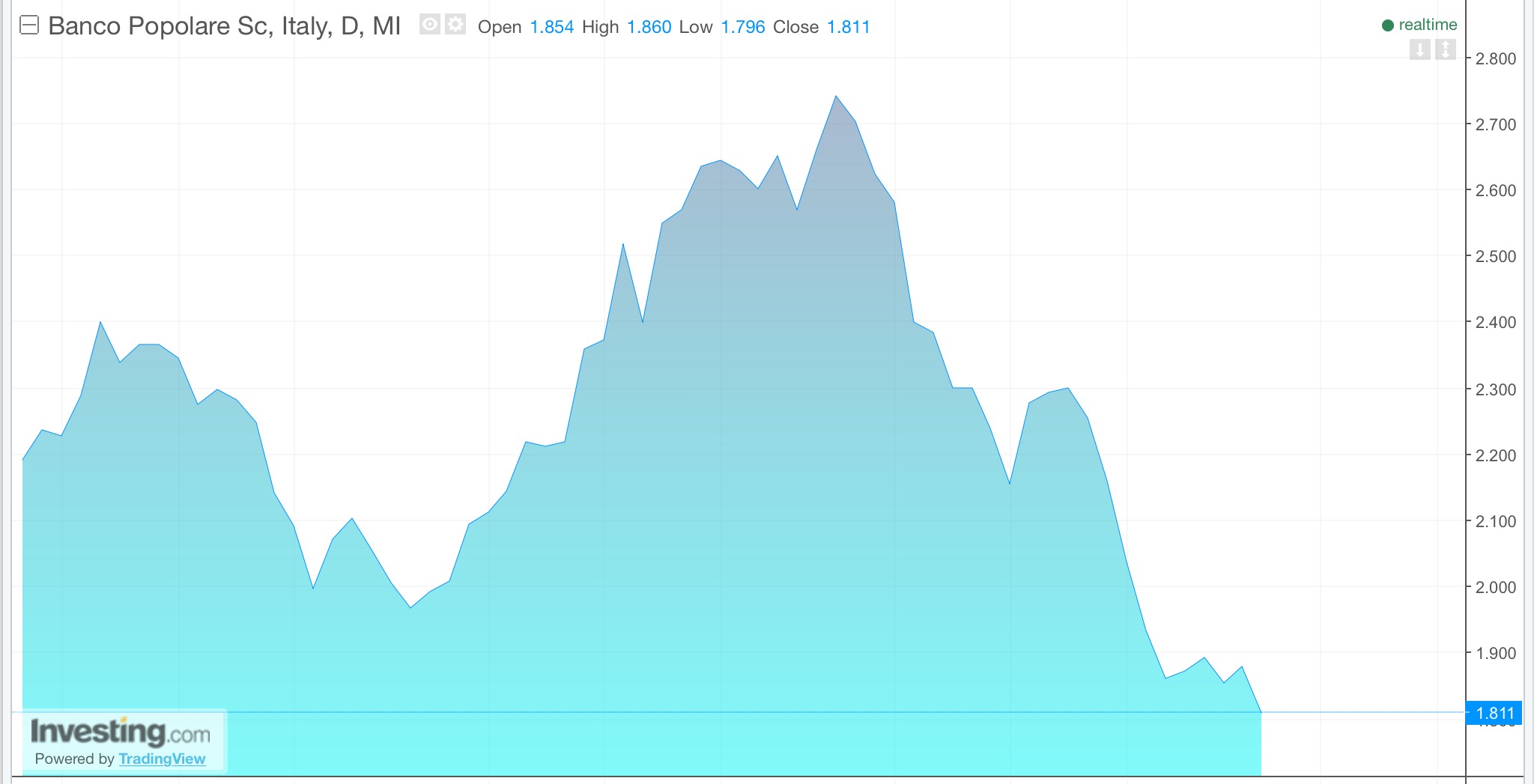

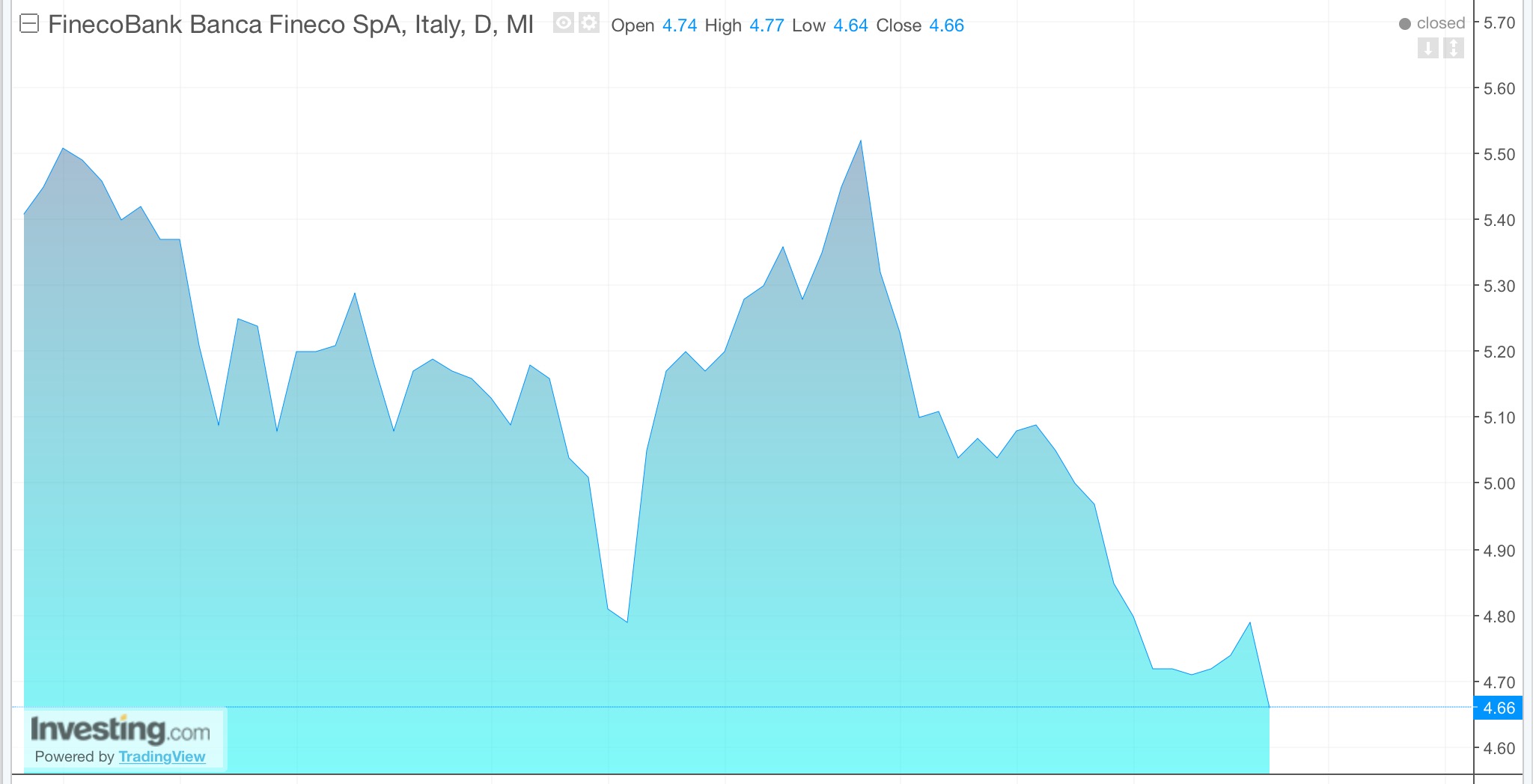

To that end, Italian banks continue to slug lower, amidst acrimonious sentiment that a potential exit from the EU might lead to the ultimate destruction of an already comically overburdened and woefully undercapitalized Italian banking system.

Shares are hitting new recent lows, down from 2-4% this morning.

Barrons sums up the best and worst case scenarios. The best case scenario is something of a fantasy, sort of like a Hillary Clinton recount election win. Not that I’m a fan of the pollsters, but the people really want to see Renzi Fire himself, with the no’s leading by 5 points in the final poll before the referendum.

IN THE EVENT the reforms are rejected and Renzi resigns, the implications are much more complicated. It is possible that Renzi’s center-left Democratic Party-led government could form a new administration, headed by one of his cabinet members, with a short term and a narrow mandate, such as writing a new electoral law. Italian equity markets probably would underperform, and the political malaise could delay capital injections at the beleaguered banks. Spreads on the 10-year bonds could widen.

In a worst-case scenario, a new government couldn’t be formed and national elections would be held, paving the way for popular euro-skeptic parties led by the Five Star Movement to put together a new administration. They could push for a referendum on continuing membership in the euro zone, which would have a destabilizing effect on the entire area.

If that happens, the euro, whose decline against the dollar has accelerated in the past few months, could face more stress. “The systemic consequences for the whole area would be material,” maintains Deutsche Bank senior economist Marco Stringa. “So the euro would probably depreciate, although it is difficult to calibrate by how much.” On Friday, the European currency was worth $1.059.

Doom is just around the bend.

If you enjoy the content at iBankCoin, please follow us on Twitter

7 comments

Pingback: TRUMPISTI! Italian Populists Expected to Defeat Referendum; EU Crisis Looms -

Pingback: TRUMPISTI! Italian Populists Expected to Defeat Referendum; EU Crisis Looms | Domainers Database

Pingback: TRUMPISTI! Italian Populists Expected to Defeat Referendum; EU Crisis Looms | StrikeEngine

Pingback: TRUMPISTI! Italian Populists Expected to Defeat Referendum; EU Crisis Looms | NewZSentinel

Pingback: TRUMPISTI! Italian Populists Expected to Defeat Referendum; EU Crisis Looms - BuzzFAQs

Pingback: TRUMPISTI! Italian Populists Expected to Defeat Referendum; EU Crisis Looms | Political American

Pingback: Italy Votes on Referendum………..*shema-ministries.com* | LOVE IS THE KEY|shema-ministries.com|JERUSALEM