Let me show you my charts.

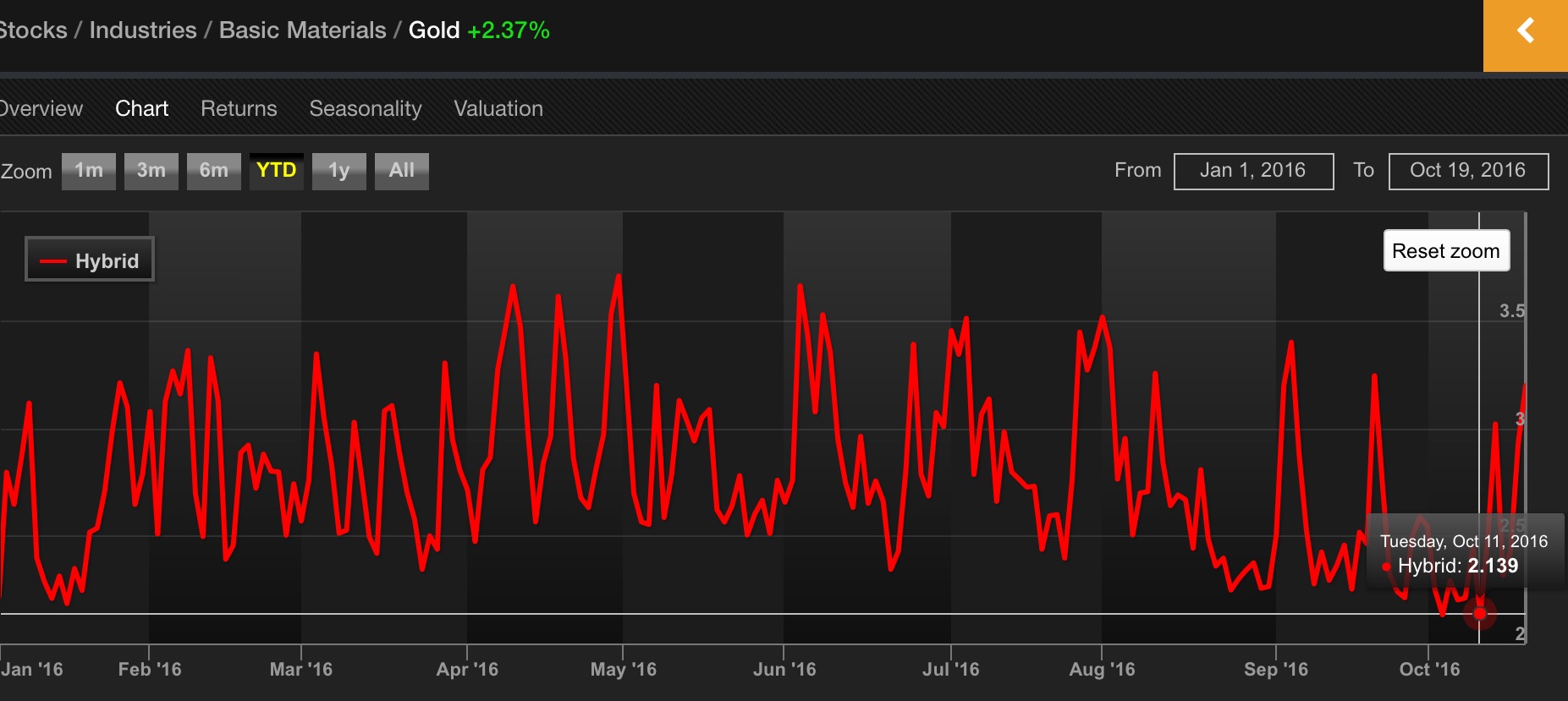

On October the 11th, while many of you gold traders were throwing yourselves into lit fireplaces, Exodus was speaking to its members, ever so quietly, and alerting them to the fact that it was oversold.

See how the oscillator was at its lowest point two weeks ago? Fast forward to today, gold is the best performing sector in the market, up by more than 10%.

Today’s gains further cement the idea that weak economic news is a positive for gold, all related to Fed rate hikes. Naturally, this is inherently stupid, since gold is a play off inflation. But there isn’t any inflation and it has morphed into a protest trade, people disaffected by markets who are sick and tired of Fed policies and wanting a way out of their sphere of influence.

From my vantage point, gold trades up sharply if the market delves into panic mode and it also will trade higher if the central banks continue to denigrate fiat currency via QE.

Today’s winners.

This is a long tail trade for me, something unusual for this site. Since entering the money management field in 1997, I’ve managed to do very well and now I’m interested in preserving what I have and making money a better way. I can’t deal with the horseshit anymore and much prefer to use Exodus and a few macro themes to further my investment evolution.

Bear with me. This is a work in progress and I’m constantly tinkering with new methods. Speaking of which, I’ll reveal my ‘FIST OF DEATH’ short sales tomorrow or the day after.

If you enjoy the content at iBankCoin, please follow us on Twitter

Whatever works for you.

Just find the edge, keep with it, research other methods, and dump it when it doesn’t work.

I have morphed since the early 1980’s from short term mutual fund trading (2-5 week holding periods), to day trading Fidelity hourly sector funds (Fidelity then ditched them), to frequent switching of mutual funds taking advantage of noticed price discrepancies (then got kicked out of Scudder, Franklin and GT Global for frequent switching), to trading individual tech (hello dot com bubble), to trading etfs (SMH,GDX,QQQ) to finally trading through RYDEX 2x funds (allowed to put on an intraday trade and then close it out the same day.

Seen it all or most of it anyway.

How’s life eating canned souping and gassing up the generator wearing body armor?

Todays

summary

Government computers 3 stage push 1015am

Also shown by open drop forced back up equal magnitude

Drift from 1050am to 1130am equalled back up 1130 to 130

A fakeout conclusion, or algos rejecting narrative into close

Have been holding NUGT for 13 days got 27% gains. Couldn’t pass that up and sold @14.85. I’m not usually a long trader either so I’d like to hear you thoughts here with a long gold trade. Will be waiting the next post.

MOAR