Alas, the evergreen joys of record highs, fueled by a mechanism that has produced more debt to GDP in the history of mankind. Naturally, if you all went out and maxed out your credit cards and spent all of your money on stuff, you’d look and feel rich too. But eventually the stuff you bought would begin to rot and get old and then you’d need more stuff. By then, it’d be too late. Credit would’ve dried up and you’d need to restructure your balance sheet in order to start anew.

The global debt burden is of an unprecedented quality. But with markets at new highs and the status quo drifting on like a summer breeze, anyone who dares to mention this very real, and very dangerous set of circumstances are castigated out for spreading insipid intellectual fare.

This pablum is out of the IMF this morning.

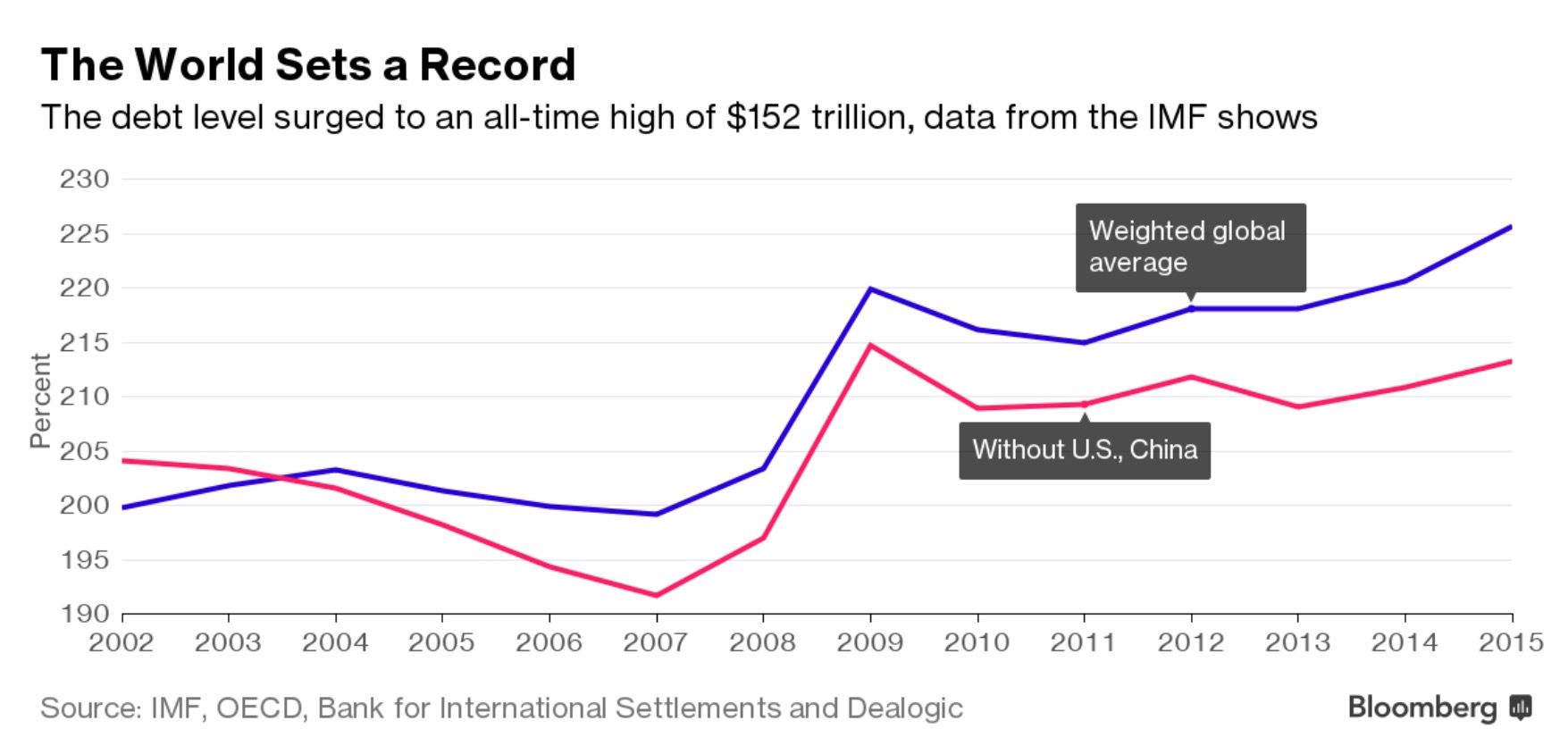

Gross debt in the non-financial sector has more than doubled in nominal terms since the turn of the century, reaching $152 trillion last year, and it’s still rising, the International Monetary Fund said. The figure includes debt held by governments, non-financial firms and households.

Current debt levels now sit at a record 225 percent of world gross domestic product, the IMF said Wednesday in its semi-annual Fiscal Monitor, noting that about two-thirds of the liabilities reside in the private sector. The rest of it is public debt, which has increased to 85 percent of GDP last year from below 70 percent.

Slow global growth is making it difficult to pay off the obligations, “setting the stage for a vicious feedback loop in which lower growth hampers deleveraging and the debt overhang exacerbates the slowdown,” said the Washington-based fund.

“Excessive private debt is a major headwind against the global recovery and a risk to financial stability,” IMF fiscal chief Vitor Gaspar said in prepared remarks. “History has taught us that it is very easy to underestimate the risks associated with private debt during the upswing.”

There’s no consensus on what levels of debt-to-GDP should be the considered alarming, the IMF said. However, financial crises tend to be associated with excessive private debt in both advanced and emerging economies, the fund said. In addition, research has shown that high debt is linked with lower growth, even when a crisis is avoided.

If companies postpone paying off debt, they could become “very sensitive to shocks, increasing the risk of an abrupt deleveraging process,” the IMF said.

Depressed economies with weak banking systems should avoid premature tightening of fiscal policy, the fund said.

The IMF flagged the euro area and China as economies where it’s particularly important for deleveraging to occur.

Markets continue to grind higher, effectively and absolutely ignoring the headwinds that are coming.

If you enjoy the content at iBankCoin, please follow us on Twitter

What to do about it? I saw an estimate (could be crap) that total world net worth is on the order of $250T, so add the $150T of debt and the total is Gross Wealth of $400T. As we know the vast majority of that is concentrated in the estates of the wealthiest. Is there anyway to pay off the debt without the wealthiest contributing the vast majority of the cash?

comical trump tower high stack of forms, well played trump, well played.

http://www.zerohedge.com/news/2016-10-05/october-surprise-trump-about-release-his-tax-returns

pump pump, then dump dump dump.

Wars have been fought over less.

thats why you need law and order trump. who is really going to pull our troops from wars and at the same time build up national defense spending. that is why the top brass military backs him, to save american lives. it saves us money and it is invested domestically. troops will spend their money in the US. and domestic defense contracts will go up. see no war if trump wins.

if killary wins she will cause wwiii, by bombing the middle east to dust and the blow back to follow.

You can’t actually pretend to know what Trump would do about anything.

Did you not see how he got trolled over MS. UNIVERSE?

Just imagine master troller Putin draw Trump in…

killary’s brash impulse to kill is catching up with her. america and even the elites will not stand for a hitler like killary.

http://www.zerohedge.com/news/2016-10-05/hillary-can%E2%80%99t-recall-suggesting-drone-strike-julian-assange

its’ different this time

only thing different is noticed in time duration. we are at one of those once in 100yrs moment as the problems have been globalized and it will be a world systemic crash. humans seem to repeat this karma, as they forget the pains caused by hubris after a couple generations. then complacency, leads to corruption, which leads to decay. and a round we go.

was tongue’n cheek but agree

fly, bonds looks like they are going to break down on the weekly bull flag, on a failed breakout.

As long as we’re getting multiple comments per blog post out of roundwego, this thing won’t crash. He will never be right.

Simple fix, just print more money to pay off the debt.

+1