Crack spreads are still rich, above $14.

But the working theory is, with lower US production levels and higher Brent crude pricing, margins at American refiners will shrink. It has been a wretched year for refiners all year, an olde school favorite sector of mine. I often harken back to the days of when I was rock solid long and strong WNR, without a moment of flaccid wavering. I bore the brunt of a harsh, Greek led, sell off and came out the other end a better man.

But much of the old refiner trade was based on the spread between WTI and Brent. With the U.S. oil production boom, refiners were grabbing cheap WTI and selling it at Brent pricing. It was egregious, quasi-illegal, and fantastic. Subsequently, all of that has gone away. The spreads between WTI and Brent have vanished and American oil is something the House of Saud scowls upon (cue Gary from spongebob).

Once again, the refiners are getting smoked. Look at those YTD losses.

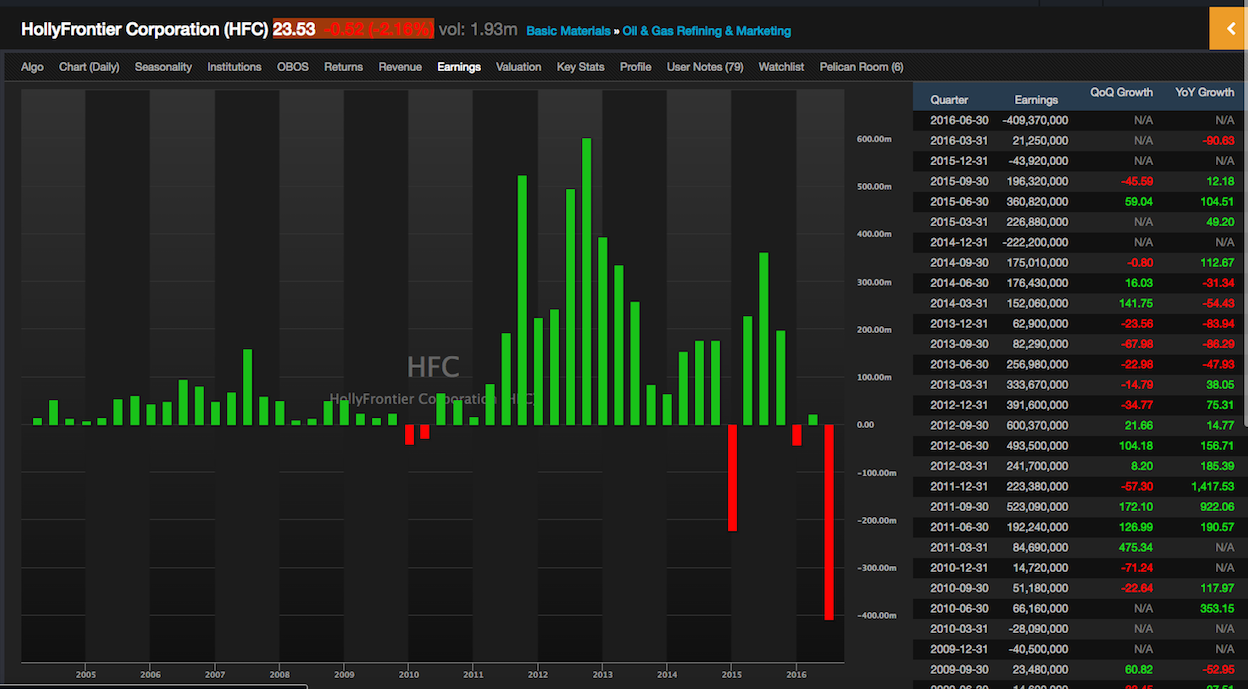

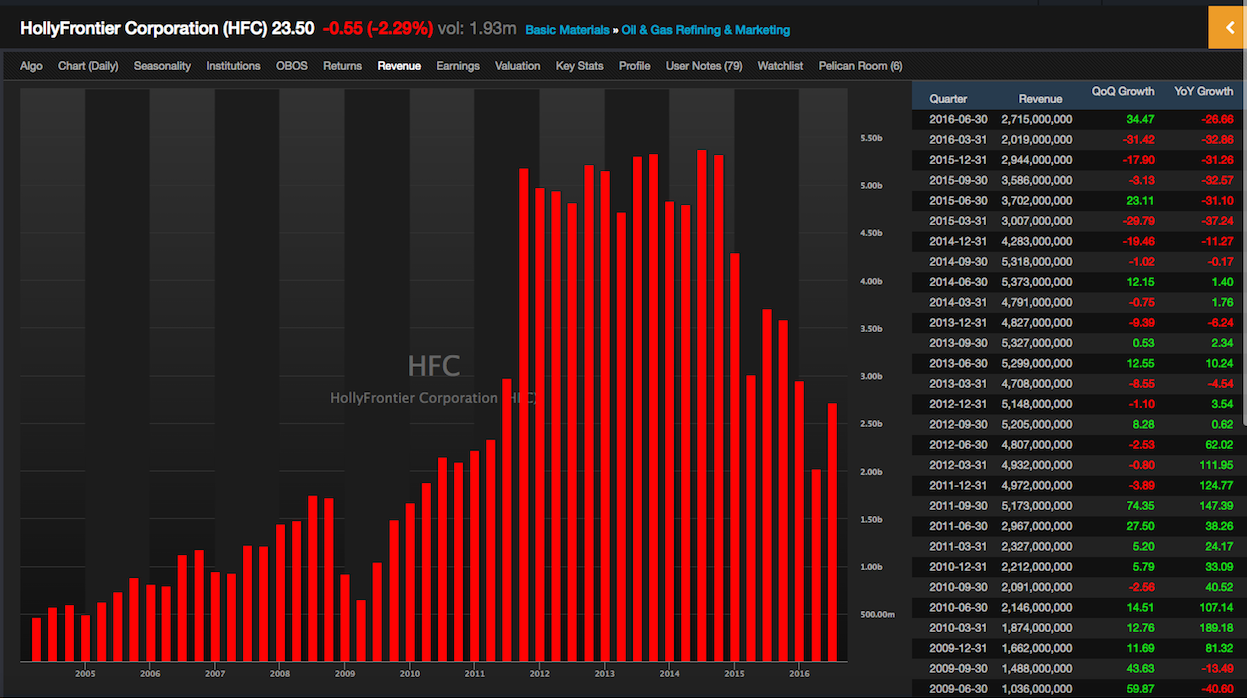

So what exactly do the revenues and earnings situation look like for them? Let’s dive into some revenue and earnings charts for the quintessential poster child for the industry, HFC, courtesy of Exodus.

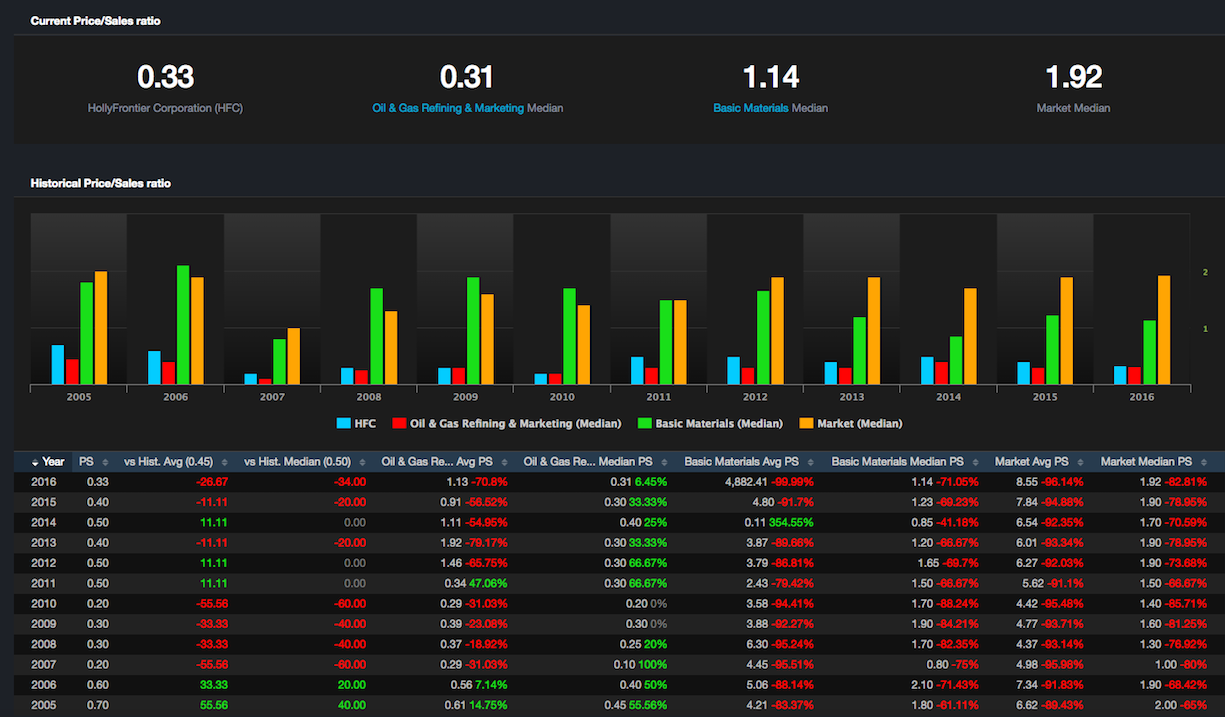

On the price to sales basis, the stock is the cheapest since 2010.

This is just a boom and bust industry, no one knows where the bottom truly is. Buyers beware.

If you enjoy the content at iBankCoin, please follow us on Twitter

How about your old friend SLCA?