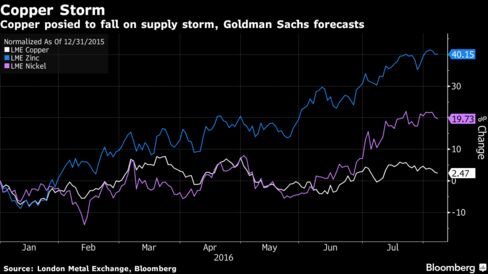

Goldman is out with a report predicting catastrophe is about to strike down the price of copper, by 17% in fairly short order. They’ve come to this conclusion, as a matter of fact, tracking 20 companies which represent more than 60% of worldwide supply. Like oil, supply is rising across the board in the debt laden copper space. The notion that any of the major commodities are enduring supply constraints is a bald faced lie.

Goldman said these 20 companies are set to increase supply by 15% in the coming quarters, which should put additional pressure to an already oversupplied copper market.

“Company guidance and our estimates suggest that copper is entering the eye of the supply storm,” analysts including Max Layton and Yubin Fu wrote in an e-mailed report received on Friday. A drop to $4,000 would be a 17 percent slump from Thursday’s close on the London Metal Exchange.

“This ‘wall of supply’ is expected to translate into higher copper smelter and refinery charges and ultimately, higher refined-copper production, set against softening demand growth,” Layton and Fu wrote. The metal is seen at $4,500 a ton in three months and $4,200 in six, they said, reiterating targets.

In July, Barclays Plc said supply may exceed demand every year through to 2020. The month before, Stephen Higgins, who heads Freeport-McMoRan Sales Company Inc., a division of the largest publicly traded copper miner, said more production has come on stream at a time demand growth in China has slowed.

At the time of this post, I am short FCX.

If you enjoy the content at iBankCoin, please follow us on Twitter

How much damn copper can China hoard? You would think Brazil, India etc. have taken on some of the demand growth, no?

Copper Bubble grew since 2009 and no one stopped it.