It took me 4 hours to write a post, as I marveled at the sheer stupidity of markets spiraling towards new record levels, all the while oil plunged lower to 3 month lows. At first I wondered if it was just me being a sour grape, some guy lancing out at the bulls who seem quite content with oil diving lower. But then I reminded myself that math does exist and how debt was something to be feared, not embraced.

Every down tick in crude is a nail in the coffin of an energy company. In turn, 10 nails are reserved for energy employees and 20 nails for the bank that lent the money in the first place.

“What the fuck is this whack a doodle talking about?”

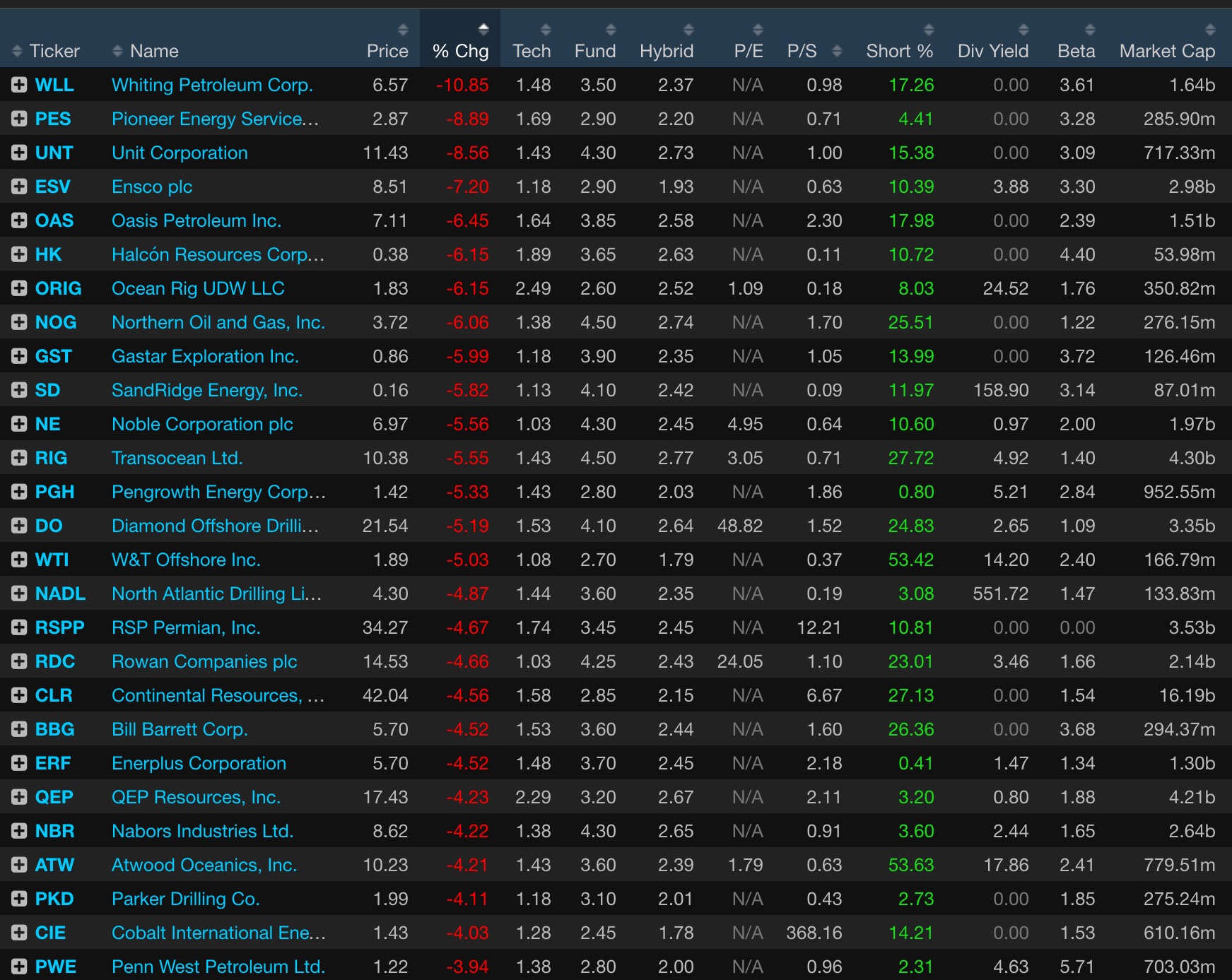

God damn it, there is at least $600b in debt that is either distressed or soon to be distressed, should their share prices drop any lower.

Here we are celebrating record highs, smugly popping corks of champagne into each other’s noses, as the energy sector is encumbered by debilitating losses.

As I write this, crude is actually a little lower, off by 2.9%. Is this wanton dismissal of a sector beguiled by huge levels of debt normal? Absolutely not. Can it last much longer? I can guarantee you it will not.

If you enjoy the content at iBankCoin, please follow us on Twitter

IT DOES’NT MATTER.

It might matter in 2017.

It will matter by this afternoon.

/CL selling seems a little over done in my eyes.

Looks like its testing the 200day, should it break I’ll start exiting equity positions. Reality will set in.

The selling is pervasive and perpetual.

Agree with the /cl selling looking close to dead cat bounce time. One of the bigger things keep shy from market shorts. At best I think we get a cute market dip of 48-72 hours and then the oil bounce and then re-rip back to highs. Not my favorite setups.

“Not favorite setups” being that the two best plays right now in the short term, to my eyes, seem to be going counter to a couple crazy strong trends. Smart play would probably be to sit on the with-trend side and wait for a dip/bounce to play back toward the with-trend direction. I’m not always that smart though. 🙂

Fly, you are a jewel among men.

https://www.youtube.com/watch?v=UNoouLa7uxA

Broken record here but oil will not drop below $35 and the longer it stays under $40 our economy will thrive for the consumer. Hedge funds may try and push it down but trust me it won’t stay there. $45 is probably the final price where it will land, when ebb and flows finish their wave. Fill up your car with $1.70 gas and be happy while it last.

End of driving season should see close to new lows.

Wait until the WS algos kick in (extra centaurs)!