Frederick Wilson, connoisseur investor and regular Joe worth $500+ million about town, is quite pleased with his latest offering to the market, Twilio–ticker TWLO. In the past, Fred has worked feverishly to exit from some high profile unicorns, such as TWTR, ETSY, LENDING FUCKING CLUB and ZNGA–just to name a few. Today, Fred presents us with his latest and greatest cash incinerator: Twilio.

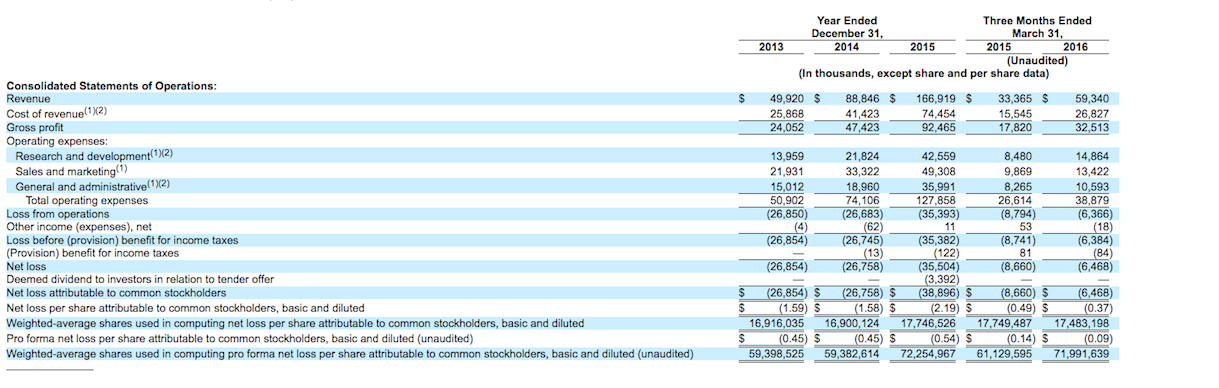

Here is the TWLO balance sheet, currently valued at more than $2 billion or 13x sales. Reasonable for a scaling money burner, eh?

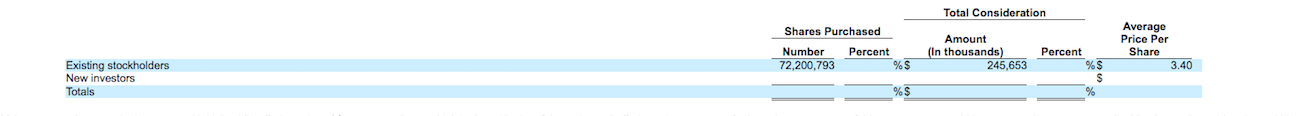

Fred got in at the ground level, due to his preference for extreme profit.

Back in 2010, Fred alerted the world how to pitch a product. Sagely, he featured Twilio’s presentation as the model to copy.

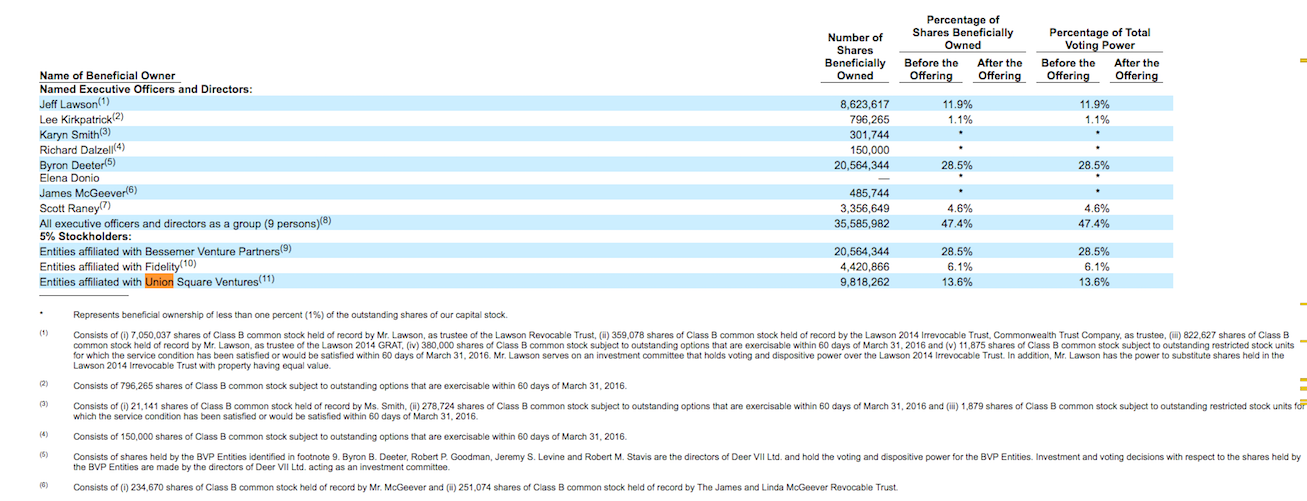

Union Square owns upwards of 13% of Twilio, virtually all profit.

Annoying balance sheet stuff, via the TWLO s-1

We have achieved significant growth in recent periods. For the years ended December 31, 2013, 2014 and 2015 and the three months ended March 31, 2016, our revenue was $49.9 million, $88.8 million, $166.9 million and $59.3 million, respectively. We incurred a net loss of $26.9 million, $26.8 million, $35.5 million and $6.5 million for the years ended December 31, 2013, 2014 and 2015 and the three months ended March 31, 2016, respectively.

Oh, about 15% of their revenues comes from Facebook’s What’s App. Should Zuckerberg decide to smite Twilio, the company might be doomed.

We currently generate significant revenue from WhatsApp and the loss of WhatsApp could harm our business, results of operations and financial condition.

In 2013, 2014 and 2015 and the three months ended March 31, 2016, WhatsApp accounted for 11%, 13%, 17% and 15% of our revenue, respectively. WhatsApp uses our Programmable Voice products and Programmable Messaging products in its applications to verify new and existing users on its service. We have seen year-over-year growth in WhatsApp’s use of our products since 2013 as its service has expanded and as it has increased the use of our products within its applications. Our Variable Customer Accounts, including WhatsApp, do not have long-term contracts with us and may reduce or fully terminate their usage of our products at any time without penalty or termination charges. In addition, the usage of our products by WhatsApp and other Variable Customer Accounts may change significantly between periods.

While we expect that the revenue for our largest customers, including WhatsApp, will decrease over time as a percentage of our total revenue as we generate more revenue from other customers, we also believe that revenue from WhatsApp may continue to account for a significant portion of our revenue, at least in the near term. WhatsApp has no obligation to provide any notice to us if they elect to stop using our products entirely and, as such, the contribution from WhatsApp could decline to zero in any future period without advance notice. In the event that WhatsApp does not continue to use our products, uses fewer of our products, or uses our products in a more limited capacity, or not at all, our business, results of operations and financial condition could be adversely affected.

Duh.

The market in which we participate is intensely competitive, and if we do not compete effectively, our business, results of operations and financial condition could be harmed.

The market for cloud communications is rapidly evolving, significantly fragmented and highly competitive, with relatively low barriers to entry in some segments. The principal competitive factors in our market include completeness of offering, credibility with developers, global reach, ease of integration and programmability, product features, platform scalability, reliability, security and performance, brand awareness and reputation, the strength of sales and marketing efforts

We may require additional capital to support our business, and this capital might not be available on acceptable terms, if at all.

We intend to continue to make investments to support our business and may require additional funds. In particular, we may seek additional funds to develop new products and enhance our platform and existing products, expand our operations, including our sales and marketing organizations and our presence outside of the United States, improve our infrastructure or acquirecomplementary businesses, technologies, services, products and other assets. In addition, we may use a portion of our cash to satisfy tax withholding and remittance obligations related to outstanding restricted stock units. Accordingly, we may need to engage in equity or debt financings to secure additional funds. If we raise additional funds through future issuances of equity or convertible debt securities, our stockholders could suffer significant dilution, and any new equity securities we issue could have rights, preferences and privileges superior to those of holders of our Class A and Class B common stock. Any debt financing that we may secure in the future could involve restrictive covenants relating to our capital raising activities and other financial and operational matters, which may make it more difficult for us to obtain additional capital and to pursue business opportunities. We may not be able to obtain additional financing on terms favorable to us, if at all. If we are unable to obtain adequate financing or financing on terms satisfactory to us when we require it, our ability to continue to support our business growth, scale our infrastructure, develop product enhancements and to respond to business challenges could be significantly impaired, and our business, results of operations and financial condition may be adversely affected.

Be on the lookout for restrictive covenants in credit facilities, for if credit ever dries up…

Our credit facility contains restrictive and financial covenants that may limit our operating flexibility.

Our credit facility contains certain restrictive covenants that either limit our ability to, or require a mandatory prepayment in the event we, incur additional indebtedness and liens, merge with other companies or consummate certain changes of control, acquire other companies, engage in new lines of business, change business locations, make certain investments, pay dividends, make any payments on any subordinated debt, transfer or dispose of assets, amend certain material agreements, and enter into various specified transactions. We, therefore, may not be able to engage in any of the foregoing transactions unless we obtain the consent of our lender or prepay the outstanding amount under the credit facility. The credit facility also contains certain financial covenants and financial reporting requirements. Our obligations under the credit facility are secured by all of our property, with certain exceptions. We may not be able to generate sufficient cash flow or sales to meet the financial covenants or pay the principal and interest under the credit facility. Furthermore, our future working capital, borrowings, or equity financing could be unavailable to repay or refinance the amounts outstanding under the credit facility. In the event of a liquidation, our lender would be repaid all outstanding principal and interest prior to distribution of assets to unsecured creditors, and the holders of our Class A and Class B common stock would receive a portion of any liquidation proceeds only if all of our creditors, including our lender, were first repaid in full.

Today at Fred’s blogsite, he waxed poetic over his Twilio investment.

I read yesterday evening that our portfolio company Twilio, which priced its IPO last night, is going to live code from the NYSE this morning. That brought a powerful flashback to the first time I met Jeff Lawson, founder and CEO of Twilio.

It was 2008 in our old offices on the 14th floor of the building we still work in. My partner Albert, who led our investment in Twilio, had met Jeff and was impressed with him and his vision for Twilio. He asked me if I would meet with him and so I did.

Jeff came into the conference room, sat down, and said “we have taken the entire messy and complex world of telephony and reduced it to five API calls”.

I said “get out of here, that’s impossible.”

Jeff proceeded to reel them off and I said “wow”.

He then pulled out his laptop, fired up an editor, and started live coding an app. He asked me for my cell phone number and within 30 seconds my phone was ringing.

I said “you can stop there. that’s amazing”.

It was, and remains, the best seed pitch I’ve ever gotten. I’ve told him that many times and have told this story many times. I am not sure why it has never made it to this blog. But this morning is a great time for that to happen.

Fred might be talking to someone using Twilio here, or maybe not.

In summary, Twilio is really ramping up both revenues and losses, almost in lock-step. The current valuation is excessive by any measure, beckoning an era of VC sponsored tech IPOs that absolutely scorched the earth late investors walked upon. The last big splash into the public markets for Fred Wilson, and the gang over at Union Square, was ETSY and LENDING FUCKING CLUB. We all know how those worked out. Nevertheless, I don’t want to rain urine on anyone’s parade. I am merely pointing out some definite red flags for many of you home gamers out there who see this stock surging, wondering to yourselves “is this the next Face’d Book”?

Without question, it most certainly is not.

If you enjoy the content at iBankCoin, please follow us on Twitter

In other news… they made it!

http://www.dailymail.co.uk/sciencetech/article-3655988/Solar-powered-plane-lands-Spain-three-day-Atlantic-crossing-SI2-touches-Seville-following-latest-lengthy-leg-round-world-trip.html

morons

Congrats to them for living their dream. It’s not my dream, but certainly must be a more fun experience than most of the people are having who are sitting at desks in offices or doing monotonous things in factories.

And Congrats to the Twilo developers who got Fred to back their venture.

so what exactly do you do here?

Get Fred to back your venture.

i was attempting to quote office space and ask what it is exactly that twilio does…it appears they are this decade’s Vonage? lol

Doesn’t Lucifer Bezos own 25% of TWLO through AMZN?

I am not a religious man and do not keep track of his actions.

Bush, religions are hard to keep track of. Please enlighten us as to why Bezos is supposed to be Lucifer.

Bezos is lucifer.

Why?

Short that shit!

some Chinese billionaire just bought ~117m more LC http://finviz.com/insidertrading.ashx?oc=1677229&tc=7

TWLO above 28. Let me guess, a definite risk off sign?

The only thing nice about you is your avatar.