I guess he’s been doing this for a while–issuing investor letters on his birthday. By the looks of VRX today, I’m guessing he’d rather go for a swim, somewhere nice, than deal with clients today.

Nevertheless, it is my duty, as an ardent believer in Montauk Bill’s financial prowess, to report on such ongoings. Truth be told, I am only hard on Bill because he makes it easy. The whole ‘I’m gonna fix JCP fiasco’ was the beginning of my ire. It was solidified when he traded on insider info, via VRX’s bid for AGN, and got away with it.

After that, Bill clown-raped himself with the HLF short and subsequent torching of several billions of dollars in VRX. Alas, we are here, with Le Fly critiquing the Q1 Pershing Square letter to shareholders, on Bill’s 50th birthday.

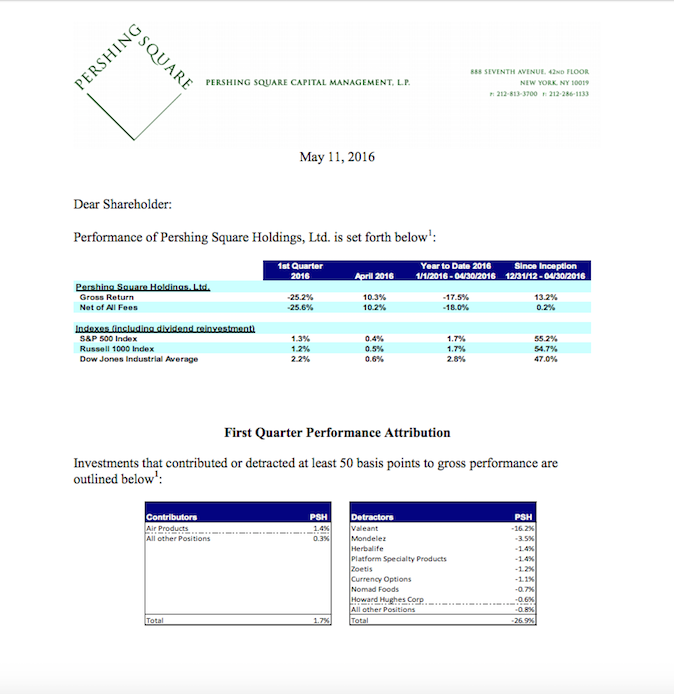

Net of fees, Pershing is flat since 2012, off by 18% this year.

Bill’s take on VRX

Valeant (VRX)

We have made material progress at Valeant since our last communication. Shortly after Steve

Fraidin and I joined the board in March, the company launched a search process for a new CEO.

On May 2nd, Joe Papa, formerly the Chairman and CEO of Perrigo (NYSE: PRGO), joined

Valeant as its Chairman and CEO. We believe that Joe is an ideal choice for Valeant as he has

extensive senior leadership experience in all aspects of the pharmaceutical industry, a strong

reputation for integrity, and an excellent track record at Perrigo as reflected by the company’s

24% compounded annual return to shareholders during his tenure. Joe is passionate about the

opportunity for value creation at Valeant, and we are excited to have him on board.Valeant filed its 10-K as expected on April 29th, eliminating any potential default under its

existing credit agreements. Other than the previously reported $58 million revenue restatement

from Q4 2014, there were no other restatements required in the company’s audited statements.

As this was likely one of the most carefully audited financial statements ever, this should serve

to comfort investors as to the integrity of the company’s financial statements.Valeant will have a largely new board slate for the upcoming annual meeting in June. Two of

the company’s legacy directors will remain on the board – Bob Power and Bob Ingram, the

company’s former Chairman. Over the past six weeks, the current board led by Bob Ingram has

worked very effectively despite difficult circumstances. We are extremely appreciative of the

board’s hard work and commitment to the company, and for the two Bobs’ willingness to

continue to serve going forward.The new board of Valeant will be comprised of CEO Joe Papa, Bob Ingram and Bob Power, the

four directors who joined in March – Tom Ross, Fred Eshelman, Steve Fraidin and myself – Rob

Hale, a representative of ValueAct, and three new directors who will join at the annual meeting.

The new board will have ample shareholder representation, substantial executive level

pharmaceutical industry expertise, and accounting expertise, as well as a practicing

dermatologist.There is much work to do at Valeant, which, among other issues, includes restoring the

dermatology business to growth while working out transition issues with its new Walgreens

distribution arrangement, accelerating the growth of Salix, Valeant’s gastrointestinal business,

and reducing the company’s debt through free cash flow generation and the potential sale of noncore

assets. We believe that Valeant has some of the best and most durable assets in the

pharmaceutical industry, which do not require aggressive pricing in order to generate growth and

substantial free cash flow. It will take time for Valeant to regain its stakeholders’ trust. We

believe that this will occur over time as the company delivers several new quarters of results and

continues to fulfill its commitments to shareholders, patients, doctors, and the community at

large. Over time under Joe’s leadership, we expect the market to rerate Valeant to a substantially

higher valuation reflective of its underlying business.

Yeah, happy bday Bill.

If you enjoy the content at iBankCoin, please follow us on Twitter

Is time something VRX has a lot of?

The most damning is the 3.5 year return vs market index fund .2% vs 50%. It’s a wonder anyone still lets him manage their money.