Who would’ve guessed that in the midst of an epic commodity collapse, a bull market in iron ore mining and steel production would forge?

That’s precisely what’s happening now, as prices in Asia rip higher by 5% to 6 month highs.

Iron ore futures jumped to their daily limit of 407 yuan ($62.47) a metric ton on the Dalian Commodity Exchange, up 4.9 percent and the highest level in almost six months, while the SGX AsiaClear contract in Singapore advanced as much as 10 percent to $54.58 a ton.

Iron ore’s upswing this year has accompanied a revival in the price of other commodities including oil and industrial metals. China set an economic expansion target of 6.5 percent to 7 percent on Saturday, and to reach that goal the government will expand the money supply and permit a record high deficit. The nation will also subsidize cuts to excess capacity in industries such as steel and coal.

Iron ore prices rose “amid hope for further stimulus measures in China,” Australia & New Zealand Banking Group Ltd. said in a note Monday. “Policy makers there continue to advocate industry reform, with the Vice Finance Minister saying large steel and coal capacity cuts are an important element of the nation’s” supply-side reform.

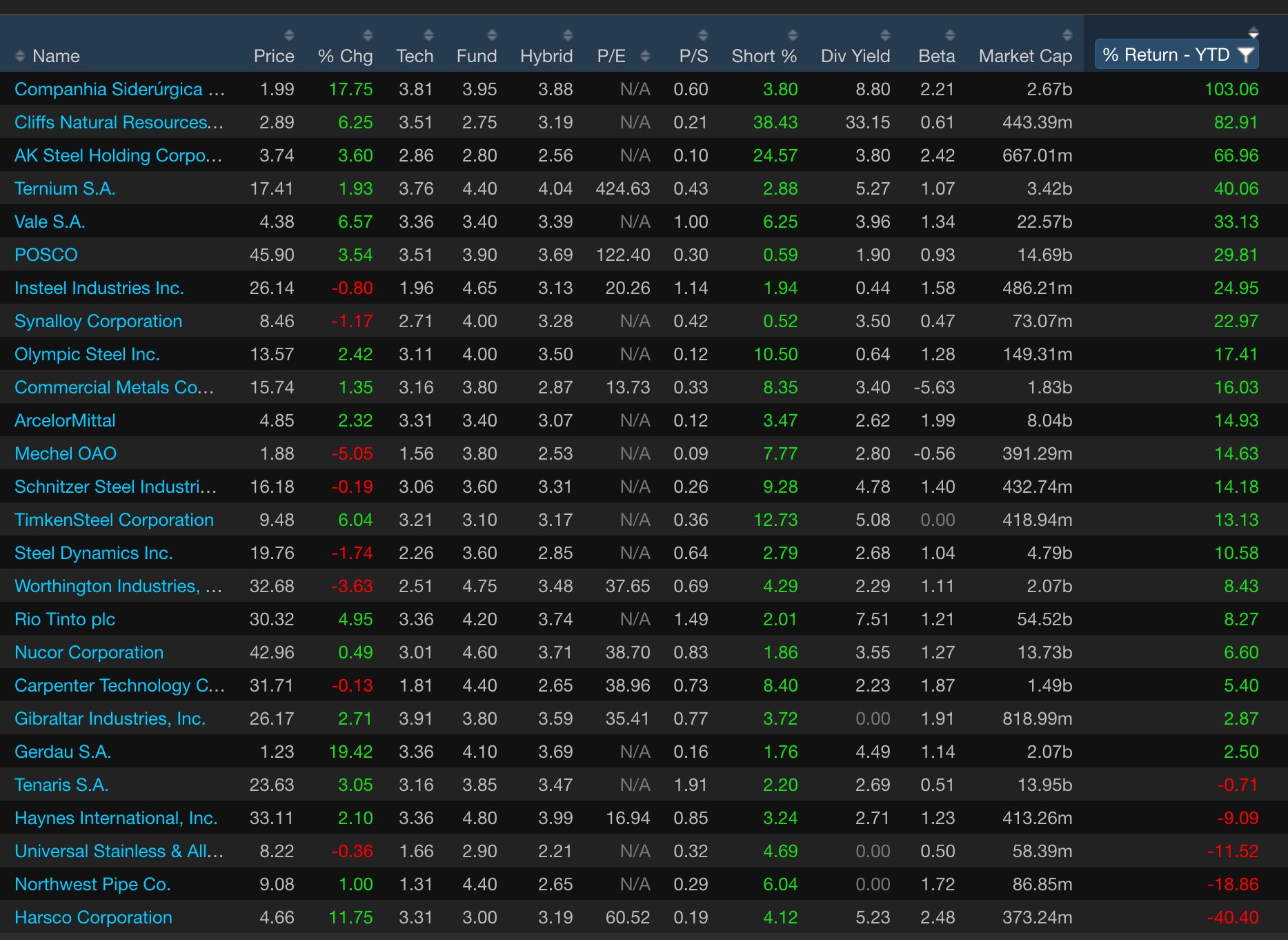

This isn’t just an ordinary bounce. The ancillary heirs of this fortune being spilled onto the markets, the stock prices of these speciality companies, have soared–year to date. As a group, the media share price return for iron ore/steel stocks is upwards of 13%, compared to a negative 2.2% drop in the S&P 500.

Moreover, many of the gains in the subsequent industries have been much more impressive than the 13% otherwise suggests.

It’s a brazen bull market.

If you enjoy the content at iBankCoin, please follow us on Twitter

No it is not a brazen Bull, Gossip is that China Govt is going to close down a huge amount of Steel Mills starting around April 24 until October. They are rushing production before the closing due to Pollution Issues. I have been pondering how much Ore can actually be Manufactured into Steel before the deadline? For tonight, JPM is coming out with their thoughts that Kuroda and BoJ won’t act this month, but will wait until July. Copper coming off its high tonight. China Govt didn’t give a massive stimulus at all, but are probably buying the market today to make it appear all good. ECB Draghi has so much Action already baked in. My sell off is coming.

Working off the High of 2015 which was Jan/Feb, it would be 130M tons of Steel..that means a limit of about 195M tons of Ore needed.

50 point minimum pullback this week?

http://content.screencast.com/users/toad69/folders/Jing/media/d6375478-e700-42a0-b5aa-1b81f1d69f23/2016-03-06_2239.png

All up to Draghi.