China has been playing a parlour game of smoke and mirrors for the better part of a decade, displaying a supreme forex reserve of upwards of $3 trillion, supported by robust GDP growth. Well, now that the growth is going away, and the smoke dissipating from the hall of mirrors, people are taking a closer look at the level of debt doled out by Chinese ‘state owned’ banks to other companies, many of which that are also ‘state owned.’

The prognosis is not good. Crisis is around the bend, if history is of any help to us at all.

Seven out of 12 economists see the debt-to-gross-domestic-product ratio increasing through at least 2019, with four expecting a peak in 2020 or later, according to a Bloomberg News survey. Debt will peak at 283 percent of GDP, according to the median estimate of eight economists.

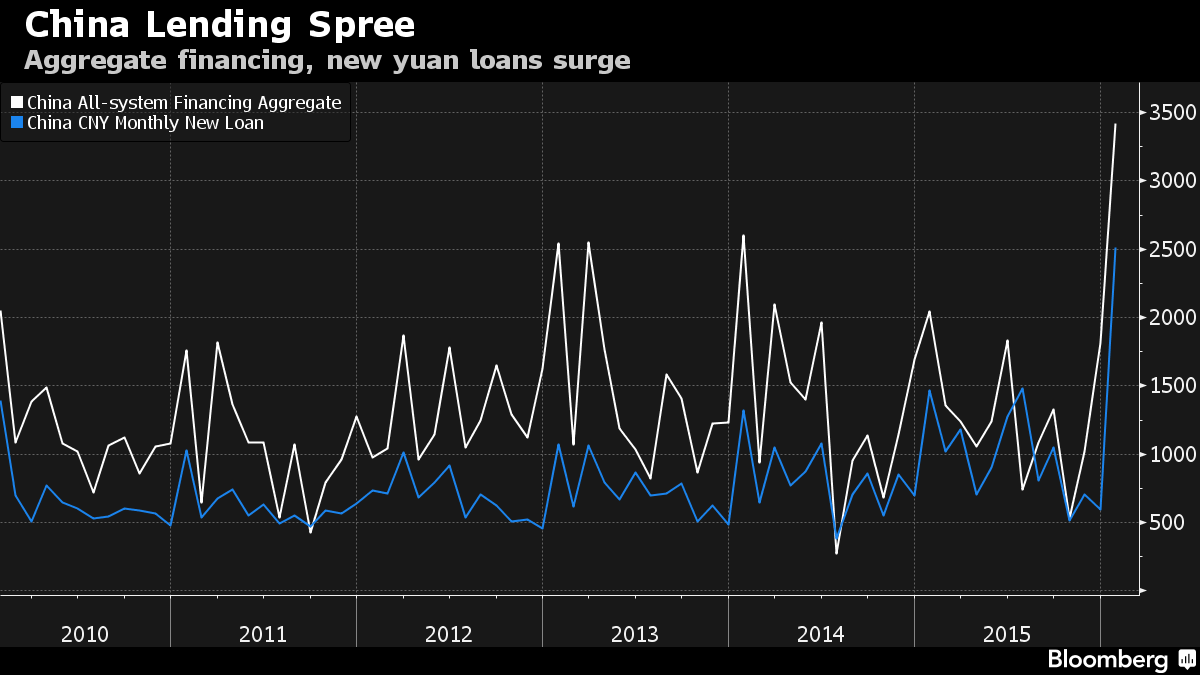

Concerns over China’s borrowing came to the fore last week, when a report showed the country’s banks extended a record 2.51 trillion yuan ($385 billion) of new loans in January. The increase in debt could pressure the country’s credit rating, Standard & Poor’s said on Tuesday, less than a week after the cost to insure Chinese bonds against default rose to a four-year high.

“Every major country with a rapid increase in debt has experienced either a financial

crisis or a prolonged slowdown in GDP growth,” wrote analysts led by New York-based chief investment officer Sharmin Mossavar-Rahmani and Hong Kong-based investment strategist Ha Jiming. “History suggests that China will face the same fate.”“If China chooses the zombie bank/company mop up and prop up strategy, they will slow not only productivity but current and potential GDP,” said Constance Hunter, chief economist at KPMG LLP in New York. “If they choose instead to take the heretofore unrecognized bad debts of the state-owned banks on the government balance sheet, a la Ireland, they will increase government debt but they won’t have zombie banks and they are more likely to see a robust recovery.”

Zombie banks? Sounds like a country well deserving of first world status.

If you enjoy the content at iBankCoin, please follow us on Twitter

Hope so. Being net short is hard to do when things are really good. But never underestimate the power of the media to spin reality anyway they need to keep the game going.

Hope you had a fun weekend Fly.

Gee I wonder what China will do