This man is out of his fucking mind. Or, maybe he’s not. Maybe central bankers are out of their minds. Either way, the specter of -4.5% rates, to me, is a great perversion of decency, an injurious policy harking back to medieval days.

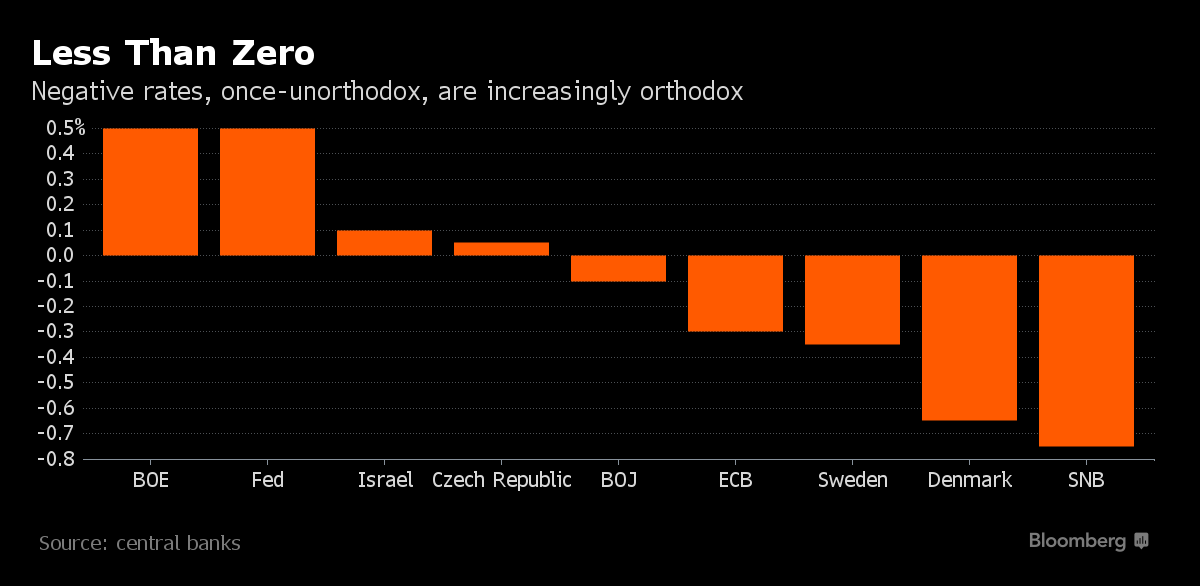

Having studied the lack of fallout in Switzerland, where the benchmark rate is minus 0.75 percent, Malcolm Barr and Bruce Kasman reckon the trick lies in a tiered system as already deployed by the Bank of Japan and in some places of Europe, whereby only a portion of reserves are subjected to negative rates.

On that basis, they estimate if the ECB just focused on reserves equivalent to 2 percent of gross domestic product it could slice the rate it charges on bank deposits to minus 4.5 percent. That compares with minus 0.3 percent today and the minus 0.7 percent JPMorgan says it could reach by the middle of this year.

The Bank of Japan’s lower bound on a similar basis may be minus 3.45 percent, while Sweden’s is likely minus 3.27 percent, the economists said. Should they also go negative, the Fed could cut to minus 1.3 percent and the Bank of England to minus 2.69 percent in JPMorgan’s view, reflecting how the ratio of reserves to assets is higher in their economies than elsewhere.

Out of Ammunition

Concentrating on 25 percent of reserves would allow the ECB to cut to minus 4.64 percent and the Fed to minus 0.78 percent. Making no change to the current regime would allow Draghi to lop to minus 1.36 percent, they said.

Easing the fall is that the JPMorgan economists bet that banks are unlikely to be able to pass on the cost of the policy to borrowers, reducing potential repercussions. They also see limited pressure on bank profits or for a need to stash cash.

This sums it up:

“It appears to us there is a lot of room for central banks to probe how low rates can go,” they said. “While there are substantial constraints on policymakers, we believe it would be a mistake to underestimate their capacity to act and innovate.”

Swiss 2 yr bonds are yielding -0.93%.

If you enjoy the content at iBankCoin, please follow us on Twitter

Central Banks will never be out of ammo until they have decimated their own credibility and/or caused an inflation fire they cannot stop. We obviously aren’t there yet.

This is insanity. CB’s know banks are loaded with shitty debt that can’t be serviced, yet they want to force them to lend more.

Of course if you’re a rich ol’ white man, that’s a great plan! !!!!