What a stupid period of time we live in, when

each nation relishes in their national currency weakening. In the olden days, national currencies would fall victim to inflation and an entire nation of savers would be ruined.

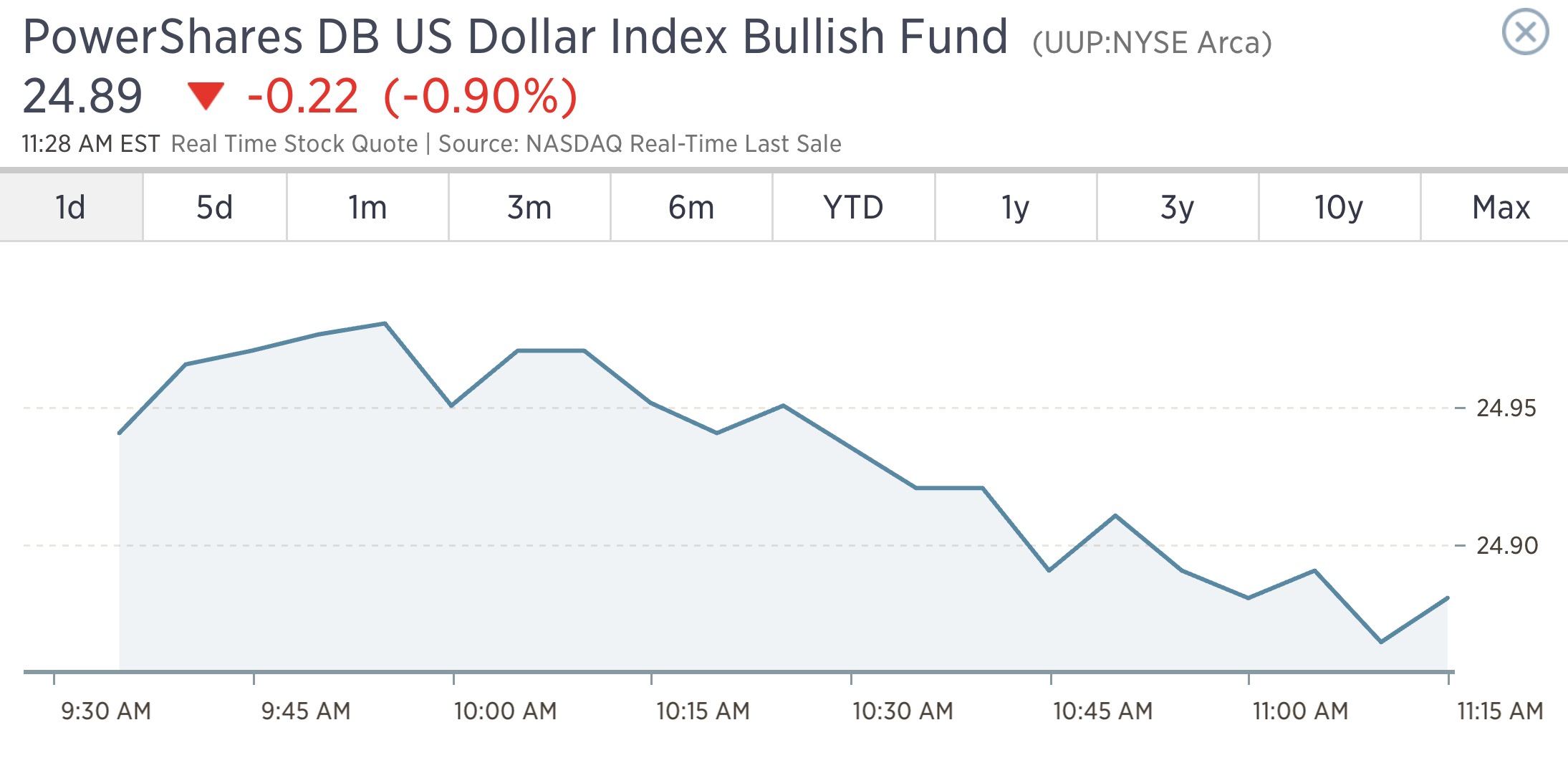

Here we are now, happy to see dollars crushed.

TLT should be lower. But people still want a seat on the ark. These are dark, dark days.

I’m constructive.

China is shut down due to monkey celebrations (rolls eyes). Oil looks stable and the Fed enters center stage tomorrow.

Potentionally, these ingredients, if mixed right, will lead to the biggest rally in over 12 months, if not MOAR.

Shorts should be removed; long exposure added, in my opinion.

If you enjoy the content at iBankCoin, please follow us on Twitter

If DB margin calls continue, so will the shortage of EUR. A Minsky moment is on deck, and waiting…

I really wonder if negative rates are coming down the pipe? Not sure what the benefits of negative rates are. In my mind, central banks are picking winners and losers (the banks)? Net effect is no gain in inflation?

maybe tlt should be lower but imo it will be higher

What’s the relationship, if any, between national currency (i.e., strong or weak dollar) and inflation? Does one lead the other? I’ve read different view points on this… Some Fed heads say that the strong dollar has subdued inflation.

From a wage standpoint, that makes sense because a strong dollar would discourage international purchases, which would then reduce a company’s ability to make money, and in turn, not pay out higher wages.

Weak dollar could be signaling that Yellen will give dovish (or at the very least, not a hawkish) statement tomorrow… Or it could just be a trap. I don’t know anymore haha.

this market has been taken over by the gays because it is now drama queens 24/7

This SPX rhyming with late Sept 2015 could come to pass if grandma acts properly tomorrow.